Picture supply: Getty Pictures

The UK inventory market is loaded with a glittering show of high-yield dividend shares. Many have the potential to generate long-term passive revenue for my portfolio.

Nevertheless, Authorized & Common (LSE: LGEN) particularly could be my best choice if I had to decide on only one inventory. It presents the proper mixture of excessive returns mixed with a monitor file of reliability and a protracted historical past of fantastic efficiency.

I’ve held the inventory for a while in my portfolio and plan to proceed contributing to it over time.

Right here’s why.

Fee monitor file

On first look, Authorized & Common won’t seem as such a scorching ticket proper now. The share worth plunged 12% in June after it revealed plans to cut back dividend development from subsequent 12 months.

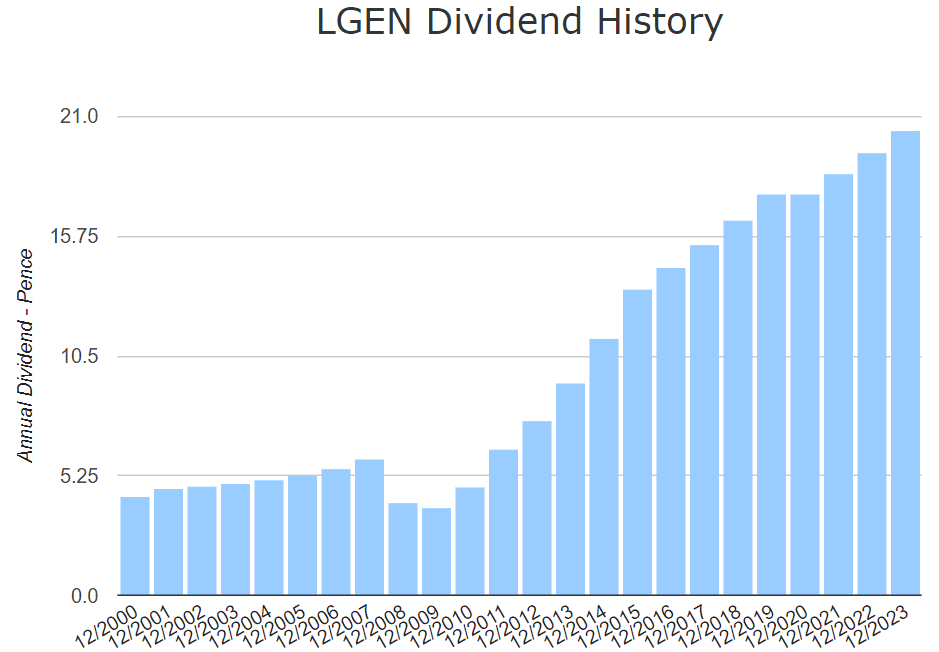

However its monitor file retains me . Apart from a minor drop after the 2008 monetary disaster, dividends have been growing persistently for over 20 years. Its 15-year dividend development price is 11.34% — significantly larger than most different shares.

When investing for the long run, I attempt to ignore minor blips. Historical past tells me that the discount in dividend development in all probability received’t final lengthy.

Lengthy-term development

Current efficiency apart, Authorized & Common reveals respectable development over prolonged intervals. For instance, over the previous 30 years, it’s up 457%, delivering annualised returns of 5.89%. That’s barely beneath the FTSE 100’s common yearly development however a lot larger when including dividends to the combination.

Even when L&G’s common yield over that interval was solely 5%, the full returns would nonetheless be higher.

However engaged on right now’s 9% yield and accounting for worth development, a £10,000 funding would web me dividends of round £930 after a 12 months. Depart it to take a seat for 20 years whereas reinvesting the dividends and it may develop to round £145,000, paying me an annual dividend of £11,800.

Now that’s not dangerous!

Dangers

Insurance coverage is a aggressive business within the UK and Authorized & Common will not be with out rivals (though I’m invested in a few of these too, simply to be protected!). Its predominant opponents embrace Aviva, Prudential, and Admiral Group.

Regardless of the falling worth, Authorized & Common’s price-to-earnings (P/E) ratio of 30 is rather a lot larger than most rivals. However with earnings anticipated to develop 178% within the coming 12 months, that quantity may come right down to 10.8. Then it will be extra in step with different UK insurance coverage companies.

If earnings don’t improve, additional worth development might be hindered. This, mixed with diminished dividend development, would considerably cut back the corporate’s worth. With a 20p annual dividend and earnings per share (EPS) at solely 7p, the payout ratio is already virtually triple (therefore plans to cut back dividend development).

Large boots to fill

All issues thought-about, my religion in Authorized & Common stays unshaken. The brand new CEO António Simões actually has some massive boots to fill. This 12 months, he took over from Sir Nigel Wilson who acquired a knighthood for his distinctive work on the firm.

To this point, Simões appears extremely motivated to fill these boots… after which some. His plans embrace a £200m share buyback programme, organisational restructuring, and the sale of Cala, the corporate’s housebuilding enterprise.

Whether or not his ambitions spell success stays to be seen, however I count on they’ll.