The speedy tempo of innovation in synthetic intelligence (AI) has introduced many experiences to actuality that have been beforehand solely regarded as fiction. As AI continues to disrupt how we stay and work, how can buyers put cash to work on this superior know-how that’s rapidly reshaping society?

We’ve created this useful newbie’s information that can assist you higher perceive what AI is and the way corporations use the know-how. Plus, we’ve recognized some well-liked investments on this fast-growing business.

What’s AI?

AI makes an attempt to copy human intelligence in a pc or machine with quicker pace and better accuracy. Firms like Microsoft (MSFT) and Google (GOOGL) make use of the know-how to program machines to resolve issues, reply questions and conduct duties beforehand finished by people.

As programs develop into extra clever, AI turns into extra highly effective, and its makes use of and purposes attain each inventory sector and business. For instance, the transportation business is present process a large transformation round electrical and autonomous autos, probably bringing trillions of {dollars} to the worldwide financial system. Equally, the banking business makes use of AI to enhance decision-making in high-speed buying and selling, automate back-office processes like threat administration, and even cut back prices through the use of humanoid robots in branches. And people are just a few examples of synthetic intelligence purposes.

Analysts at Worldwide Information Corp. (IDC), a supplier of market intelligence, predict that worldwide revenues for the AI market might attain $900 billion by 2026, logging a compound annual development price of 18.6 p.c from 2022-2026.

“ChatGPT’s explosive international reputation has given us AI’s first true inflection level in public adoption,” says Ritu Jyoti, group vice chairman, Worldwide Synthetic Intelligence and Automation Market Analysis and Advisory Companies at IDC. “As AI and automation investments develop, deal with outcomes, governance, and threat administration is paramount.”

How corporations use AI

Whether or not it’s law-enforcement businesses utilizing facial recognition software program to conduct investigations, AI-powered house home equipment like Samsung’s good fridges making our lives simpler, or robo-advisors utilizing automated, algorithm-driven fashions to optimize our investments and make financial-planning suggestions, AI is all over the place.

At AI’s core is huge knowledge, which knowledge scientists, engineers, and different specialists use to construct complicated algorithms that may soak up new data to enhance their efficiency and accuracy. With machine studying, for instance, a sub-field of AI, organizations like Netflix make use of consumer knowledge to make content material suggestions and predictions. As customers enter extra data, corresponding to giving a present a thumbs up or thumbs down, the system then shops and processes that information — incrementally changing into smarter.

In response to a survey of greater than 350 AI researchers performed by the College of Oxford and Yale College in 2015, there’s a 50 p.c likelihood that machines might outperform people in all duties by the yr 2060. And a few tech visionaries like Tesla CEO Elon Musk imagine it may very well be a lot sooner.

Organizations more and more faucet into the facility of AI to tell vital enterprise selections, corresponding to prioritizing medical care in an emergency, enhancing recruitment practices, and figuring out a person’s eligibility for credit score, housing and different important providers.

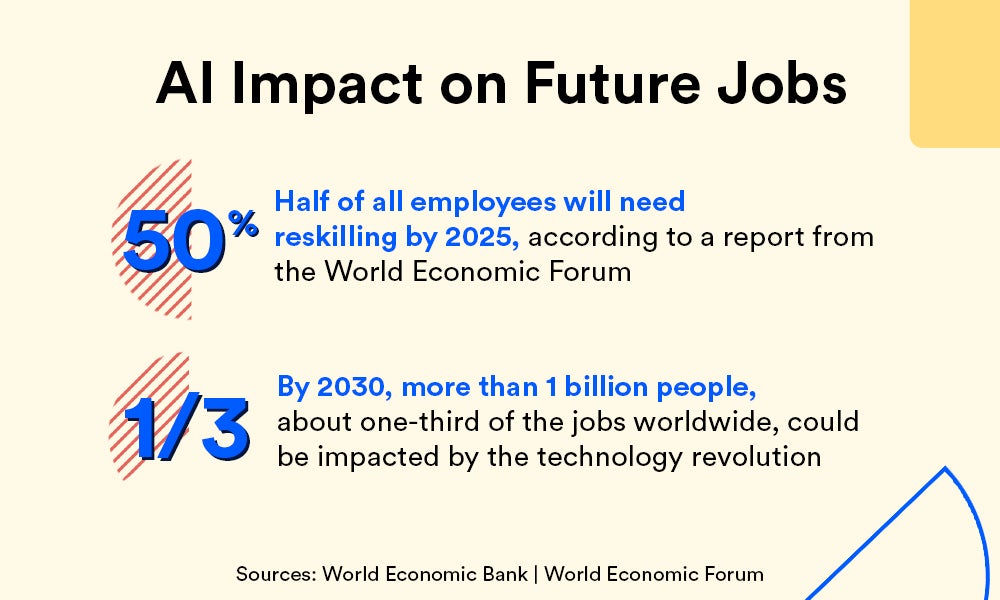

There’s additionally a variety of debate on how AI will impression the job market. As people’ dependence on machines will increase, so does the necessity for workers to enhance and study new abilities. By 2030, the World Financial Discussion board estimates that greater than 1 billion folks, about one-third of the roles worldwide, may very well be impacted by the know-how revolution.

To account for the constraints of AI — not less than till the know-how additional evolves — organizational leaders have relied on augmented intelligence, which mixes machine intelligence and human experience. In essence, augmented intelligence empowers people to work higher and quicker. The necessity for people’ enter, nevertheless, diminishes as AI will get stronger.

spend money on synthetic intelligence

For many retail buyers, there’s an opportunity you have already got publicity to AI, as many massive U.S. public corporations are both utilizing AI or are actively trying to spend money on the know-how.

However for these in search of broader publicity, exchange-traded funds (ETFs) provide an environment friendly and simple method to spend money on AI shares.

Much like different thematic investing varieties — corresponding to blockchain know-how, cybersecurity and genomics — AI ETFs maintain a basket of publicly traded corporations concerned in numerous phases of AI, from growth to implementation.

Outlined listed here are among the most generally owned AI ETFs. As you take into account these choices, be sure to assessment the fund’s prospectus to grasp the funding technique, holdings and charges.

Be aware: All ETF knowledge beneath is as of January 16, 2024.

World X Robotics & Synthetic Intelligence ETF (BOTZ)

BOTZ invests in corporations centered on AI and robotics applied sciences throughout sectors in developed world markets.

Fund issuer: Mirae Asset World Investments

Property underneath administration: $2.3 billion

High holdings: NVIDIA (NVDA), ABB Ltd (ABBN) and Intuitive Surgical (ISRG)

Expense ratio: 0.69 p.c

ARK Autonomous Expertise & Robotics ETF (ARKQ)

ARKQ identifies and invests in home and overseas corporations that might profit from rising applied sciences and automation.

Fund issuer: ARK Make investments

Property underneath administration: $973.1 million

High holdings: Tesla (TSLA), Iridium Communications (IRDM), UiPath (PATH) and Kratos Protection & Safety Options (KTOS)

Expense ratio: 0.75 p.c

ROBO World Robotics and Automation Index ETF (ROBO)

ROBO invests in a worldwide index of corporations driving innovation by robotics, automation and AI.

Fund issuer: Trade Traded Ideas

Property underneath administration: $1.3 billion

High holdings: Azenta (AZTA), Intuitive Surgical Inc (ISRG), Illumina (ILMN) and iRhythm Applied sciences (IRTC)

Expense ratio: 0.95 p.c

Editorial Disclaimer: All buyers are suggested to conduct their very own unbiased analysis into funding methods earlier than investing resolution. As well as, buyers are suggested that previous funding product efficiency is not any assure of future value appreciation.