Key takeaways

- Whereas some bank card issuers will routinely enhance your credit score restrict over time when you qualify, you may as well request the next restrict.

- Capital One lets customers request the next credit score restrict by their on-line account administration web page, or they’ll name in to inquire.

- It is simpler to qualify for the next credit score restrict on a Capital One card in case you have a historical past of utilizing your card responsibly, your earnings has elevated or you’ve gotten different causes to suppose you may be eligible for extra obtainable credit score.

A better credit score restrict may offer you extra flexibility in your price range and profit your credit score rating by reducing your credit score utilization ratio. That is true relating to Capital One bank cards, in addition to playing cards from different issuers, though particular person corporations all have their very own processes relating to granting extra obtainable credit score.

In case you have a Capital One card particularly, requesting the next credit score line ought to be a breeze. Learn on to be taught all the things you must find out about growing your credit score restrict with Capital One, both by displaying your creditworthiness so your restrict is elevated routinely or by taking the initiative to request extra credit score as a substitute.

Earlier than you apply for a credit score enhance

Earlier than you apply for the next credit score line with Capital One, you’ll wish to take into consideration your present credit score restrict and the way you’re utilizing it, together with how a lot credit score you wish to have. You also needs to think about your present monetary standing and the way doubtless you’re to get authorized for extra credit score when you request it.

Inquiries to ask your self embrace:

What’s your present credit score restrict?

Earlier than you resolve how large of a rise to ask for, ensure you know the present restrict in your Capital One bank card. You possibly can simply discover this data by logging into your account.

EXPAND

Luckily, asking for a credit score restrict enhance with Capital One received’t negatively affect your credit score rating. It’s because the cardboard issuer solely performs a smooth inquiry for credit score restrict enhance requests, and smooth credit score inquiries don’t affect your credit score in any method.

How a lot credit score would you like?

Whereas it could possibly be tempting to ask Capital One to double the quantity of accessible credit score you’ve gotten proper now, asking for 10 p.c to twenty p.c extra credit score could also be extra affordable and current the next probability the request will probably be accepted.

Additionally, take into consideration how your card issuer decided your unique credit score restrict. Contemplating what elements have modified in your credit score report can provide you an thought of what you could be authorized for now.

Are you eligible for a rise?

Capital One evaluates numerous standards when figuring out whether or not to grant a credit score restrict enhance. Listed here are a couple of elements that may enable you get authorized:

- You’ve been utilizing your Capital One card responsibly. A optimistic cost historical past demonstrates you can handle debt properly, so the issuer is likely to be extra inclined to increase extra credit score to you.

- You’ve had your Capital One account open for a number of months at a minimal. The longer you’ve had your card, the extra time you’ve needed to present the issuer you’re a accountable borrower.

- It’s been a number of months or longer since your final credit score restrict enhance. In case you ask for extra credit score too usually, the issuer would possibly interpret it as a pink flag signaling that you simply is likely to be in dire want of money.

- You’ve an unsecured Capital One bank card. Capital One doesn’t grant increased credit score limits on its secured bank cards except you enhance the quantity of your safety deposit.

3 ways to extend your credit score restrict with Capital One

There are a couple of methods you will get a credit score restrict enhance with Capital One — and generally you don’t even should ask.

1. Obtain an automated credit score restrict enhance

Capital One could routinely enhance your credit score restrict when you use your bank card responsibly. Some Capital One playing cards, particularly these geared towards shoppers establishing or constructing credit score, provide the chance for a rise after six months of on-time funds.

2. Request a credit score restrict enhance on-line

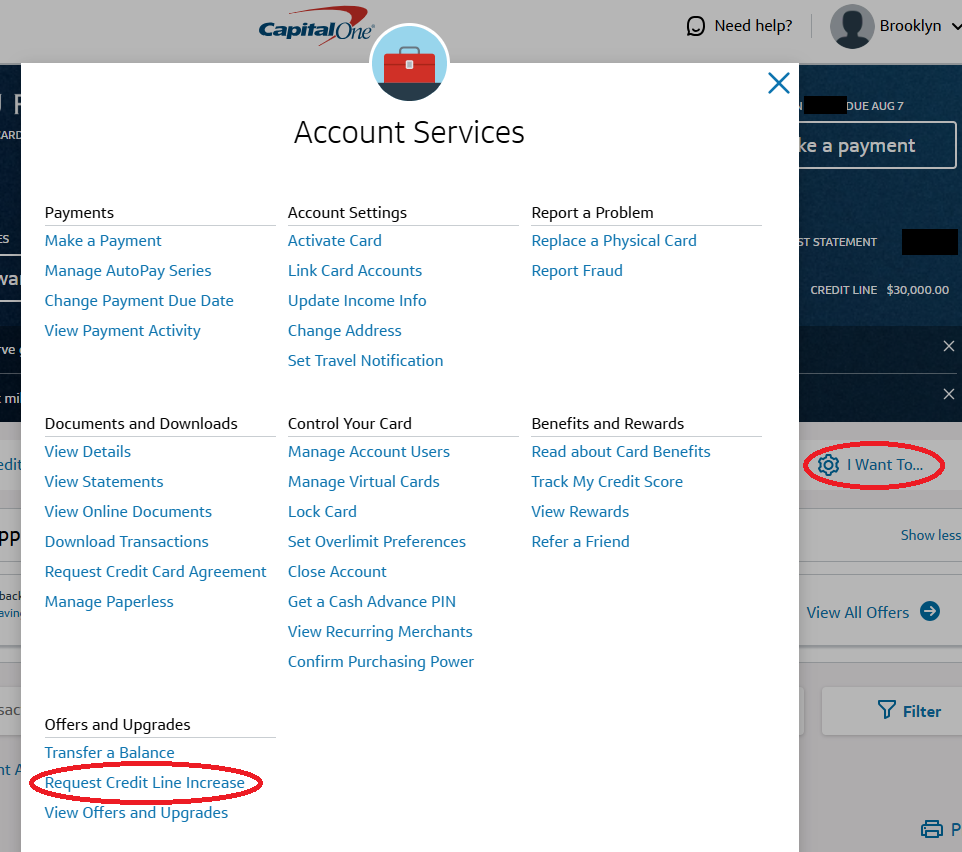

The best option to ask for the next credit score line is thru your on-line account. Log in to your account in an online browser and click on “Request Credit score Line Improve” within the “I wish to” part of settings. You are able to do this on the internet model of the Capital One web site or within the Capital One cellular app through your profile web page.

EXPAND

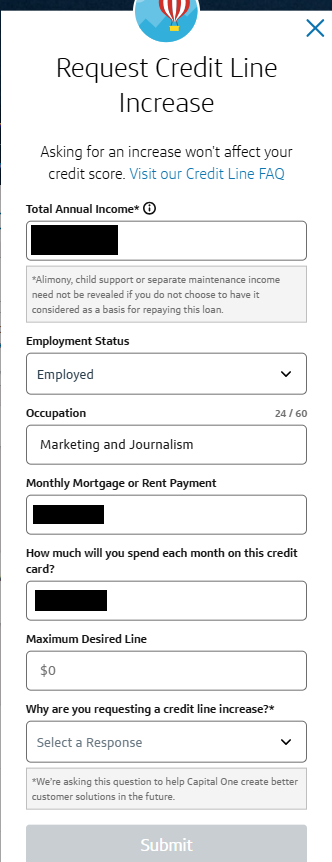

It will convey you to a different web page the place you’ll be able to replace your earnings data (beneficial in case your earnings has elevated), ask for the next credit score restrict or set overlimit preferences.

EXPAND

3. Name Capital One customer support

An alternative choice is to name the quantity on the again of your card. Be ready to reply some questions and have all of the required data helpful. You would possibly want to elucidate why you’re requesting extra credit score, so consider that upfront. Has your earnings elevated? Are you planning a big buy? What warrants the next credit score line in your state of affairs? Ensure you’re not getting extra credit score with the intention to tackle extra debt than you’ll be able to comfortably afford.

This will appear to be a problem in comparison with making the request on-line, however speaking to a consultant presents a chance to personally current your case for the credit score restrict enhance. Point out your optimistic cost historical past and the way lengthy you’ve been a cardholder to enhance your approval odds.

How lengthy does a credit score line enhance take?

In case you’re requesting the rise on-line, your credit score restrict enhance could also be authorized instantly after you present some data, resembling your employment standing and annual earnings. In different instances, it’d take a couple of days to get a response from the issuer.

Equally, when you name to request a rise, a Capital One consultant would possibly provide the choice straight away or take a couple of days to assessment your account.

What to do in case your request is denied

Requesting the next credit score line is an easy course of with Capital One, however approval isn’t assured. In case you’ve been denied, don’t fear. There are various options and steps you’ll be able to take to enhance your probabilities the subsequent time you inquire.

Work in your credit score

Pay down debt, make on-time funds and use your bank cards responsibly. A better credit score rating and clear credit score report improves your odds of getting extra obtainable credit score, whether or not you’re searching for extra credit score in your current playing cards or making use of for a brand new one.

Apply for a unique bank card

Talking of recent bank cards, making use of for a unique provide also can result in gaining access to extra credit score. If Capital One denied your credit score restrict enhance request, it’d make sense to use for a bank card from a unique issuer.

In case your credit score rating isn’t in the most effective form, look into bank cards for weak credit or bank cards for truthful credit score to keep away from one other denial. To these with good or wonderful credit score, one other bank card can provide extra buying energy in addition to an opportunity to proceed bettering credit score.

Contemplate prequalification choices

Attempt a stability switch

In case you had been contemplating a credit score restrict enhance since you’ve gotten too near the credit score restrict in your card, you would possibly wish to look right into a stability switch.

With a stability switch bank card, you’ll be able to switch balances from current playing cards and never pay something in curiosity for a couple of months. The very best 0 p.c APR bank cards provide zero curiosity for 21 months, so make sure that to check your choices.

The underside line

Quite a few advantages can come up from growing your credit score restrict. You might be able to enhance your credit score utilization ratio, enhance your credit score rating, enhance your possibilities of being authorized for different prime bank cards down the street and extra.

To benefit from these advantages, ensure you are dealing with your debt responsibly so your card issuer will wish to offer you entry to extra credit score. Even when Capital One rejects your request, you’ll be able to take steps to extend your probabilities for the subsequent time and check out once more in a couple of months.