Picture supply: Getty Photos

I already had a Shares and Shares ISA once I began work at 22, and it was topped up by inheritance and sporadic items. Nonetheless, it wasn’t till a lot later that I began making common contributions to my ISA.

At 22, the rationale for not contributing was easy: “I’ll be incomes extra sooner or later, so why now?” However this mindset can imply lacking out on the facility of compounding. The important thing benefit for younger buyers isn’t how a lot they make investments, however how lengthy their cash has to develop. It’s all about time out there.

The rationale

Investing £3.33 per day is the equal of investing £100 per thirty days. That might have been about 5% of my first paycheque. It won’t sound like so much, particularly as it could now take me greater than three months to afford one Tesla share, but it surely provides up over time. Plus, buyers can use fraction shares to realize entry to costlier shares.

The key ingredient is compounding. That is what occurs when buyers maintain their cash invested over the long term. It’s like a snowball that, because it will get greater, can decide up much more snow.

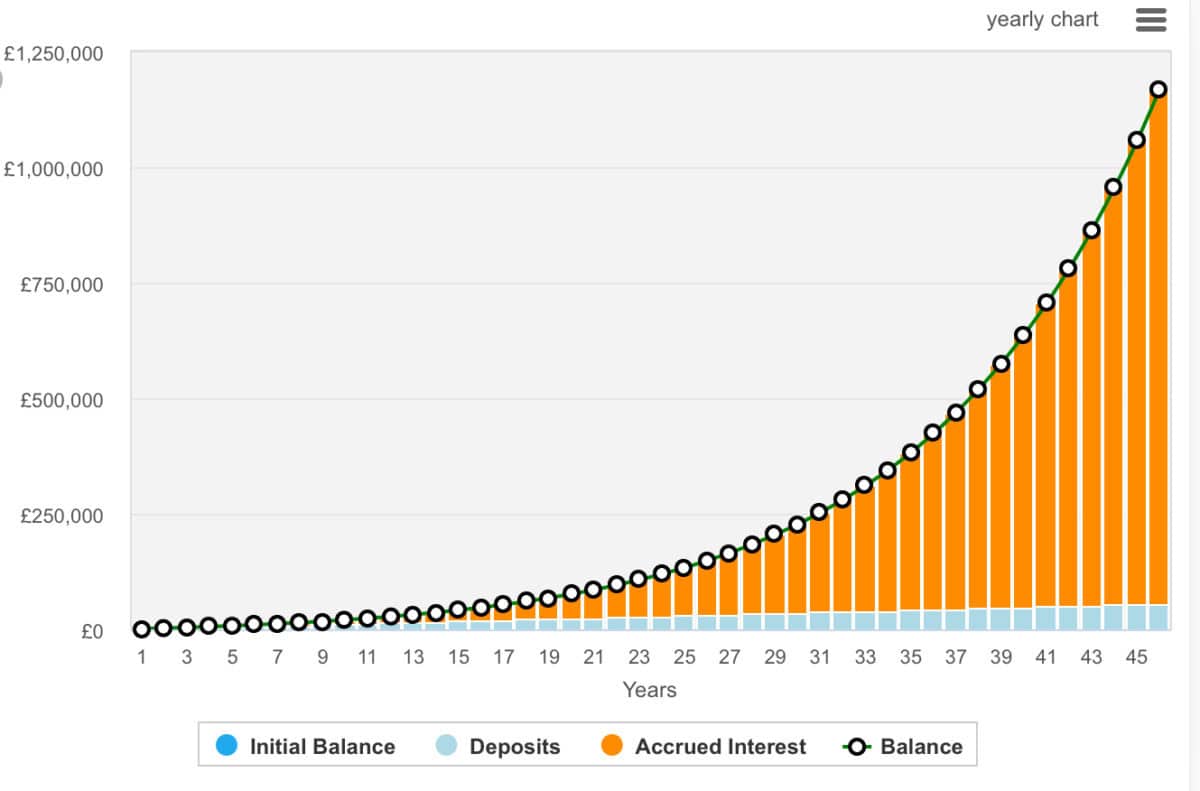

As we are able to see from the under graph, £100 actually begins to compound after 15 years — this instance assumes a progress fee of 10% yearly. In direction of the top of the 46-year interval, £100 of month-to-month contributions ought to appear very reasonably priced, whereas the portfolio shall be rising at a formidable fee.

Why 46 years? Effectively, that’s the variety of years between me beginning work at 22 and my predicted retirement age at 68.

Getting there

So, we’ve acquired the system. However how can we truly flip £3.33 a day right into a small fortune? Effectively, many novice buyers will put money into index-tracking funds. It is a sensible transfer that gives diversification and comparatively low danger.

Another choice might be an exchange-traded fund (ETF) or perhaps a conglomerate like Berkshire Hathaway (NYSE:BRK.B). Warren Buffett’s holding firm supplies publicity to a broad combine of companies, from insurance coverage to client items, with a confirmed observe report of compounding shareholder worth.

Buffett’s worth investing method, specializing in undervalued corporations with sturdy fundamentals, has confirmed profitable over a long time. Nonetheless, buyers ought to take into account dangers akin to Berkshire Hathaway’s giant dimension probably limiting future progress alternatives, the problem of discovering attractively priced acquisitions within the present market, and the eventual succession of management as Buffett ages.

Regardless of these considerations, Berkshire Hathaway’s sturdy stability sheet, cash-generating companies, and confirmed funding philosophy make it a lovely choice for long-term buyers in search of stability and progress potential. Over 10 years, the common return is 12.3%. That is one I’m including to my daughter’s pension.

The passive revenue half

Within the above instance, £100 a month would develop into nearly £1.2m over 46 years. Now, with all that cash invested in shares, funds, and bonds with a mean yield of 5%, an investor would obtain round £60,000 a yr or £5,000 month-to-month.

In fact, there’s a caveat. £60,000 in 46 years will probably really feel like £20,000 in at present’s cash. Nonetheless, when utilizing the ISA, this is able to be totally tax free and would properly complement a pension.

Please be aware that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.