Picture supply: Getty Photographs

We right here at The Motley Idiot are large believers within the the power of UK shares to create long-term wealth. Placing your cash to work in a tax-efficient Shares and Shares ISA give one’s returns a pleasant added increase, too.

Don’t simply take our phrase for it, although. A Freedom of Info (FOI) request from The Openwork Partnership reveals how ISAs have helped supercharge the variety of British millionaires.

ISA tens of millions

Newest HM Revenues and Customs (HMRC) knowledge showa that have been 4,070 buyers sitting on seven-figure ISAs as of April 2021. That’s a near-tenfold enhance from the 450 that have been reported 5 years earlier.

The 50 prime ISA millionaires have been sitting on common pots of £8,509,000, the info revealed. The typical throughout all these 4,000-plus millionaires stood at a tasty £1,397,000.

All of those rich buyers are more likely to have used their ISAs to purchase shares and shares, the info steered.

Finest on the planet

The ISA has proved a gamechanger for tens of hundreds of on a regular basis buyers. In accordance with then-head of partnership providers at The Openwork Partnership, Setul Metha:

The ISA has not solely created hundreds of millionaires, but it surely has additionally empowered tens of millions of peculiar buyers to construct a nest-egg alongside their pension.

Metha — who’s now head of UK Middleman Distribution at AIG – went on to explain the ISA as “maybe one of the best tax-free funding wrapper within the western world”.

Please word that tax therapy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

My wealth constructing technique

Proudly owning shares generally is a bumpy experience at instances. It’s by no means good to see the worth of your investments stoop when financial circumstances worsen and inventory markets fall.

Nevertheless, UK shares have confirmed to be a superb strategy to create wealth over the long run. And this makes the opportunity of some short-term discomfort simpler to swallow.

The FTSE 100, as an illustration, has offered a mean annual return of round 7.5% since 1984. The FTSE 250, in the meantime, has yielded an even-better return of 11% since 1992.

This is much better than the return offered by a money financial savings account over the interval. It’s why I make investments a few of my spare money every month in a Money ISA, however use the bulk to purchase shares in my Shares and Shares ISA.

Previous efficiency just isn’t a dependable indicator of the long run. However the potential to make huge riches makes this technique worthwhile to me, as I display beneath.

A £520 month-to-month funding

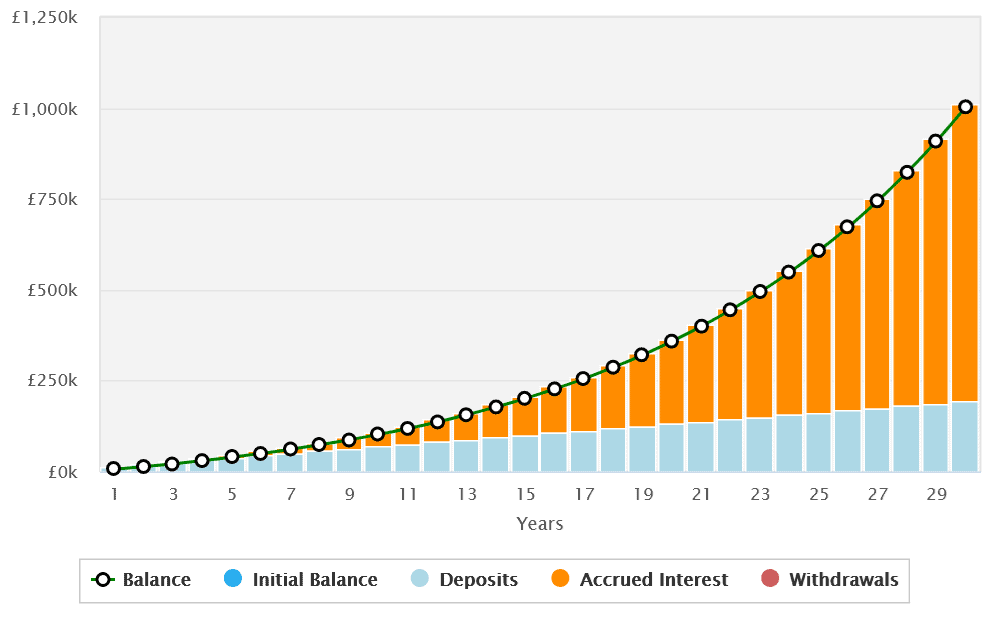

Let’s say I’ve £520 able to put money into a Shares and Shares ISA every month, and determine to take a position this equally in FTSE 100 and FTSE 250 shares.

Based mostly on a mean 9.25% yearly return, this month-to-month funding may assist push me into millionaire standing after 30 years. Because the chart above reveals, I might have made a nest egg of £1,003,045.94 if these confirmed charges of return proceed.

And that’s excluding any further money I might earn by additionally investing in a Money ISA.

Shopping for UK shares isn’t a risk-free exercise. However, as I’ve proven above, it may launch substantial wealth and assist on a regular basis individuals safe monetary independence.