Picture supply: Getty Pictures

For me, the easiest way to focus on a sizeable passive revenue in retirement is with a Self-Invested Private Pension (SIPP). I’m not wanting to attract down any cash earlier than the age of 57, so I don’t have to fret about any early withdrawal penalties.

I additionally get to take pleasure in a beneficiant annual allowance that towers above that of the Shares and Shares ISA. This variable determine is equal to a person’s yearly revenue, as much as a most of £60,000.

Large advantages

The primary benefits of utilizing a SIPP to construct long-term wealth are twofold. Like a Shares and Shares ISA, traders don’t pay a penny in tax on capital features and dividend revenue. This frees up additional cash for funding, enhancing the compounding impact and constructing wealth quicker.

Along with this, people obtain more money to spend money on the type of tax reduction. It is a luxurious that ISA traders don’t get to take pleasure in, and is about on the following charges:

- 20% for basic-rate taxpayers.

- 40% for higher-rate taxpayers.

- 45% for added fee taxpayers.

Please observe that tax remedy is determined by the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Concentrating on a £1m+ portfolio

Let’s see how this works in apply. We’ll use the instance of Steve, a higher-rate taxpayer who has £500 of his personal money to take a position every month in a portfolio of UK and worldwide shares.

He receives 20% basic-rate tax reduction at supply, which routinely will increase his month-to-month contribution to £625. Steve may declare one other 20% via his tax return, including one other £125 and taking his whole month-to-month contribution to £750.

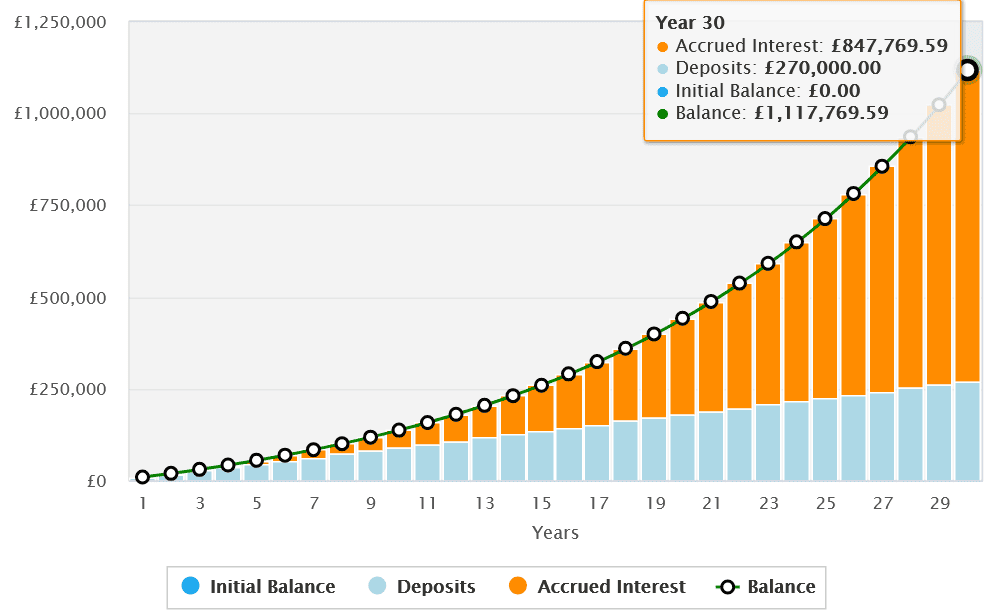

Now let’s say Steve invests for 30 years and achieves a median annual return of 8%. At this fee he’d develop his retirement pot to greater than £1.1m.

With out this tax reduction, Steve’s retirement fund could be far decrease, at £745,179.

On the draw back, SIPP traders do need to pay tax after they draw down money, in contrast to ISA customers. Nonetheless, they’ll take as much as 25% of their pot tax-free at retirement. Mixed with that beneficiant tax reduction, this could nonetheless depart traders in a stronger place general.

Harnessing US shares

One other benefit is that traders can select from all kinds of UK and abroad shares, funding trusts and funds of their SIPP to develop their wealth.

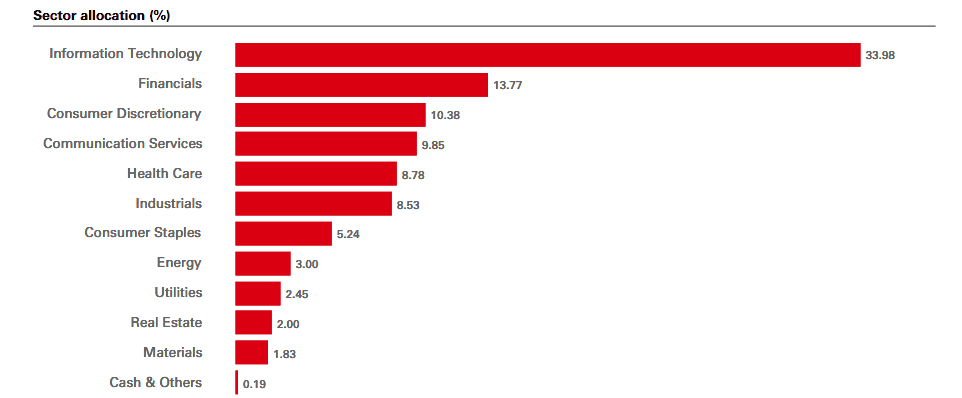

The HSBC S&P 500 ETF (LSE:HSPX) is one such asset I maintain in my very own portfolio. Over the past decade it’s delivered a median annual return of 13.3%. That is thanks partially to its massive contingent of high-growth tech shares like Nvidia, Microsoft, Apple and Amazon:

As you possibly can see, although, it additionally offers large publicity to quite a lot of completely different industries, permitting traders to harness the wealth-growing energy of the US inventory market. Such diversification additionally permits traders to successfully unfold threat and luxuriate in a smoother return throughout the financial cycle.

Rotation out of US shares has impacted the fund’s efficiency extra lately. Whereas nonetheless a threat, I imagine that on steadiness it can — together with my different SIPP holdings — considerably enhance my possibilities of making a big retirement revenue. It’s one to think about.