Picture supply: Getty Photographs

Investing within the inventory market could be a wild experience at instances. However make no mistake, proudly owning UK shares can construct important wealth for buyers who take a long-term view.

In keeping with funding agency Vanguard, the typical yearly return from British shares sits at 9.18%, unadjusted for inflation. Even adjusted for inflation it sits at a powerful 5.35%.

Each figures beat the returns from financial savings accounts and bonds by a cushty margin, because the desk exhibits.

Complete returns between 1901 and 2022

| Asset class | Nominal return | Actual (inflation adjusted) return |

| Money* | 4.55% | 0.87% |

| UK bonds | 5.14% | 1.44% |

| UK shares | 9.18% | 5.35% |

Previous returns are not any assure of the longer term, in fact. However the efficiency of UK shares exhibits I might doubtlessly unlock a considerable passive earnings stream with out having to interrupt the financial institution.

Let’s say I’ve £400 accessible to take a position every month. That might be sufficient to assist me set up a second earnings of £21,473 for the remainder of my life. Right here’s how.

A FTSE 100 technique

Investing in FTSE 100 shares might be the technique to assist me obtain this purpose. The UK’s main index is full of market-leading, multinational firms with nice development data. On prime of this, Footsie shares are recognized for offering constant and beneficiant dividends.

Between its inception in 1984 and 2022, the FTSE 100 delivered a staggering return of 1,514.92%. That mixes each value features and dividends, and works out at an annual common of seven.48%, in line with IG Group.

Let’s assume the FTSE retains on delivering this common return for the subsequent 30 years. What would this rework an everyday £400 month-to-month funding into?

| FTSE 100 | |

| 5 years | £28,995.78 |

| 10 years | £71,093.32 |

| 20 years | £220,948.85 |

| 30 years | £536,824.97 |

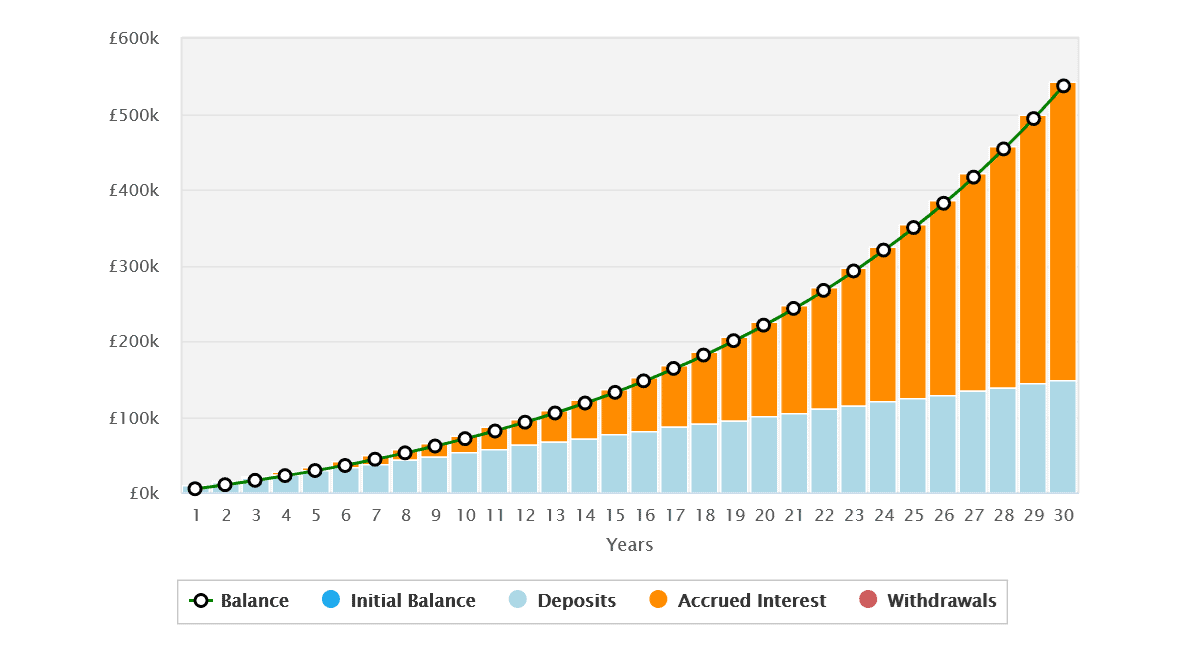

Because the desk exhibits, investing in blue-chip shares would construct me an enormous nest egg value £536,824.97. That’s due to the miracle of compounding, during which I’d reinvest dividends over these three a long time to purchase much more shares and obtain much more dividends.

The graphic under exhibits the highly effective influence of this mathematical miracle on constructing long-term wealth.

Now let’s switch that right into a passive earnings through the use of the 4% drawdown rule. This may enable me to attract a retirement earnings for 30 years earlier than the properly ultimately runs dry.

Utilizing this withdrawal technique would offer me with a wholesome annual passive earnings of £21,473.

Reward vs danger

In fact the prospect of constructing a five-figure earnings whereas doing nothing could be very engaging. Nevertheless it’s vital to keep in mind that share investing isn’t a risk-free endeavour and constructive returns are by no means assured.

A protracted interval of excessive inflation and elevated rates of interest, for example, might hurt the earnings I make. So might financial slowdowns in main economies just like the US and China. Lastly, rising geopolitical tensions can also harm my returns if commerce frictions flare up and conflicts emerge.

Nevertheless, I feel these dangers are value taking. As I’ve demonstrated, investing in UK shares can create life-changing wealth and hasten the trail in direction of monetary independence. It’s why I plan to proceed constructing my very own shares portfolio in 2024.