Picture supply: Getty Photographs

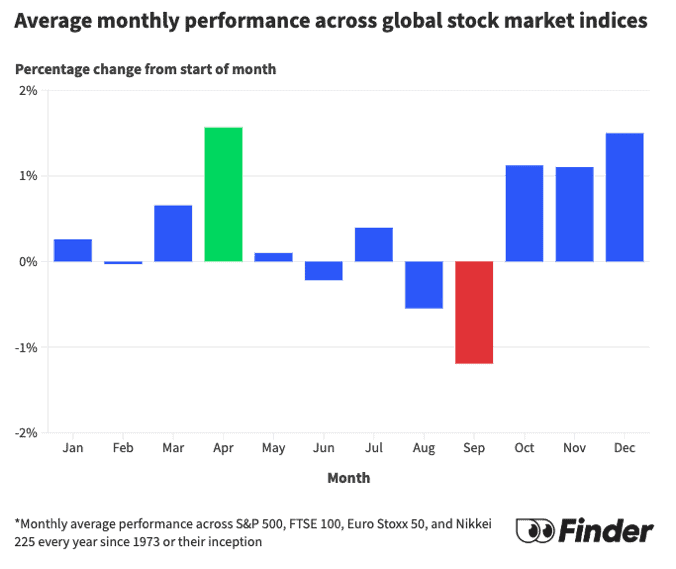

September is the worst month for the inventory market, in response to a current research by comparability web site Finder. Its analysis discovered that in current many years, main international inventory indexes such because the FTSE 100 and the S&P 500 have constantly underperformed on this explicit month.

The excellent news nevertheless, is that Finder additionally discovered that October, November, and December are usually sturdy months for shares. So if historical past is something to go by, we could also be about to see a inventory market rally.

September’s a tough month for shares

Finder analysed the month-to-month value efficiency of the FTSE 100, the S&P 500, the Euro Stoxx 50, and the Nikkei 225 indexes yearly since 1973, or their inception (the Footsie was created in 1984). And it discovered that in September these main indexes are likely to drop by about 1.2% on common.

Issues get higher

But, within the following three months, efficiency has traditionally been a lot better. Up to now, shares have usually risen between 1% to 2%, on common, in every of those months.

Apparently, Finder discovered that December is the perfect month of the yr for the UK’s FTSE 100 index. Since inception, it has delivered a value return of about 2.2% on common in December.

My transfer now

Now, whereas Finder’s analysis is actually attention-grabbing, I’m not going to make any large strikes on the again of it. Realistically, something might occur within the fourth quarter of 2024 as within the brief time period shares are notoriously unpredictable.

Having mentioned that, I’m going to proceed to drip feed cash into the market after I see attention-grabbing funding alternatives. And there are at all times alternatives in at this time’s risky markets.

One FTSE inventory I’m taking a look at

One inventory I’m considering shopping for extra of proper now’s FTSE 250 firm Alpha Group Worldwide (LSE: ALPH). It’s a number one supplier of forex administration and different banking options.

This inventory took a giant hit final week after it got here to gentle that founder and CEO Morgan Tillbrook goes to step down from the put up within the close to future. Clearly, buyers weren’t anticipating this (I had highlighted this situation as a threat up to now however wasn’t anticipating it to occur).

Having had just a few days to course of the information, I feel the share value weak spot may very well be a superb shopping for alternative for me. The CEO place’s going to be crammed by present chairman Clive Kahn, who is aware of the corporate properly and has a wonderful observe document within the monetary companies/funds world.

And he has purchased extra shares within the firm for the reason that information was introduced. This implies he’s assured the corporate – which has been rising at a speedy clip – can proceed to develop and generate extra wealth for buyers.

In fact, the lack of Tillbrook’s a giant blow. With out his management, the corporate (which has a high-performance tradition) might not carry out in addition to it did.

However I’m optimistic the enterprise – and the share value – can proceed to do properly. In spite of everything, winners are likely to hold successful.