Picture supply: Getty Photos

Have you ever ever thought of loading a Shares and Shares ISA with high-yield dividend shares for passive revenue? Tens of millions of Britons do. I personal a variety of worldwide dividend shares.

For the time being, I revinvest the dividends I obtain to develop my portfolio. After I retire, I plan to make use of my money rewards to complement my State Pension revenue.

However how giant will my Shares and Shares ISA have to be to generate a £3,000 second revenue each month?

First steps

The excellent news is I don’t should issue any money grabs from the taxman into my calculations. With a tax-efficient ISA, I don’t should pay a penny in capital beneficial properties or dividend tax. And critically for my retirement revenue, I received’t pay any revenue tax after I make withdrawals. The dividends I obtain are mine and mine alone.

Please be aware that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

To get a predictable passive revenue every month, although, I’ll have to diversify my portfolio throughout totally different asset courses. Financial situations can change rapidly and considerably. Not constructing an ISA to cater for this might make my revenue extremely risky.

Because of this, it’s vital to have a group of shares spanning totally different industries and components of the globe. Corporations in defensive sectors like utilities, healthcare and telecoms can present a dependable revenue throughout the financial cycle. Extra cyclical shares can ship tasty dividend development over time.

A mixture of each could be a good way to focus on a long-term second revenue. It can be a good suggestion so as to add different fastened revenue property like bonds for assured revenue.

Diversification

I like the concept of shopping for funding trusts to resolve this want. Let’s take a look at Henderson Excessive Earnings (LSE:HHI) to grasp why.

Right this moment, the belief holds shares in 58 firms, the majority of that are listed in London. This geographic allocation may hurt the share value if investor urge for food for UK shares declines. However the giant variety of multinationals on HHI’s books helps defend dividend revenue from weak point in particular areas.

What’s extra, the shares it owns function throughout each cyclical and non-cyclical sectors for further passive revenue stability. A few of its largest holdings are British American Tobacco, Lloyds, Rio Tinto and Unilever.

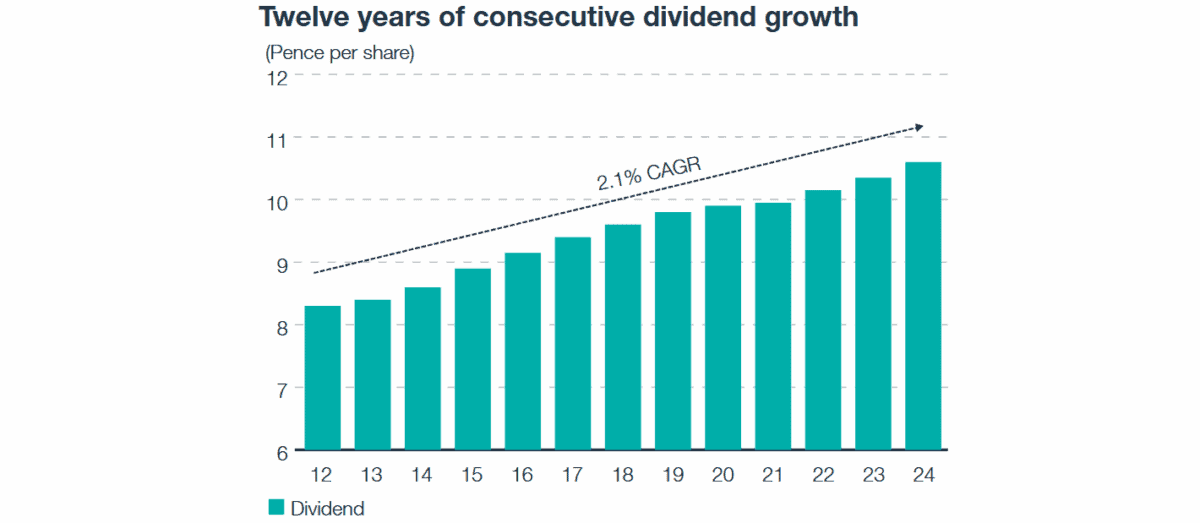

Henderson Excessive Earnings additionally holds a big selection of fixed-income company bonds. This mix of shares and bonds has helped the belief develop annual dividends yearly for greater than a decade.

The ultimate query

The very last thing I want to consider when focusing on a future passive revenue is dividend yield.

For our month-to-month goal of £3,000, I’ll want my ISA to be value £900,000 if full of shares yielding a median 4%. The quantity is £720,000 if the common yield is 5%, and £600,000 based mostly on a 6% yield. You get the concept.

Focusing on shares with increased dividend yields can include further threat. Better dividend yields can point out an unsustainable dividend, or an organization dealing with vital challenges whose share value has slumped.

Nonetheless, constructing a diversified portfolio as I’ve described can unfold these dangers and generate a predictable long-term passive revenue. Somebody investing £500 a month may obtain that £600k ISA in underneath 25 years with a 9% common annual return.