Picture supply: Getty Photos

When gearing as much as construct a passive revenue stream, there are a selection of issues to contemplate. One of the vital necessary is the kind of financial savings account to make use of.

Many UK residents use a Money ISA to minimise the tax they pay on their capital positive factors. Whereas this is usually a good possibility, falling rates of interest go away them much less engaging.

In the long run, I believe it makes extra sense to contemplate a Shares and Shares ISA. It provides related tax reduction with the benefit of doubtless beating the returns of a Money ISA.

Please be aware that tax therapy depends upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

So how a lot are we speaking about?

It’s usually finest to save lots of as a lot as one can every month. Nevertheless it’s nonetheless necessary to get a tough thought of how a lot is ample. Investing few kilos right here and there may be unlikely to generate life-changing wealth — however that doesn’t imply buyers must stash each penny they’ve of their ISAs.

Every particular person has completely different wants with regards to monetary necessities. So, for need of a greater quantity, I’m utilizing £10,000 of annual passive revenue for instance. That will be a good bit of additional money on prime of a State Pension.

To attract down £10k a 12 months for 30 years, a £300,000 pot is required. Nevertheless, with the cash invested and incomes a return, the quantity may very well be much less.

Utilizing a median return of 5%, a pot of round £200,000 may final indefinitely (5% of £200k is £10k). However annual returns aren’t steady and a few years might require decreasing the pot. What’s extra, inflation might necessitate bigger withdrawals every year.

With that in thoughts, I’d contemplate £250,000 a accountable purpose to purpose for. This additionally ties in with the really helpful 4% drawdown for retirement funds.

Constructing a portfolio

1 / 4 million kilos is not any small quantity of financial savings. It will take a good portfolio about 25 years to succeed in that quantity with £200 invested per thirty days. That’s assuming a median return of round 6% with a median of 4% in dividends reinvested.

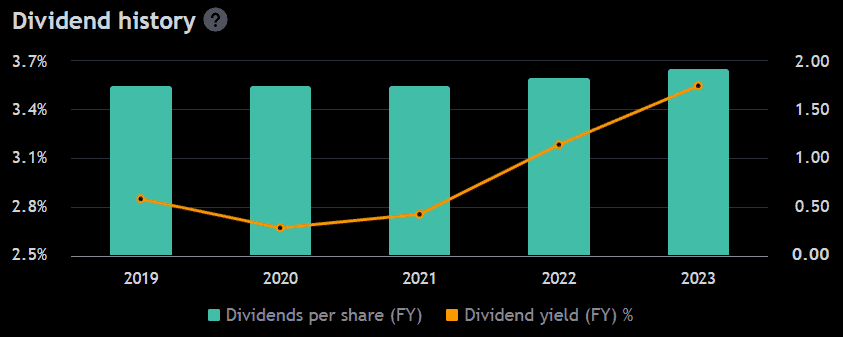

Client items big Reckitt Benckiser (LSE: RKT) could also be one to contemplate. It has supplied annualised returns of 6% per 12 months for the previous 20 years and at present has a 4% dividend yield. Plus, it has a stable historical past of dependable funds and constant dividend progress.

However previous efficiency is not any indication of future outcomes. Will it stick with it?

To determine that out, I’m checking its dangers and valuation.

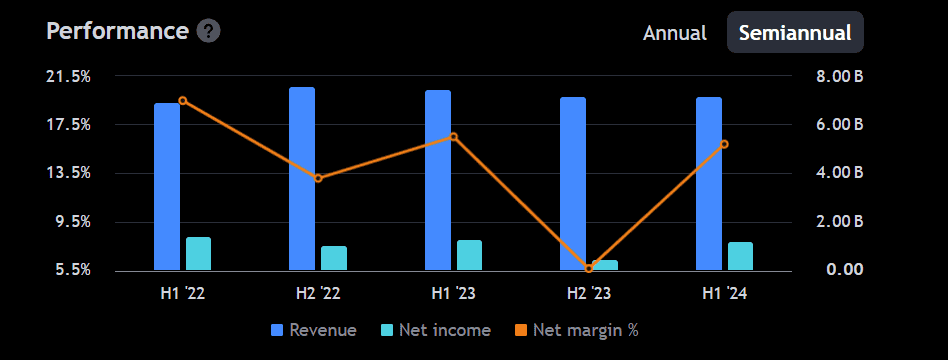

Reckitt took a giant hit final 12 months after buying the newborn meals enterprise Mead Johnson. One among its merchandise, Enfamil, was implicated in a lawsuit concerning an toddler fatality. Whereas that challenge has reportedly been resolved, there’s at all times a danger of comparable instances arising.

Acquisitions are crucial for enterprise enlargement however they are often pricey if issues go flawed.

On the plus aspect, the falling worth makes it look engaging. A restoration has already begun however the worth stays 37% down from its five-year excessive. With earnings anticipated to enhance, analysts forecast a median worth enhance of 14.21% within the coming 12 months.

That’s why I contemplate it a great possibility as a part of a passive revenue technique. I’ll be commonly topping up my Reckitt place because the 12 months progresses.