Picture supply: Getty Photos

At first of the month, the boohoo (LSE:BOO) share worth hit contemporary 52-week lows at 26.5p. It has managed to rebound considerably over the previous couple of weeks. But at simply above 28p, I’m questioning if the inventory continues to be too low cost or if it’s really a good worth proper now.

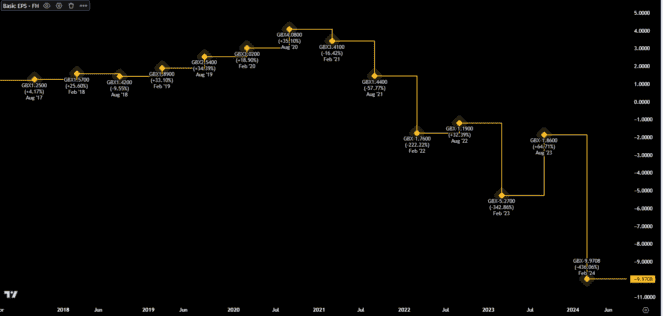

Earnings falling with the share worth

The 20% fall within the share worth over the previous yr compounds the losses from earlier years. The truth is, over a three-year time horizon, the inventory is down simply shy of 90%.

The agency’s poor funds have acted to cut back the worth of the corporate over time. The beneath chart of primary earnings per share (EPS) is proof of this. Up till 2021, the enterprise was producing constructive EPS. But the flip to posting losses has dragged the share worth decrease.

The detrimental EPS numbers — that’s, losses — have been rising and at the moment are on the lowest stage because the agency went public.

Tying this again to the difficulty of the inventory, it’s onerous to make a case for it being undervalued when the enterprise is shedding extra money annually. Logically, the share worth ought to fall to replicate an organization that’s value lower than it was the prior yr. In spite of everything, the profitability of an organization is without doubt one of the major methods buyers put a price on a inventory.

Pinning a good worth

One other issue to think about is the price-to-book (P/B) ratio. This metric appears on the share worth and compares it to the ebook worth of the agency. If the worth is beneath 1, it’s usually thought of to be an affordable inventory. Beneath is the change within the P/B ratio for boohoo over the previous few years.

What’s actually attention-grabbing to notice is that regardless of the sharp fall within the share worth in recent times, the P/B ratio continues to be above 1 (1.17 to be particular). So when taking a look at this, I can’t actually make the case for it being undervalued. Fairly, when contemplating the truth that the ratio was properly above 10 in 2020-2021, I feel it was overvalued again then. The transfer decrease within the inventory is solely nudging it in direction of a good worth at present.

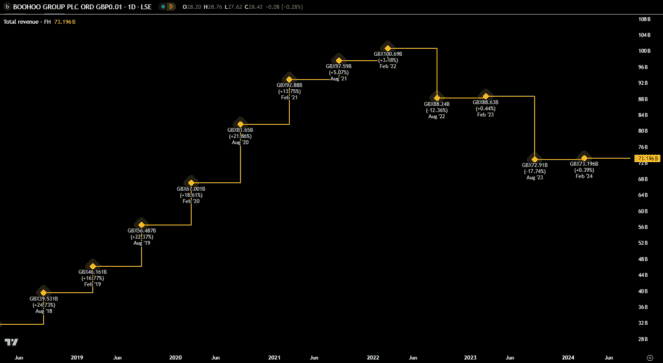

Demand nonetheless sturdy

However, some buyers will level to income at boohoo as a cause for getting the inventory. Despite the fact that income has moved decrease over the previous couple of years, the most recent reported annual determine was nonetheless above the pre-pandemic stage (proven beneath).

This can be utilized to point out that demand for the garments and different merchandise boohoo sells continues to be there. Despite the fact that gross sales may need moved somewhat decrease, they don’t equate to the drop in earnings. This tells me that the issue with the enterprise lies in prices and different bills.

The administration workforce is already specializing in streamlining prices, as talked about within the newest annual report. Additional, after some backlash, government bonuses aren’t going to be paid, saving extra money.

Due to this fact, if demand stays agency and prices fall, it might imply that the share worth is at present honest worth for the long run. Finally, I don’t really feel that the inventory is just too low.