Picture supply: Getty Photos

Constructing passive revenue with an ISA is usually a highly effective strategy to safe monetary freedom in retirement. Rising dwelling and social care prices imply many pensioners are feeling the monetary squeeze. However by investing in a Shares and Shares ISA, many hundreds of individuals have managed to realize a top quality way of life in later life.

People can select to avoid wasting or spend money on a Money ISA, a Shares and Shares ISA, or a Lifetime ISA. Nevertheless, the better annual allowance and stronger long-term returns imply that the investing ISA has proved the best alternative for constructing wealth.

Annual returns right here have averaged 9.6% over the past decade. With the Money ISA, this sits manner again at 1.2%, in keeping with Moneyfacts.

Utilizing an ISA to purchase shares, trusts and funds entails better danger. However it additionally offers a formidable probability to construct a £1,000 second revenue in retirement

Please word that tax remedy depends upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Development AND revenue

Of the various methods you may goal for a big passive revenue, investing in dividend shares is one path to contemplate. It’s the technique I plan to observe, as it will probably present a gentle revenue in addition to room for additional portfolio progress.

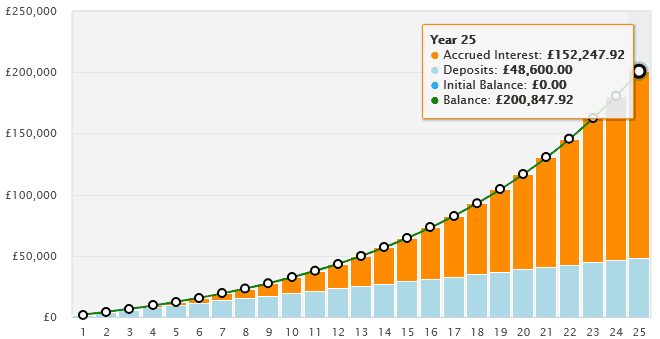

Let’s say I select to purchase 6%-yielding dividend shares as soon as I hit retirement. To make a month-to-month revenue of £1,000 a month, my Shares and Shares ISA will should be price £200,000 by then.

That’s not a small sum. However it’s additionally isn’t one which’s essentially out of attain for most individuals, because of the long-term efficiency of the inventory market and the tax advantages of the ISA.

If I can hit that 9.6% common annual return I discussed above, as little as £162 a month (excluding buying and selling charges) over 25 years would let me attain that magic £200,000 portfolio.

Concentrating on high quality shares

Selecting particular person shares could be the best strategy to goal blockbuster returns by common investing. This technique can ship index-beating returns, serving to people maybe double or triple their cash, maybe extra.

Take Ashtead Group (LSE:AHT) as one to contemplate. Fast growth through the twenty first century has remodeled it right into a powerhouse within the North American rental tools sector. It’s benefitted from the power of the US economic system, and the continued shift from possession to rental for building and industrial {hardware}.

Revenues have grown from £1.6bn in 2014 to £8.7bn final yr (based mostly on common alternate charges). And pre-tax earnings have swelled from £357m to £1.7bn. This has translated into a mean annual return of 18.8%, taking into consideration share value positive factors and dividends.

That is an trade that’s confronted challenges attributable to larger rates of interest and bother in key finish markets. However the long-term outlook stays sturdy, helped by plans for enormous infrastructure upgrades within the US. With {the marketplace} nonetheless extremely fragmented, Ashtead has scope for additional earnings-boosting acquisitions as effectively.

Not all shares are equal, and a diversified portfolio may comprise winners like this alongside some a lot poorer performers. However cautious evaluation to determine high quality corporations like Ashtead can set ISA traders up for retirement.