Picture supply: Getty Photos

To my thoughts, ‘passive earnings’ is among the sweetest keyphrases within the investor’s vocabulary. Who doesn’t love the thought of having fun with a second earnings with out having to elevate a finger?

There are a number of methods people can goal a second earnings with little-to-no-effort. However to my thoughts, one of the best ways to realize that is by constructing a portfolio of shares, exchange-traded funds (ETFs), funds, and money.

This methodology can present the proper stability of threat and reward. And, over time, it may possibly present an earnings stream that we are able to comfortably stay off of.

The plan

However learn how to get began? There’s a world of monetary merchandise we are able to use to attempt to construct long-term wealth, and all kinds of monetary belongings.

The very first thing I’d do is open a tax-efficient Shares & Shares ISA or a Self-Invested Private Pension. After paying buying and selling and administration charges (if relevant), the remainder of the earnings are mine. I don’t must pay a penny to the taxman and, over time, this may add as much as a princely sum.

Please notice that tax remedy is determined by the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

The following factor I’d do is create a balanced portfolio of FTSE 100 and FTSE 250 shares. I’d additionally get publicity to the US inventory market with the S&P 500.

Such a technique would permit me to unfold out threat and clean my returns over time. What’s extra, these indices have supplied distinctive returns in latest many years, giving me the possibility to turbocharge my wealth.

A juicy nest egg

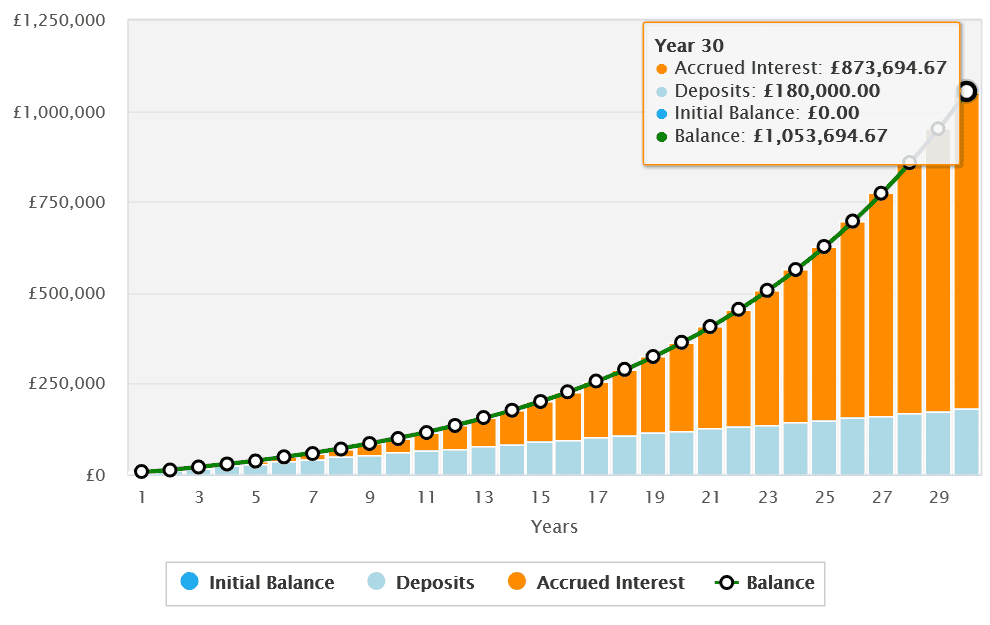

The Footsie’s delivered a mean annual return of 8% since its inception throughout the previous 30 years. The FTSE 250’s return stands at 11%, whereas the S&P 500 has supplied a long-term return of round 10%.

Previous efficiency isn’t any assure of future returns. But when previous efficiency continues, a £500 funding distributed equally throughout these indices would flip into £1,053,695 after 30 years.

I might then draw down 4% from this £1m+ nest egg annually for a yearly passive earnings of £42,148. At this charge, I might stretch my retirement fund out for 30 years.

A high FTSE inventory

I might attempt to obtain this by spreading my month-to-month funding throughout three ETFs that monitor the FTSE 100, FTSE 250 and S&P 500. Alternatively, I would select to purchase particular person shares as an alternative of, or along with, this. This method may help me to probably obtain a market-beating return.

Ashtead Group‘s (LSE:AHT) a blue-chip inventory I’ve added to my very own portfolio. It’s delivered the most effective return of any present FTSE 100 share over the previous twenty years. I’m assured it’s going to proceed to be a powerful performer because it continues to quickly increase.

The corporate’s Sunbelt Leases unit is the second-largest heavy tools provider within the US. With a big presence in Canada and the UK too, it’s capitalising successfully on the rising development of shoppers renting {hardware} as an alternative of shopping for it.

Encouragingly, Ashtead stays extremely money generative, and so it has the firepower to proceed making profits-boosting acquisitions. Earnings might undergo if the financial panorama worsens and building exercise cools. However, on stability, I feel it is a high Footsie inventory to think about as we speak.