Picture supply: Getty Pictures

There are between 4,850-5,000 Shares and Shares ISA millionaires, primarily based on current information. And I think about only a few of them are below 30. Nevertheless, this doesn’t imply it’s not possible for somebody to realize millionaire standing by this still-young age.

The trick in fact is beginning early. A Junior Shares and Shares ISA might be began at any younger age earlier than being transformed to a standard grownup Shares and Shares ISA once they flip 18. Nevertheless, by beginning an ISA for a beloved one at beginning, we are able to really leverage the ability of compound returns.

Doing the maths

So how does all of it work? Properly, at first, a mum or dad, grandparent or guardian must open a Junior ISA within the identify of the kid. This may be carried out by any main UK brokerage. Then comes common contributions. By continually contributing to a portfolio, we’re offering the gasoline with which to develop wealth.

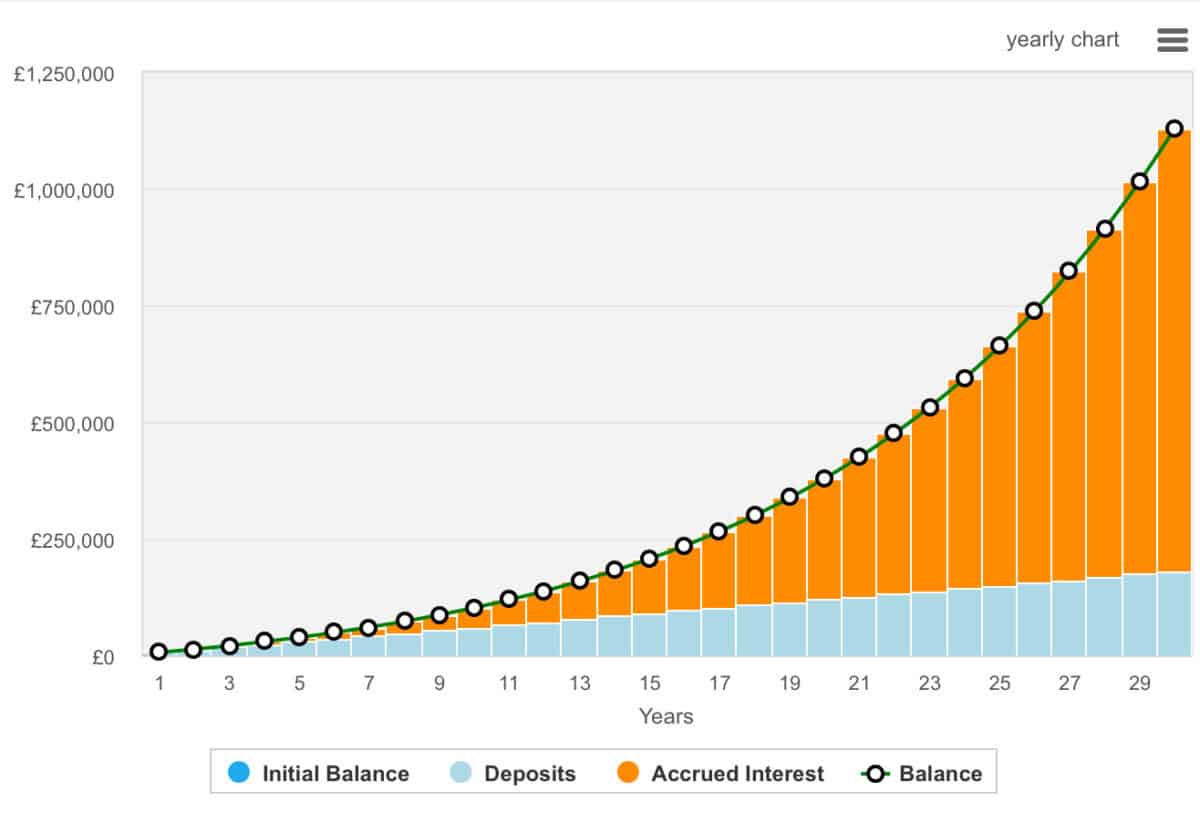

Turning common contributions into £1m isn’t simple. Nevertheless, it’s actually attainable. Right here’s one calculation: with £500 of month-to-month contributions and a ten% annualised return, the portfolio would attain £1.13m inside 30 years.

Now, this calculation depends on an above-average fee of progress — 10%. Nevertheless, it’s very possible when buyers give attention to constructing a various portfolio of high quality shares. For some, a extra real looking long-term common can be 8%.

After all, anybody operating their very own portfolio must be conscious that they’ll lose cash. Share costs might be unstable within the quick time period, and even well-researched investments might underperform expectations.

The place to take a position?

My daughter’s Junior ISA comprises principally shares, however some funding trusts. The latter provides a further measure of diversification, particularly when the vast majority of the investments I make are in growth-oriented shares.

One of many funding trusts she invests in is Scottish Mortgage Funding Belief (LSE:SMT). Loads of buyers had their fingers burned with this belief a couple of years in the past when growth-oriented shares slumped, and Scottish Mortgage tanked.

This occurs as a result of Scottish Mortgage shares replicate the worth of the belief’s holdings. The highest holdings at the moment embrace privately-held SpaceX, in addition to main public names equivalent to MercadoLibre, Meta, Amazon, and Nvidia.

These corporations are the driving forces behind the technological adjustments, however their valuations are additionally relatively unstable. For Scottish Mortgage, this volatility’s enhanced by gearing — borrowing to take a position — which may amplify losses.

Nevertheless, on a optimistic word, I’d level to administration’s observe document of selecting the following large winners earlier than most of us have even heard of them. The belief’s shares are up a formidable 2,800% over the previous 32 years, representing a really sturdy fee of return.

Whereas there are many funding trusts on the market, I do imagine Scottish Mortgage — the UK’s largest belief — is actually price contemplating.