Morsa Photos/Getty Photos

Key takeaways

- You may full a steadiness switch on-line with Financial institution of America after you are permitted for an eligible card or if you have already got a card with an intro APR provide.

- Most Financial institution of America steadiness transfers are accomplished inside two to 4 days, nevertheless it would possibly take as much as 14 days for brand spanking new accounts.

- When selecting a Financial institution of America steadiness switch card, decide whether or not you’d moderately have an extended intro APR provide and no ongoing rewards or a shorter intro APR provide and ongoing money again rewards.

Paying off bank card debt can appear overwhelming, particularly when that debt comes with excessive rates of interest. To start out tackling that debt, it’s good to benefit from a steadiness switch bank card with a 0 p.c intro APR provide.

A number of Financial institution of America bank cards include intro APR affords, and transferring your steadiness with one among these playing cards needs to be simple. Go this route, and you’ll repay your bank card debt with out paying curiosity for a restricted time — so long as you pay it off earlier than the intro APR provide expires. In case you don’t pay all of it off by then, you’ll begin paying a variable APR on any remaining steadiness.

Right here’s what to know if you happen to’re planning on utilizing a Financial institution of America card for a steadiness switch, in addition to the right way to full the method.

What to know earlier than transferring your steadiness to a Financial institution of America card

Transferring your steadiness to a Financial institution of America card with an introductory APR provide needs to be a straightforward course of, however earlier than you get began, it’s best to nonetheless do some prep work. Earlier than you switch your steadiness, observe the following tips:

- Ensure you’re transferring from a special issuer: You can not switch debt from one Financial institution of America bank card to a different Financial institution of America bank card.

- Don’t neglect to switch your balances throughout the given timeframe: For brand spanking new Financial institution of America cardholders, you have to switch your balances throughout the first 60 days of account opening if you wish to benefit from any intro APR affords.

- Begin eager about your reimbursement plan earlier than you make the steadiness switch: You’ll must repay your balances earlier than your intro APR interval ends to keep away from paying curiosity. As soon as the intro APR interval is over, you’ll start paying the common variable APR on any steadiness left on the cardboard.

- Issue the steadiness switch payment into your reimbursement plan: You’ll sometimes pay a 3 p.c or 4 p.c steadiness switch payment for every steadiness you switch.

- Keep away from transferring any steadiness you’ve disputed together with your issuer as being faulty, fraudulent or duplicative: In case you switch a disputed transaction, you’ll lose sure dispute rights on that cost.

The best way to switch a steadiness to a Financial institution of America bank card

The best option to full a Financial institution of America steadiness switch is on-line, although it’s also possible to accomplish that over the telephone. You may full a steadiness switch after you’re permitted for a brand new, eligible card or if you have already got a card with an intro APR provide.

The best way to do a steadiness switch on-line with a brand new card

- Fill out an software for the steadiness switch card you’re excited by. In case you’re already a Financial institution of America buyer, you’ll be able to log in to finish this step sooner.

-

Go to the “Further Choices” part and examine the “Switch a steadiness to my new bank card” field. As soon as checked, the appliance will present extra containers so that you can fill out, reminiscent of a field for the title of your different card’s issuer, the quantity you need to switch and the account variety of your different card.

EXPAND

- Fill out these containers and add any extra steadiness transfers if obligatory. Remember that you don’t know what your credit score restrict will likely be but, so if the entire quantity you request exceeds your new card’s credit score restrict, Financial institution of America would possibly solely fulfill the primary steadiness switch request you listed or would possibly solely fulfill a partial request. They may even deny your request outright.

- Submit your software with the steadiness switch request. If Financial institution of America approves your steadiness switch, it can switch your steadiness as requested, beginning with the primary switch listed if you happen to’ve listed multiple.

The best way to do a steadiness switch on-line with an present card

If you have already got a Financial institution of America card, you’ll be able to examine to see if you happen to’re eligible for an intro APR provide on steadiness transfers. When you have an eligible card and need to switch a steadiness to it, observe these steps:

- Log in to your account. You must see your bank card account listed when you log in.

-

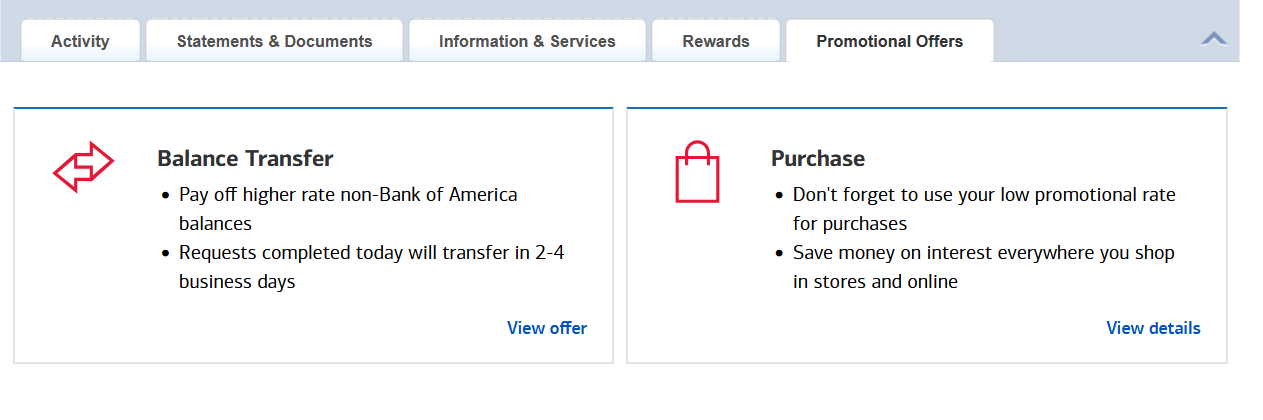

Click on in your bank card account web page and navigate to the “Promotional Gives” tab. This tab ought to show your out there introductory APR affords.

EXPAND

- Select “View Supply” and observe the directions to finish your switch. Present the account variety of the bank card from which you’d prefer to switch the steadiness, in addition to how a lot of the steadiness you’d prefer to switch and the bank card issuer’s title.

- Submit your switch request. When you have one other request to make, you’ll should undergo this course of once more.

The best way to do a steadiness switch over the telephone

When you’re permitted to your steadiness switch card, you can begin your steadiness switch over the telephone by following these steps:

- Name the quantity on the again of your card. In case you don’t but have your card, you’ll be able to name the corporate’s customer support line.

- Discuss to the consultant about your request. They are going to doubtless ask you to confirm your identification.

- Present the steadiness switch info and account particulars wanted to finish the request. Be sure to issue within the steadiness switch payment and your credit score restrict if you do your math.

- Watch for the steadiness switch to complete processing. You also needs to ask for a follow-up e mail about your name earlier than hanging up with the consultant.

What occurs after submitting a steadiness switch request?

Most Financial institution of America steadiness transfers are accomplished inside two to 4 days, nevertheless it would possibly take as much as 14 days for brand spanking new accounts, in response to the issuer. You’ll know you’re profitable if you see the transferred steadiness seem in your Financial institution of America bank card account.

Remember to hold making funds on the bank card you transferred the steadiness from till the steadiness switch is full. If a cost comes due whereas your switch is in progress, pay it promptly. In case you don’t, you’ll run the chance of getting hit with late charges and penalty APRs.

Greatest Financial institution of America playing cards for steadiness transfers

The underside line

In case you’re coping with excessive curiosity debt, making use of for a bank card with a 0 p.c intro APR provide for steadiness transfers is a viable choice to keep away from these charges. Many Financial institution of America playing cards have intro APR affords on steadiness transfers, permitting you to repay debt over time with out accruing curiosity.

Remember to decide what you’re on the lookout for in a card — reminiscent of an extra-long intro APR interval or a shorter intro APR provide with money again rewards — earlier than making use of. The extra you perceive what you need from probably the greatest steadiness switch bank cards, the better will probably be to find out which card is finest for you.

Often requested questions (FAQs) about BofA steadiness transfers

*The details about the BankAmericard® bank card has been collected independently by Bankrate.com. The cardboard particulars haven’t been reviewed or permitted by the cardboard issuer. All info concerning Financial institution of America bank cards was final up to date on August 26, 2024