Picture supply: Getty Pictures

The Shares and Shares ISA permits Britons to contribute as much as £20,000 every year right into a tax-free funding portfolio. When it comes to wealth creation within the UK, there’s nothing fairly prefer it.

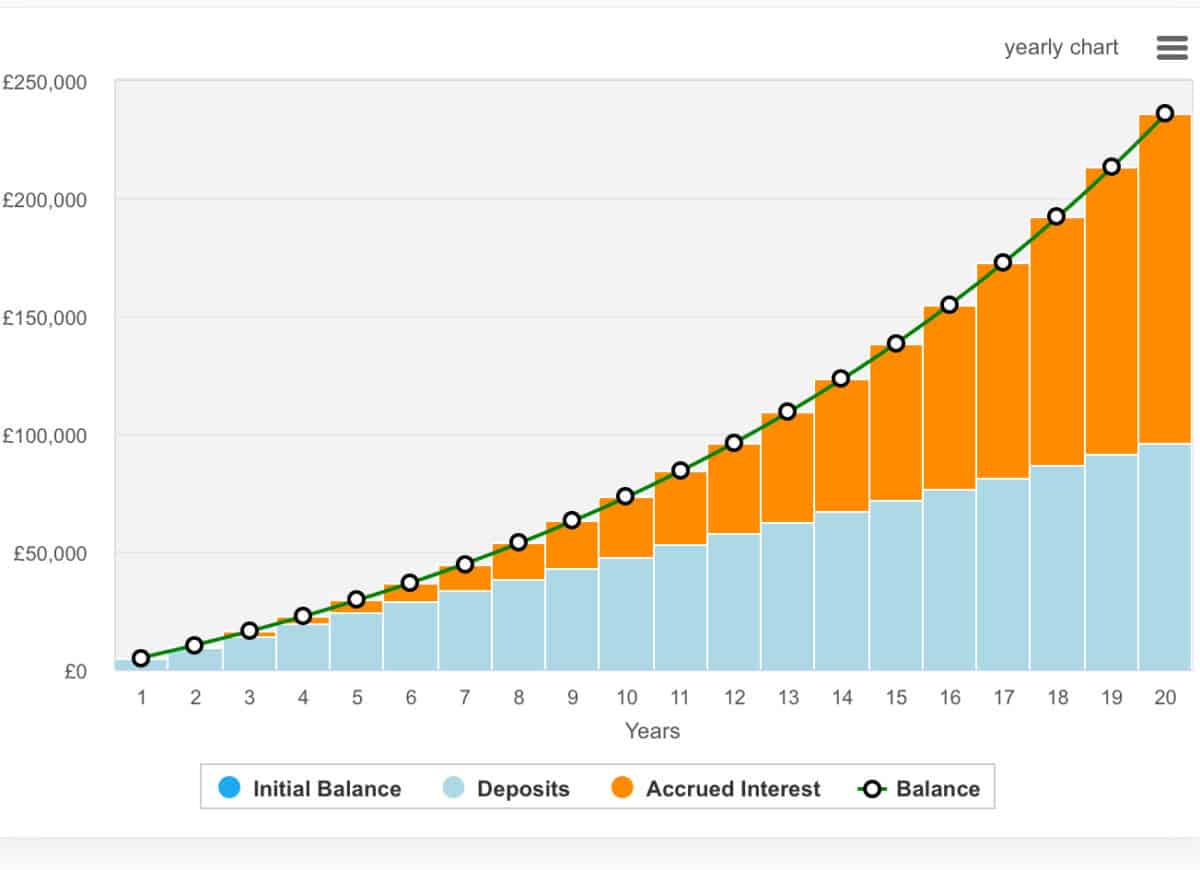

To generate £1,000 in passive earnings every month (£12,000 per yr) from a Shares and Shares ISA, an investor would want a portfolio of round £240,000 yielding 5% yearly.

That’s a considerable sum, however the great thing about compounding means it doesn’t need to be constructed in a single day.

For example, investing £400 a month right into a diversified ISA returning a median of 8% per yr might develop to roughly £235,000 after 20 years.

Annually, the returns themselves begin incomes returns — that’s compounding in motion. Early contributions have a long time to develop, whereas later ones profit from an ever-larger base.

The bottom line is consistency and time available in the market, not timing it. Even modest, common investments can snowball right into a significant passive earnings stream, notably when sheltered from tax inside an ISA.

Please observe that tax therapy is determined by the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

The place to take a position?

Okay, so we’ve explored how this could possibly be achieved in concept, however the subsequent half is know what to do to get there. After opening a Shares and Shares ISA with a brokerage, traders want to decide on which shares to purchase with their hard-earned money.

The choices — relying on the brokerage — are usually huge. There’s every part from funds and trusts to shares and bonds.

Funds and funding trusts pool cash from many traders to purchase a diversified mixture of belongings, managed by professionals aiming to generate regular returns.

They’re usually seen as a better strategy to unfold threat with out choosing particular person shares. Shares, alternatively, characterize possession in particular corporations — larger threat, however with the potential for larger long-term beneficial properties.

Bonds are basically loans to governments or companies that pay mounted curiosity, providing stability and predictable earnings.

Personally, as a extra skilled investor, my portfolio is geared in the direction of a variety of shares. An information-driven strategy helps me obtain returns which can be usually far in extra these of an index-tracking fund.

A present favorite

My solely funding within the month of October has been the London Inventory Trade Group (LSE:LSEG). In response to analyst consensus, the London Inventory Trade Group is at the moment considered as essentially the most undervalued firm on the FTSE 100.

Forecasts recommend a 42% low cost to honest worth. Nonetheless, such estimates should be handled with warning as analyst protection can differ in high quality. So, why is it so undervalued?

The London Inventory Trade Group has a large financial moat and excessive margin operations, particularly in information and analytics. It additionally presents double-digit earnings progress whereas buying and selling at a little bit over 20 instances ahead earnings.

Nonetheless, no inventory is ideal. Dangers stay. Competitors in information and analytics is fierce, and the transition away from legacy merchandise might dent recurring revenues.

Nonetheless, for long-term traders, these dangers could also be balanced by the agency’s diversified, high-margin operations. I actually consider it’s a inventory price contemplating.