Picture supply: Getty Photographs

When discussing Shares and Shares ISAs, I’m usually reminded of Weapons N’ Roses’ acoustic masterpiece Endurance. Investing in one among these fashionable merchandise offers long-term buyers appreciable scope to develop their cash over time, due to the beneficiant tax breaks on supply.

Like that 1989 smash hit, the shares ISA has stayed the course and rewarded those that make investments for the lengthy haul. Markets rise and fall, however over time they have a tendency to rise significantly. And affected person buyers who make investments what they’ve saved on capital beneficial properties and dividend taxes can harness the wealth-boosting impact of compounding much more successfully.

The standard investor is unlikely to make the form of money Weapons N’ Roses’ frontman Axl Rose has amassed. His wealth is put at round $200m. Nevertheless, a cushty retirement is properly inside attain, with a big ISA earnings supplementing the State Pension.

However how giant would your portfolio must be to generate a £3,333 month-to-month passive earnings?

Constructing a nest egg

Having an earnings goal is a good suggestion, because it permits for higher funding planning. I believe a determine of £3,333 a month is a wise one to goal for — that equates to only beneath £40k a yr.

It’s a sum that, mixed with the State Pension, might fund a really comfy life-style in retirement in my opinion.

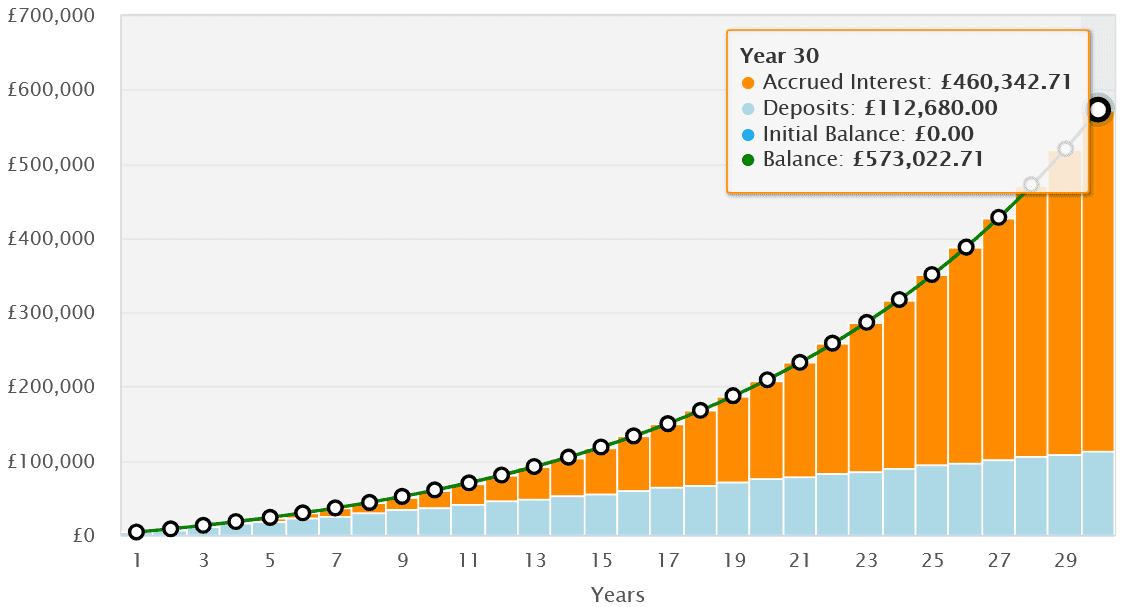

To hit that determine, somebody would want an ISA value £572,000. This assumes our investor places their cash in 7%-yielding dividend shares and lives off the money rewards.

However how straightforward is it to attain a half-a-million-pound shares portfolio? It gained’t be easy, however with the fitting technique and (right here’s that phrase once more) endurance, it’s greater than attainable.

Somebody investing simply £313 month-to-month might attain that £572k goal after lower than 30 years. That’s based mostly on them attaining a median yearly inventory market return of 9%.

Please notice that tax remedy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Dividend star

I really like the thought of investing in dividend shares for an earnings in retirement. A diversified portfolio can ship a gentle move of money, in addition to offering scope for additional portfolio progress over time.

Phoenix Group (LSE:PHNX) is one prime share I really feel dividend buyers ought to contemplate. Dividends have risen persistently since 2016, reflecting the corporate’s strong working mannequin and deep money reserves.

Because of this, its dividend yield has persistently crushed the long-term FTSE 100 common of three% to 4%. For 2026, its ahead yield is an excellent 8.2%.

Rumours has it Phoenix could also be lining up acquisitions, beginning with a takeover bid for Aegon‘s UK operations. Acquisition exercise is all the time dangerous, and might come at nice expense, which might affect dividends.

But I’m assured the insurer will stay one of many FTSE’s finest payers. Its Solvency II capital ratio of 175% illustrates simply how deep its pockets are. This additionally gives a cushion for dividends within the occasion earnings come beneath stress.

Ultimate ideas

I believe Phoenix Group could be an ideal addition to a dividend-generating Shares and Shares ISA. A broad portfolio of 15-plus shares like this might ship a big and regular passive earnings over time.