Picture supply: Getty Pictures

Are you able to think about incomes £60,000 a 12 months — or £5,000 every month — for doing completely nothing? It’d seem to be a pipe dream. However as I’ll clarify, with the fitting passive revenue technique, it may be nearer than you suppose.

For me, one of the simplest ways to chase a life-changing second revenue is with dividend shares. The bounties may be even larger when held inside a tax-efficient Shares and Shares ISA.

Safety from capital beneficial properties and dividend tax provides buyers extra monetary heft to develop their wealth. And with no revenue tax on withdrawals, buyers can maintain extra of the money their portfolios generate.

However how a lot would an ISA investor must have for a daily £5k month-to-month revenue?

Please observe that tax therapy depends upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Constructing an ISA

I believe a determine on this area is smart, given the hovering price of dwelling and social care. In two to a few many years, a £60k annual revenue (plus the State Pension) could also be wanted for a cushty life-style.

This clearly isn’t any small chunk of change. However the wonderful long-term returns of the inventory market make it a really achievable goal, as previous efficiency exhibits.

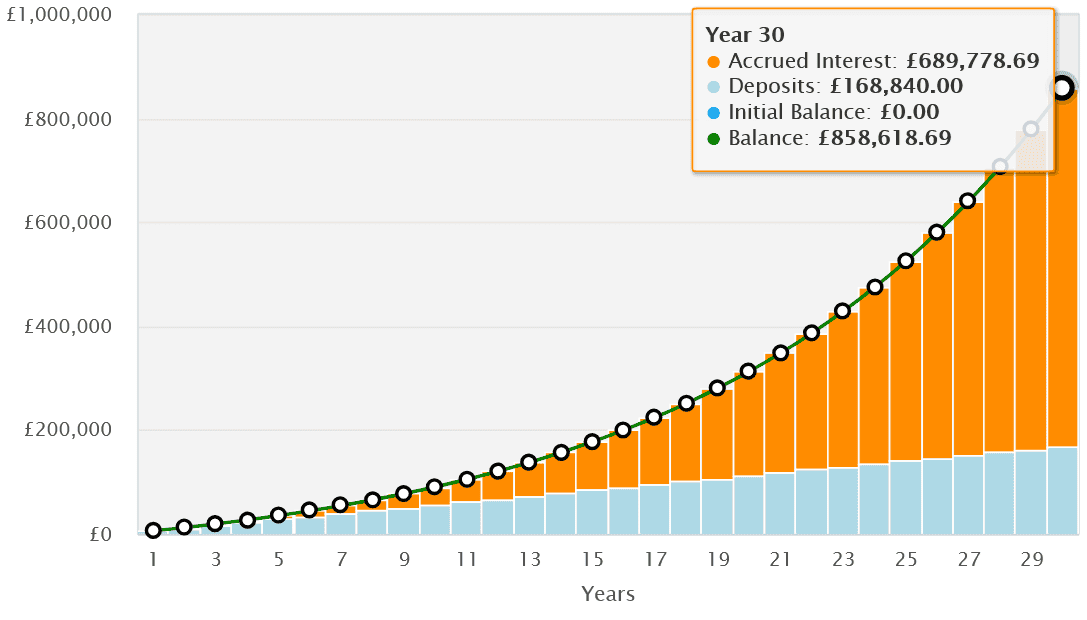

To realize a £5,000 revenue a month, somebody would wish a Shares and Shares ISA price simply over £857,000. This determine assumes our investor buys 7%-yielding dividend shares as soon as they hit retirement.

Based mostly on the 9% common annual return that share investing usually delivers, somebody investing simply £469 of their ISA over 30 years may attain that £857k goal.

FTSE 100 dividends

The UK inventory market’s full of wonderful dividend shares to show that right into a dependable long-term revenue. The FTSE 100 alone has dozens of high quality shares with sturdy information of delivering massive and rising money rewards.

Aviva‘s (LSE:AV.) one such dividend inventory I personal right this moment in my portfolio. Intensive restructuring and stability sheet repairs have made it one of many Footsie‘s hottest revenue shares in my e-book.

Annual dividends have risen by a mean 11.2% over the past 5 years. Supported by an enormous money buffer, Metropolis analysts tip payouts to continue to grow to 2027 a minimum of.

In consequence, the dividend yield for subsequent 12 months is a superb 5.8%.

Aviva’s drive in the direction of capital-light companies is a vital step in the direction of boosting money era and supporting future dividends. With a broad vary of insurance coverage, wealth, and retirement merchandise, the agency also can harness demographic developments to assist payout development.

Given its cyclical operations, Aviva’s earnings may come underneath stress if financial circumstances worsen. But I wouldn’t anticipate this to influence the corporate’s skill to maintain elevating dividends. Its Solvency II capital ratio stays comfortably above 200%.

The ultimate phrase

I imagine Aviva’s dividend prospects make it an important share to think about for an revenue portfolio. A diversified ISA of 15 or extra shares like this might ship a rising and dependable passive revenue over time.