Picture supply: Getty Photos

The FTSE 100‘s full of high-yield dividend shares. In the intervening time, there are 21 corporations providing ahead yields above 5%. And Authorized & Common Group‘s (LSE:LGEN) one the index’s finest, for my part.

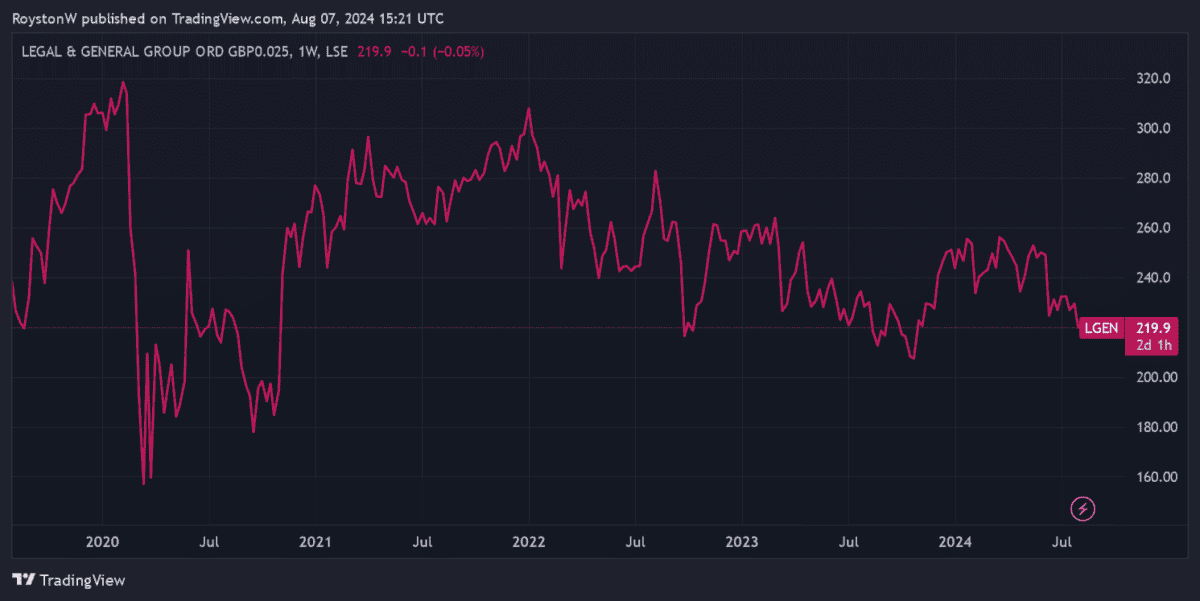

I already personal it in my Self-Invested Private Pension (SIPP) for passive revenue. And following latest share worth weak point, I’m contemplating shopping for extra.

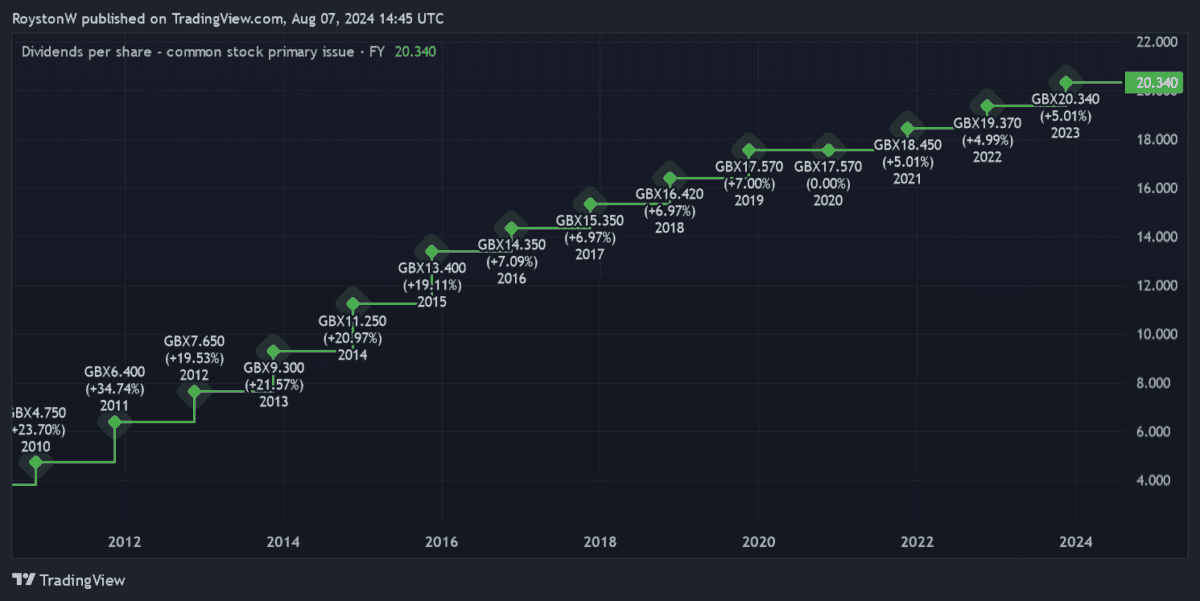

Dividend progress

At 219.9p per share, Authorized & Common shares carry a mighty 9.7% dividend yield. Because the chart beneath reveals, the monetary providers big has an distinctive file of lifting shareholder payouts yearly.

The Footsie firm’s in a position to persistently pay a big and rising dividend for quite a lot of causes:

- Its diversified enterprise mannequin (throughout life and basic insurance coverage, funding administration, and pensions) helps shrink earnings shocks and supplies a constant circulation of money

- Robust model energy reduces the menace from rivals like Aviva and Aegon

- Demographic adjustments are steadily rising demand for retirement, wealth, and safety merchandise, and due to this fact revenues

- Extremely regulated operations be certain that the agency maintains a powerful stability sheet

- Its skilled administration workforce makes sound strategic selections and is dedicated to common dividend progress

Strong buying and selling replace

Authorized & Common’s newest financials on Wednesday (7 August) underlined the robustness of its its operations, even in robust occasions.

Because of robust gross sales of its annuities merchandise, core working revenue rose 1% within the first half, to £849m. This was barely above what Metropolis analysts had been forecasting.

The corporate maintained its goal of rising core working revenue by “mid single-digits” for the complete yr, raised the interim dividend 5% yr on yr, and affirmed plans to repurchase £200m of its shares.

A powerful stability sheet’s enabling Authorized & Common to proceed returning stacks of money to its traders. Its Solvency II capital ratio stood a formidable 223% as of June.

The Footsie agency isn’t with out its dangers, after all. It warned that “the worldwide financial outlook stays unsure with the potential for exterior shocks to knock economies and markets astray“.

However, on stability, issues are trying fairly good on the monetary providers big.

A £2,490 passive revenue

In order I say, I’m occupied with shopping for extra Authorized & Common shares for my portfolio. It’s a call that might give my passive revenue a big increase within the close to time period and past.

Let’s say I purchased 2,273 shares within the firm immediately for a complete price of slightly below £5,000. With a 9.7% yield, I’d obtain a passive revenue of slightly below £485 this yr, if dividend forecasts show correct.

Now let’s assume I reinvest any dividends I obtain, and that the shareholder payout stays steady over time. We’ll additionally say that the share worth fails to develop.

After 25 years, my £5k may flip into £34,512. With an additional £200 every month spent on Authorized & Common shares, I may enhance this to £308,132. This is able to then throw off round £2,490 a month in dividends.

Nevertheless, I believe each the share worth and dividends might develop strongly over time. If I’m proper, I may make a considerably higher month-to-month revenue than that £2,490.

Whereas it’s not with out threat, I imagine Authorized & Common’s one of many FTSE 100’s finest dividend shares.