Picture supply: Getty Photos

One of many extra disappointing underperformers on the inventory market in recent times has been Diageo (LSE: DGE). The FTSE 100 spirits large is down 11% yr so far and 37% because the begin of 2022.

This inventory’s already a pretty big holding in my portfolio, however now I’m questioning whether or not to reap the benefits of the dip and make it even bigger. Listed here are my ideas.

Shopper slowdown

On 30 July, the agency reported its preliminary outcomes for FY24 ended 30 June. Total income fell 1.4% yr on yr to $20.3bn, lacking estimates for $21.2bn. Volumes declined by 2.1%, with demand weak within the US and dreadful demand within the Latin America and Caribbean area (a 21.1% quantity decline).

That large droop was because of shoppers shifting to cheaper native spirits. This was most pronounced in Brazil and Mexico, the place demand for Scotch and tequila was significantly weak. Diageo’s premium manufacturers in these respective classes embrace Johnnie Walker and Don Julio.

On the underside line, natural working revenue fell 5% to $5.9bn. Earnings per share of $1.73 dipping from $1.97 in FY 23.

Trying ahead, administration isn’t providing an improved outlook for FY25, which it says will proceed to be “difficult“.

Modest restoration anticipated

The US accounts for nearly 40% of Diageo’s gross sales. Final yr, the US spirits market declined for the primary time in practically 30 years, in line with business researcher IWSR.

The principle threat is an extra deterioration in that key market. With a US recession already a priority, it could possibly’t be dominated out.

In line with the identical analysis from IWSR although, world beverage alcohol’s anticipated to start its restoration in 2025. Nevertheless, progress’s anticipated rise “at a compound annual progress price of +1% between 2023 and 2028“.

It additionally added that the “premiumisation universe for spirits is narrowing”. That’s not nice for Diageo’s personal premiumisation story.

On the plus aspect, what forecast progress there may be will largely come from India, China and the US. Diageo has a presence in all three markets, whereas world tequila progress ought to stay robust. In addition to Don Julio, Diageo owns the Casamigos tequila model.

In the meantime, Guinness has grown globally by double digits for seven consecutive quarters. Not unhealthy for a 265-year-old model!

Cut price basement?

On some key metrics, the inventory seems to supply nice worth. It’s buying and selling on a price-to-sales (P/S) a number of of three.5 whereas the ahead price-to-earnings (P/E) ratio is round 18. Each are at multi-year lows.

Regardless of the difficult surroundings, the corporate nonetheless generates significant free money move and returns it to shareholders by means of dividends. Final yr, free money move elevated by $400m to $2.6bn whereas the dividend was raised by 5%.

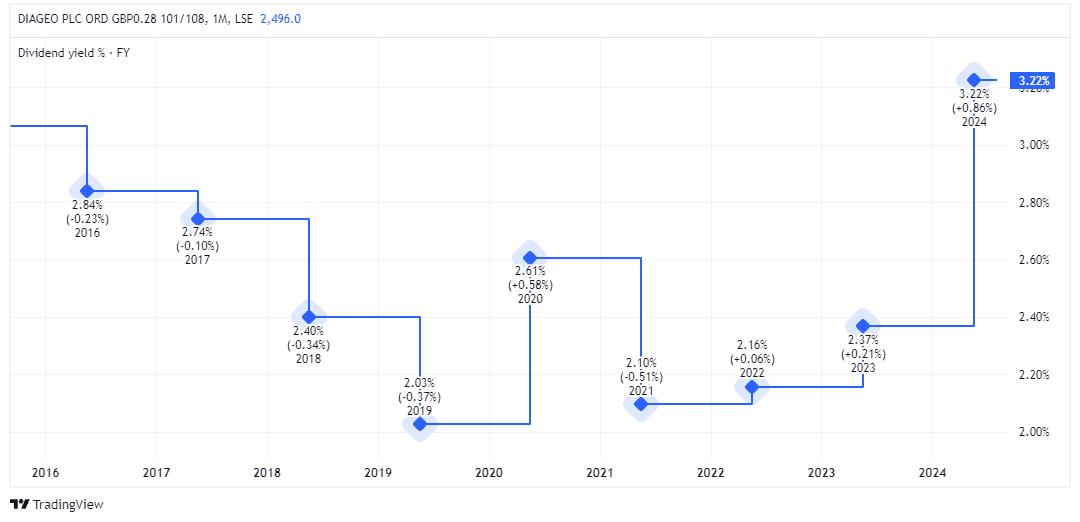

The yield’s climbed to three.2%, which is 50% extra earnings than buyers had been getting simply two years in the past. Diageo stays a blue-blooded Dividend Aristocrat.

I observe that dealer Citi not too long ago reiterated its Purchase advice on the inventory, saying that it’s “time to revisit what stays a gorgeous compounding mid-term progress story”.

Solely time will inform if the inventory’s in cut price basement territory at the moment. However I see good worth right here and I’m tempted to purchase extra Diageo shares in September.