Picture supply: Getty Pictures

Lots of UK traders have cash in FTSE 100 exchange-traded funds (ETFs). This isn’t shocking because the Footsie’s the UK’s foremost inventory market index and traders are inclined to put cash into issues they’re accustomed to.

It will probably pay to diversify a portfolio and look past the FTSE 100, nonetheless. Right here’s a have a look at a product that has delivered round twice the return of the Footsie during the last 5 years.

A prime fund

The product in focus right this moment is the Vanguard FTSE All-World UCITS ETF (LSE: VWRP). This can be a tracker fund that has a worldwide focus and seeks to trace the efficiency of the FTSE All-World index.

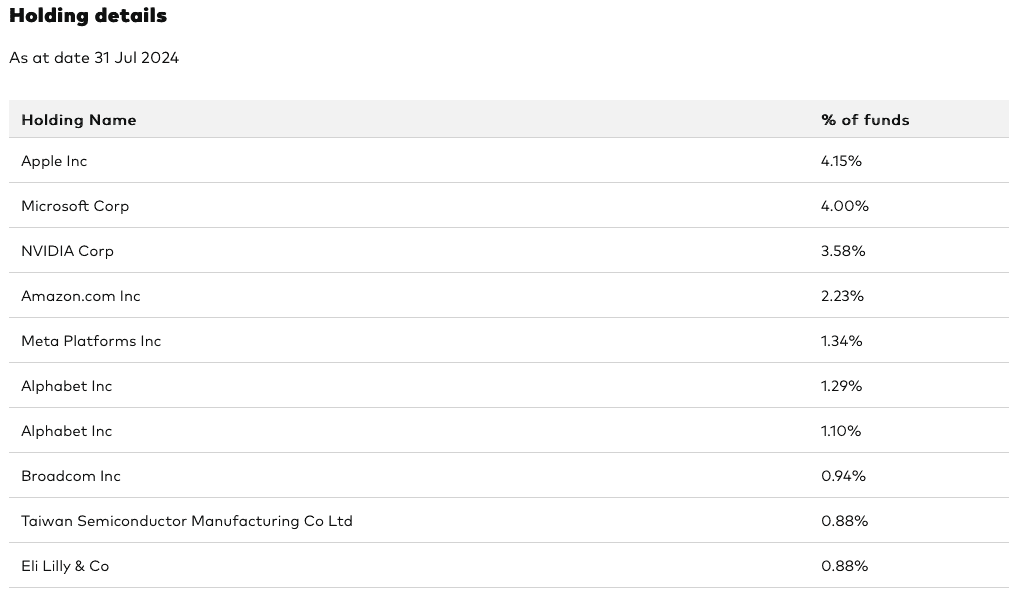

With this ETF, traders get publicity to round 3,700 shares (versus 100 for a FTSE 100 ETF) throughout each developed and rising markets. The highest 10 holdings at 31 July are proven under.

Spectacular efficiency

When it comes to efficiency, this product has delivered spectacular returns recently. Over the five-year interval to the top of August, it returned 77%. By comparability, the Vanguard FTSE 100 UCITS ETF returned 38.9%. So anybody who was invested on this world product over that five-year interval outperformed the FTSE 100 by a large margin.

It’s value noting that these returns consider dividends (each are ‘accumulation’ merchandise). However they don’t consider buying and selling charges or platform fees.

The outlook from right here

Now, previous efficiency isn’t an indicator of future returns, after all. Nonetheless, wanting forward, I wouldn’t be stunned to see the Vanguard FTSE All-World UCITS ETF proceed to outperform FTSE 100 tracker funds over the long run.

The explanation I say that is that we’re residing in a tech-driven world right this moment. And the FTSE All-World index has much more publicity to the Know-how sector than the FTSE 100. On the finish of July, 27.5% of the worldwide index was invested in tech shares. That compares to only 1% for the Footsie.

Volatility dangers

However, the tech publicity right here additionally presents a threat. Anybody that has invested in shares like Microsoft, Meta Platforms (Fb), and Nvidia will know that tech shares will be unstable at instances. Nvidia, for instance, lately fell greater than 30% within the blink of a watch.

One other threat is the truth that about 62% of the ETF’s allotted to the US inventory market. Over the long run, this market has outperformed the UK fairly considerably however, wanting forward, there are prone to be durations the place it doesn’t.

One extra subject to concentrate on is that ongoing charges are 0.22%. That’s a little bit larger than the continuing charges for Vanguard’s FTSE 100 ETF (0.09%)

All issues thought of nonetheless, I really feel this world ETF has lots going for it. For these searching for a stable core holding for his or her portfolio, I believe it’s value contemplating.