Picture supply: Getty Photographs

With a tax-efficient Particular person Financial savings Account (ISA), any of us can considerably improve our probabilities of making an enormous second earnings in retirement.

Right here’s a method an individual can attempt to construct a £3,000 passive earnings with tax-free ISA accounts.

Please word that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Consider carefully

The very first thing to say is that there’s no blueprint to investing or saving. All of us have totally different short- and long-term funding objectives, in addition to various attitudes to threat and distinctive units of monetary circumstances.

That stated, there are some cast-iron tips for investing that some ignore at their peril.

One is that saving predominantly in Money ISAs is unlikely to make most of us a second earnings for a snug retirement. Put merely, our cash could also be protected in such an account however the returns one makes are more likely to be inadequate, based mostly on most individuals’s circumstances.

Concentrating on a £3k month-to-month earnings

Let’s say an investor has £514 spare every month. That’s the typical quantity that Britons at the moment save or make investments, in keeping with monetary providers supplier Shepherd’s Pleasant.

In the event that they invested that in a 4%-yielding Money ISA they’d, after 30 years, have £356,741 sitting of their account. Primarily based on a 4% annual drawdown price, that will give them an earnings of £14,270, or £1,189 a month.

As talked about, such earnings is assured and protected. However even with the State Pension added, this individual is unlikely to have the £43,100 that the Pensions and Lifetime Financial savings Affiliation (PLSA) says that individuals must retire comfortably.

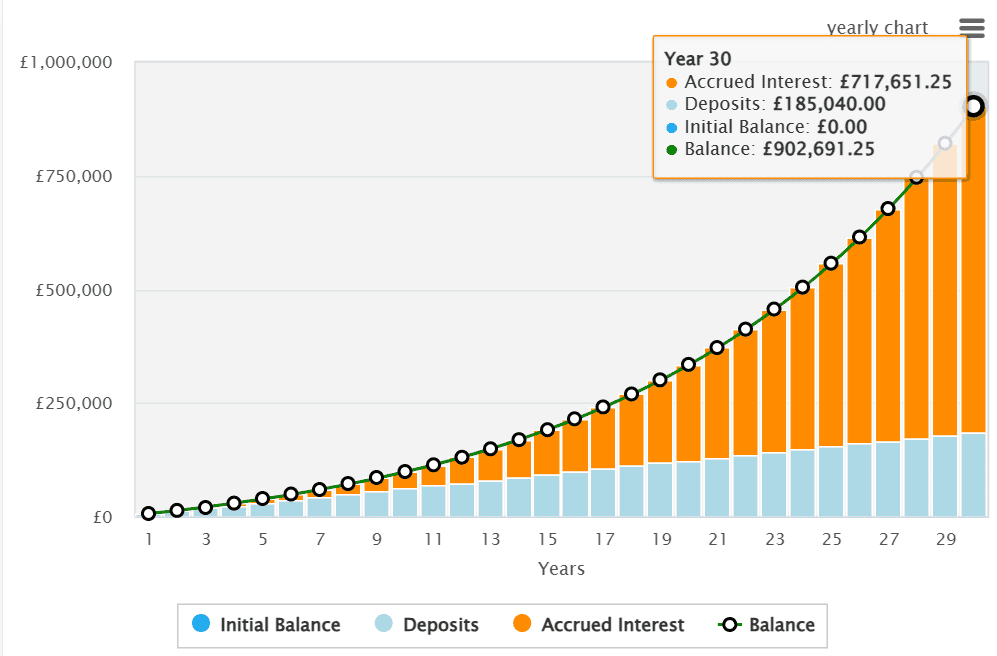

As a way to hit this threshold, an ISA investor would want a stability of £900,000 or thereabouts by the point they retire.

Primarily based on that very same 4% drawdown price, this £900k stability would supply a mean month-to-month earnings of £36,000. With the State Pension added in, that PLSA goal of £43,100 might be fairly achievable.

This might be achieved by investing in shares that present a mean annual return of 8.8% in a Shares and Shares ISA.

Investing in funds

That 8.8% return is achievable, for my part, based mostly on the confirmed long-term charges of return of UK and US shares.

The FTSE 100 and S&P 500 have delivered annual common returns of seven% and 11%, respectively. If this continues — which not like a Money ISA just isn’t assured — that £514 invested equally throughout a tracker fund for every index would web an investor that magic £3k month-to-month second earnings.

The iShares Core S&P 500 ETF (LSE:CSPX) is one such fund that buyers can think about at the moment.

With an ongoing cost of 0.07%, it’s the most affordable S&P-based ETF at the moment out there within the UK. When mixed with a Shares and Shares ISA, it might save buyers an enormous wad of money by eliminating pointless charges and taxes.

Investing in any fund is riskier than holding money. Nevertheless, by investing in 500 totally different corporations, merchandise like this might help buyers unfold threat successfully whereas additionally chasing these superior returns.

On this case, people scale back threat with a whole lot of various corporations spanning many geographies and industries. This doesn’t imply the fund can’t decline throughout financial downturns. However it might minimise volatility and produce a clean and stable return over the long run.

It’s why I maintain an S&P 500 fund in my very own ISA.