In October 2025, the worldwide top-tier Bitcoin miners barely elevated manufacturing, total prices, and community problem reached new all-time highs. On the similar time, a number of mining corporations started shifting their strategic focus towards AI-related knowledge infrastructure.

This shift aimed to diversify income streams and cut back dependence on Bitcoin value volatility.

Slight Drop in Bitcoin Manufacturing, Rising Pattern of BTC Gross sales

In comparison with September, total Bitcoin (BTC) mining output declined barely, primarily as a consequence of greater mining problem and unstable energy provides throughout a number of North American areas.

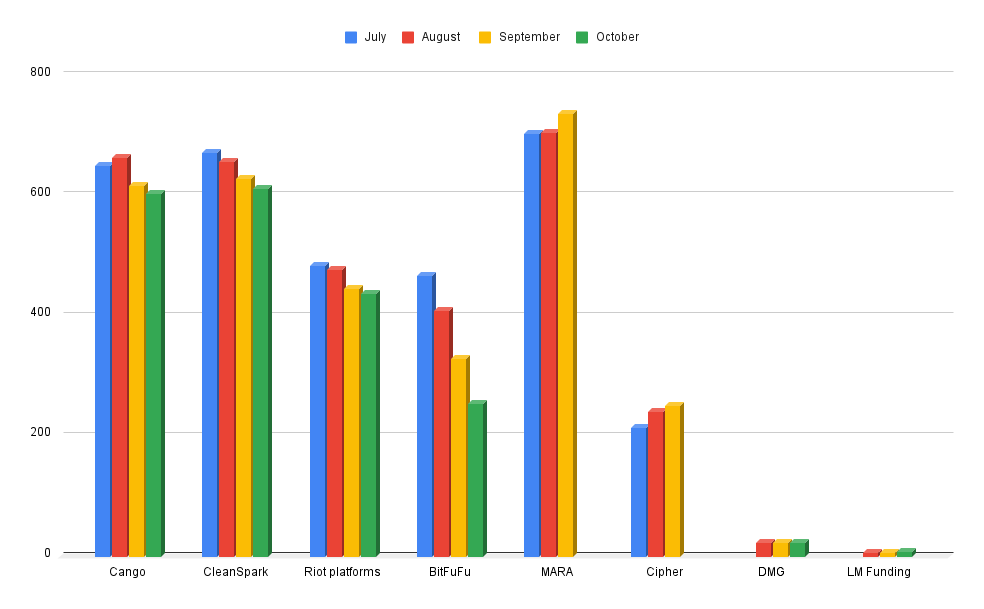

Particularly, Cango Inc. mined roughly 602.6 BTC in October, bringing its complete Bitcoin holdings to six,412.6 BTC. CleanSpark reported the same output to September, producing 612 BTC in the course of the month.

Riot Platforms mined 437 BTC, down from 445 BTC within the earlier month. Its complete Bitcoin holdings reached 19,324 BTC, up 37 BTC from the final month. Nonetheless, given the manufacturing quantity, the information counsel that the corporate doubtless bought a part of its mined Bitcoin to handle its money circulation.

BitFuFu produced 253 BTC, bringing complete holdings to 1,953 BTC, suggesting potential BTC liquidation to optimize capital.

Amongst smaller miners, DMG Blockchain mined 23 BTC, elevating its complete holdings to 359 BTC, whereas LM Funding America maintained secure manufacturing ranges. Regardless of their modest scale, these smaller entities assist preserve Bitcoin’s decentralization by distributing international hashrate extra evenly.

October Bitcoin mining output by some public firms. Supply: BeInCrypto

Marathon Digital Holdings (MARA) and Cipher Mining haven’t but disclosed their October Bitcoin manufacturing knowledge. Nonetheless, each firms launched constructive Q3 2025 monetary outcomes, signaling operational resilience regardless of a weaker September.

Marathon maintained its trade management with a record-breaking $123 million revenue within the third quarter of 2025. On-chain knowledge reveals that MARA’s mining deal with transferred 2,348 BTC (roughly $236 million) inside 12 hours, doubtless profit-taking following Bitcoin’s current value rally.

Cipher Mining additionally reported strong quarterly outcomes with $72 million in income and introduced a $1.4 billion high-yield bond issuance to fund a Google-linked knowledge middle mission.

Equally, TeraWulf expects third-quarter 2025 income to be between $48 million and $52 million. The corporate raised $3.2 billion in senior secured notes to broaden its US-based infrastructure. These large-scale financing strikes underscore a broader trade development. Main miners are repositioning themselves as suppliers of digital infrastructure, bridging Bitcoin mining with AI-driven high-performance computing (HPC).

Manufacturing Prices Hit File Excessive, Intensifying Business Competitors

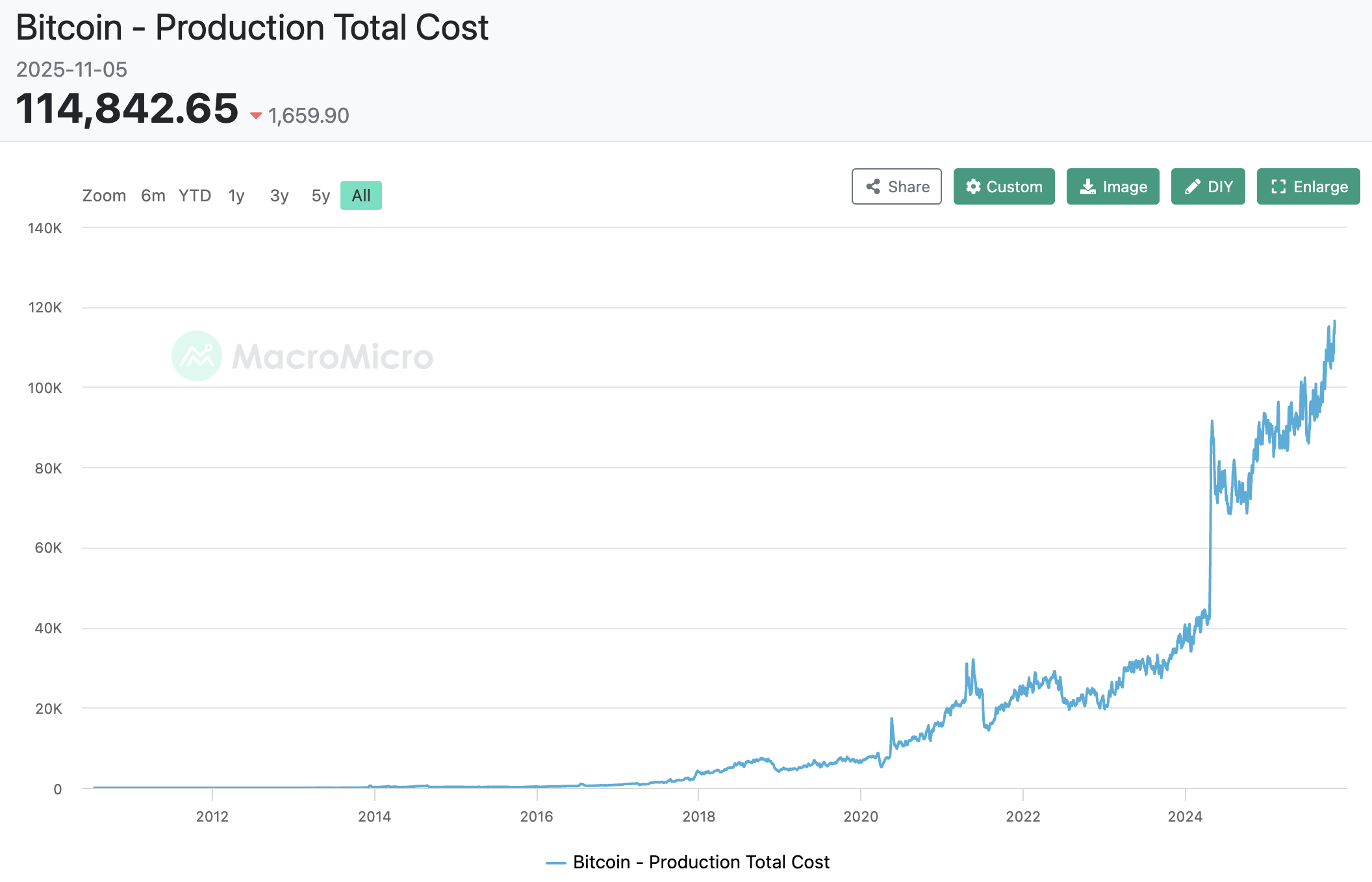

Based on MacroMicro, the common value to supply 1 BTC surged to $114,842, marking the very best degree in historical past. In the meantime, Bitcoin’s mining problem rose by 6.31% to 155.97T, setting a brand new all-time excessive for the community. With Bitcoin’s market value hovering round $102,000, the widening hole between market worth and breakeven value is squeezing revenue margins, particularly for smaller operators.

Common manufacturing value per BTC. Supply: MacroMicro

In response, miners are being compelled to reinforce power effectivity, spend money on next-generation ASICs, and scale their operations to safeguard profitability. Business leaders reminiscent of Cipher, TeraWulf, and CleanSpark are experimenting with hybrid fashions combining Bitcoin mining and HPC for AI workloads, a technique more and more seen as inevitable amid mounting value pressures.

Concurrently, governments and sovereign funding funds are coming into the Bitcoin mining sector to reinforce their management over strategic power and knowledge property. This rising “nationalization” of mining may reshape the worldwide energy construction, as some nations leverage surplus power assets to mine Bitcoin extra effectively, thereby lowering reliance on private-sector operators.

October 2025 marks the start of a profound structural transformation throughout the Bitcoin mining trade. Solely corporations with sturdy expertise capabilities, monetary stability, and long-term imaginative and prescient are more likely to endure.

As power prices and mining problem proceed to rise, 2026 may see probably the most vital wave of mergers and consolidations within the trade’s historical past, paving the way in which for a worldwide hybrid mannequin integrating Bitcoin mining with AI knowledge computation.

The put up October BTC Mining: Excessive Prices, Tight Margins, and AI Transformation appeared first on BeInCrypto.