Picture supply: Getty Pictures

The Shares and Shares ISA is a strong funding car. With entry to tons of various investments and no tax on capital good points or earnings, it’s doable to generate a variety of wealth over the long term with one among these accounts.

And don’t suppose that you must make investments its full £20,000 allowance to prosper, so right here’s a take a look at how a lot a £2,000 funding a yr could possibly be value by 2050.

Please observe that tax remedy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Engaging returns

There’s no set or assured fee of return with a Shares and Shares ISA. In the end, your long-term returns will rely upon the property you’ve invested in.

I believe it’s cheap to count on returns of 6-10% a yr on common, over the long term nevertheless, assuming a well-structured, diversified funding portfolio. So let’s run a number of calculations to see what these ranges of return may do to a £2,000 funding a yr by 2050.

5 eventualities

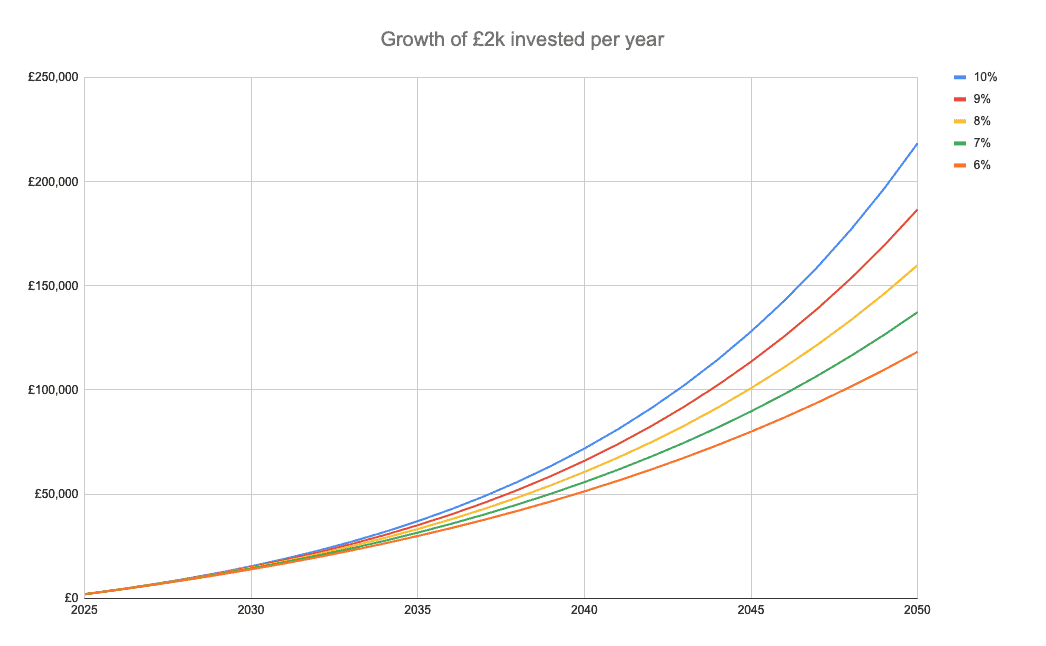

The chart beneath exhibits the expansion of £2k a yr at 5 charges of returns – 6%, 7%, 8%, 9%, and 10%. It ignores charges.

At a 6% annual return, the £2,000 a yr grows to round £118,000 by 2050. At a ten% annual return, it grows to round £218,000.

The facility of long-term investing

These calculations present the facility of investing for the long run (with no tax). Over the long term, even small quantities of cash can develop into big sums because of the energy of compounding.

Additionally they present how somebody with many years till retirement may doubtlessly set themselves up for the long run by beginning early. Over the course of 25 years, it’s doable to construct a considerable sum, even with smaller quantities invested.

Producing excessive returns

Now, historical past exhibits that producing a 6% return a yr over the long term isn’t that tough. Over the past 10 calendar years, the UK’s FTSE 100 index has returned about 6.3% a yr.

Assuming the index produced the identical sort of return over the subsequent 25 years (it could not), a easy low-cost Footsie tracker fund could do the trick right here. Observe that dividends would should be reinvested.

Attaining 10% a yr over the long term is more durable, nevertheless it’s not inconceivable.

To focus on this sort of return, I’d recommend contemplating a mixture of world fairness funds and particular person development shares. I’d use the funds as the inspiration of the portfolio and shares for further development.

For the latter, I’d give attention to high-quality companies with important long-term development potential (buying and selling at cheap valuations). An instance right here is Google proprietor Alphabet (NASDAQ: GOOG). This firm has an awesome monitor document relating to producing wealth for traders. Over the past decade, it’s returned about 22% a yr as the corporate has grown.

Wanting forward, I imagine it has the potential to get larger. Not solely ought to it profit from the expansion of YouTube and its cloud computing division, nevertheless it ought to see development from Waymo and different up-and-coming enterprise segments.

In fact, there aren’t any ensures this inventory will proceed to ship for traders. If generative synthetic intelligence (AI) finally ends up destroying Google’s profitability, returns could possibly be disappointing.

I imagine the inventory’s value contemplating nevertheless. It at present trades on a forward-looking price-to-earnings (P/E) ratio of twenty-two, which isn’t excessive for a world class tech firm.