Picture supply: Getty Photos

The Shares and Shares ISA is an unimaginable car for our investments. It’s protected against capital positive aspects and taxes on dividends. This implies it will possibly develop unimpeded by taxation and we are able to withdraw an earnings on it… with out being taxed.

Now, in keeping with experiences, the federal government is ready to focus on folks with incomes over £46,000 within the upcoming Price range. So, that bought me asking… how a lot cash would you want in a Shares and Shares ISA to take a tax-free earnings price £46,000 per 12 months?

Please word that tax therapy will depend on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Working the maths

To generate an annual earnings of £46,000 totally from a Shares and Shares ISA, the important thing issue is the withdrawal fee — the proportion of the portfolio withdrawn every year to fund residing prices.

Utilizing a 5% withdrawal fee, the calculation is simple:

- £46,000 ÷ 0.05 = £920,000

Which means a portfolio price round £920,000 might, in concept, produce a £46,000 tax-free earnings every year. In fact, this assumes the portfolio continues to develop sufficient to offset withdrawals and inflation over time.

A 5% withdrawal fee is extra bold than the normal 4% guideline usually utilized in monetary planning, so it carries larger threat of eroding the portfolio if markets carry out poorly for a sustained interval. Nonetheless, it presents a helpful benchmark for understanding the size of funding wanted to generate a cushty, tax-free earnings totally throughout the ISA wrapper.

However that’s some huge cash?

In fact, some readers will see this and assume “I might by no means have a portfolio price £920,000″. Nicely, it’s very doable. It simply takes time, constant contributions, and a some frequent sense on the subject of investing.

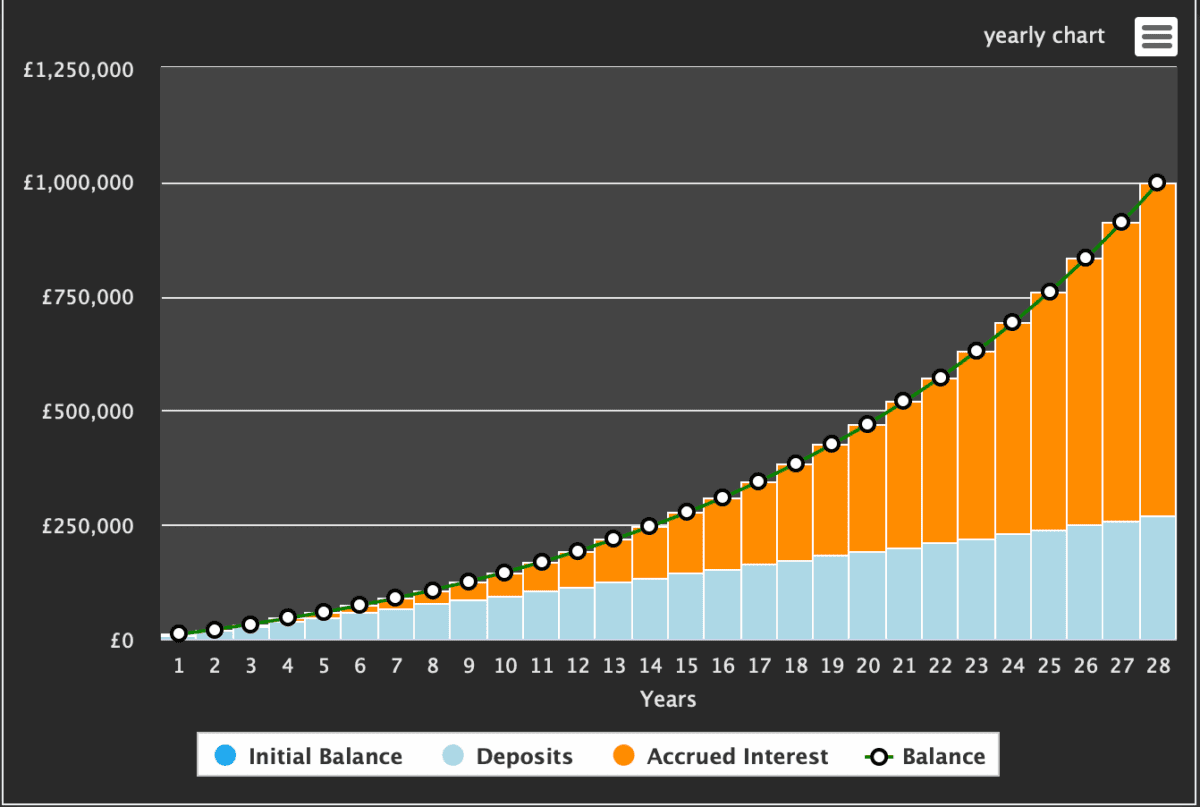

As this graph reveals, £800 of month-to-month contributions coupled with a median 8% return, can compound massively over the long run. On this instance, an investor would have £940,000 in 27.5 years.

And as we are able to see from the graph, the overwhelming majority of that cash will come from curiosity compounding. That is when our returns begin to generate their very own returns.

The place to speculate?

In fact, the above is theoretical, and it’s depending on the investor making the appropriate investments. So, the place to speculate? Nicely, one inventory that I imagine is price contemplating is Recent Del Monte (NYSE:FDP).

It’s bought nothing to do with expertise, and meaning there’s a point of isolation towards any pullback within the pink sizzling expertise and AI segments — and a pullback is definitely doable.

Recent Del Monte is a serious vertically built-in producer, marketer, and distributor of contemporary and fresh-cut vegatables and fruits worldwide. It owns and conserves important agricultural land — for instance, round 9,400 hectares of forested land in Costa Rica tied to its pineapple and banana operations. Wanting long-term, I actually like firms with land holdings.

It’s additionally not costly. Buying and selling at 13.2 occasions ahead earnings — falling to 12.1 occasions for 2026 — it’s nicely beneath the index common. It’s additionally an honest dividend payer too, with the yield presently sitting round 3.2%. This appears set to rise additional within the coming years.

One threat is price inflation into inputs like gasoline and fertiliser. This might put margins beneath strain.

Nevertheless, for now, it appears like a superb enterprise at undemanding multiples.