Picture supply: Getty Photographs

I personal many various shares and funds in my SIPP. And that’s unlikely to vary any time quickly.

Nevertheless, just lately, I used to be interested by the shares I’d purchase for my account if I may solely select three. And right here’s the trio I got here up with.

Microsoft

Now, I don’t plan to retire for at the least 15 years. So I’m in search of long-term progress. With that in thoughts, my first decide for my SIPP can be know-how powerhouse Microsoft (NASDAQ: MSFT).

Why Microsoft? Effectively, there are a number of causes.

One is that this firm is among the most dominant gamers in cloud computing. That is an business projected to develop considerably within the years forward and the corporate is already seeing glorious outcomes. Final quarter, for instance, cloud revenues had been up 29% yr on yr.

One other is the corporate is main the synthetic intelligence (AI) revolution. Not solely is it a part-owner of ChatGPT, however it has additionally developed a ‘copilot’ AI characteristic for apps like Phrase, Excel, and Groups.

“With copilots, we’re making the age of AI actual for individuals and companies all over the place,” CEO Satya Nadella stated just lately.

Now, Microsoft is a comparatively costly inventory. At current, it has a forward-looking P/E ratio of about 29, which is a threat. However this firm is a real winner and, for my part, it has baggage of potential.

Alphabet

My subsequent decide can be Google and YouTube proprietor Alphabet (NASDAQ: GOOG).

That is one other tech firm with big progress potential.

Like Microsoft, it’s a serious participant within the AI house. Already it’s launched Bard – its rival to ChatGPT. And within the close to future we are able to anticipate to see the launch of Gemini – an assortment of AI instruments used for chatbots, textual content era, software program coding, and extra.

Alphabet can also be a pacesetter within the digital promoting house. That is one other business that appears set for long-term progress. The a part of the enterprise that excites me essentially the most right here is YouTube. This platform is getting larger by the day and its progress potential is limitless, to my thoughts. Final quarter, YouTube advert income was up 12% to $8bn.

Alphabet does face a number of dangers. Intense competitors from Microsoft and different tech firms is one. Regulatory intervention is one other.

I reckon plenty of threat is baked into the share worth already nonetheless.

Presently, Alphabet’s P/E ratio is simply 19. I believe that’s a steal.

Nvidia

Lastly, my third decide can be Nvidia (NASDAQ: NVDA). It specialises in ‘accelerated computing’ {hardware} and software program.

The rationale I’d decide Nvidia is that it appears set to play a serious function within the AI revolution.

AI requires an enormous quantity of computing energy and all the massive gamers within the house are turning to Nvidia’s merchandise to energy their AI purposes (it at present has an 80% market share of the associated chip business).

So I see it as an excellent ‘pick-and-shovels’ play on AI. Irrespective of who wins (there’ll in all probability be a number of winners), it ought to do nicely.

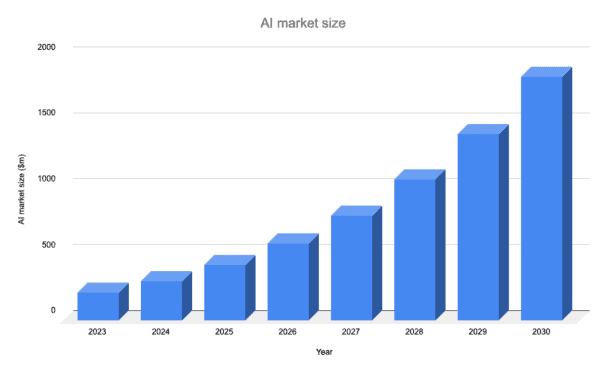

Supply: Statista, Subsequent Transfer Technique Consulting.

Now, this can be a risky inventory. So, I’d must be ready for some wild swings in its share worth.

In the long term, nonetheless, I’d anticipate it to generate highly effective positive factors for my SIPP.