Picture supply: Getty Pictures

Producing a small quantity of passive revenue is pretty straightforward with a well-balanced portfolio of dividend shares. Nevertheless, reaching some extent the place one can stay completely off the revenue could take a bit extra effort.

For these outdoors of London, the Nationwide Residing Wage (NLW) is £12.60 per hour. Primarily based on a normal 35-hour work week, that quantities to about £2,000 a month, or £24k yearly.

How a lot wouldn’t it take to realize that a lot passive revenue?

Let’s have a look.

Lowering outgoings

The very first thing to do when formulating an revenue technique is to discover price discount choices. With a Shares and Shares ISA, UK residents can eradicate one of many greatest prices: tax.

This sensible self-directed account permits as much as £20k to be invested per yr with no tax charged on the capital good points. Good!

Please word that tax therapy will depend on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Constructing the funding

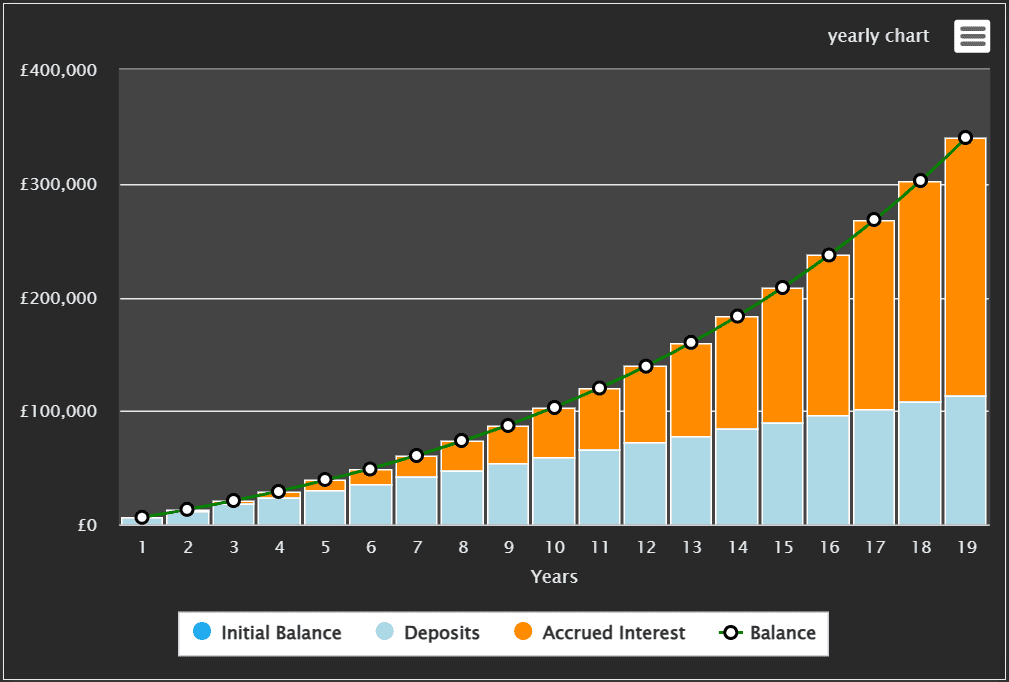

The typical dividend yield on the FTSE 100 is 3.5% however income-focused portfolios can obtain as a lot as 7%. With £343,000 invested, a 7% portfolio would return £24k a yr in dividends.

That’s no small chunk of money. It will take over 56 years of saving £500 a month! Fortunately, compounding good points may velocity issues up. In a portfolio attaining the market common 10% return, it may take solely 19 years.

Hitting that top yield

Within the funding world, passive revenue nearly all the time comes within the type of dividends. How a lot in dividends will depend on how excessive a portfolio’s common yield is. Thankfully, the UK inventory market is a heavenly treasure trove of high-yield dividend shares.

Let’s crack open our two fundamental indexes and see what gems they’re hiding.

On high of the FTSE 100, we now have Phoenix Group, with a ten.4% yield; M&G, with a 9.3% yield; and Authorized & Basic, with 8.5%.

Over on the smaller-cap FTSE 250 index, the highest three are renewable energy-related companies with yields upwards of 12%. I’m a fan of renewables however in the case of dependable passive revenue, I feel giant established firms are the best way to go.

On the Footsie, the most important firm paying significant dividends is HSBC (LSE: HSBA), with a 5.8% yield. With a £156.8bn market cap, it’s second solely to AstraZeneca and lately handed Shell.

AstraZeneca is one other nice inventory however the 2% yield doesn’t make it nice for revenue. Shell’s 4.2% yield is first rate however recently its efficiency has been underwhelming.

A worldwide banking powerhouse

HSBC is a well-liked choice amongst dividend buyers. With a world presence unfold throughout the US, Europe, and Asia, it’s shielded from a stoop in any single area. This provides to its dependable income-focused credentials.

Over time, it has maintained a constantly excessive yield and robust earnings, giving it greater than enough protection for funds.

Regardless of this, it has made some giant dividend cuts up to now throughout financial downturns. If one other pandemic or monetary disaster happens, it’d enact extra cuts, limiting returns.

Thankfully, it tends to recuperate shortly and normally enjoys regular worth development. The inventory is up 43% up to now yr and 90% up to now 5 years, equating to annualised returns of 13.7% per yr.

HSBC is only one instance of a terrific dividend inventory to think about for passive revenue.