Picture supply: Getty Photos

Usually, the inventory market’s completed fairly properly in 2024. The FTSE 100 is up virtually 7% and the S&P 500 has gained round 23%.

With share costs although, the sharpest falls typically comply with durations of the best returns. So may buyers be in for a fright within the close to future?

Scary indicators

There are two fundamental causes the inventory market may crash. The primary is that shares look costly – and never simply US ones.

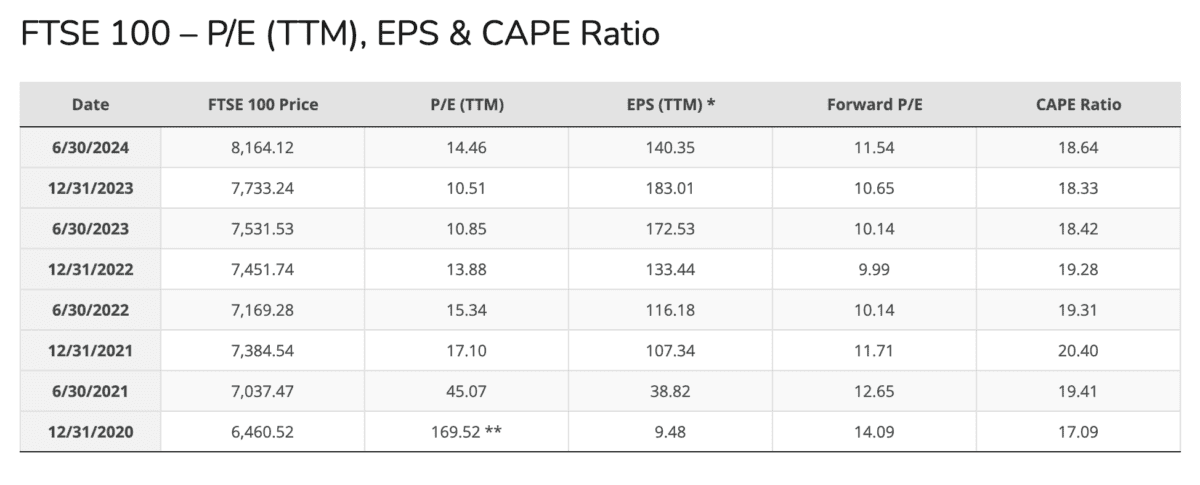

On the finish of June, the FTSE 100 was buying and selling at a ahead price-to-earnings (P/E) a number of of 11.5. That’s the best it’s been since 2022 and the index has gone up since then.

On high of this, the macroeconomic surroundings isn’t wanting notably pleasant to shares. After chopping rates of interest in August, the Financial institution of England determined to carry regular in September.

If the US Federal Reserve does the identical, then buyers who have been anticipating charges to fall might need to rethink their shopping for selections. And that might be dangerous for share costs.

This can be a very actual chance – falling bond costs point out buyers are involved concerning the spectre of inflation. If that makes an look, the central financial institution might need to vary course.

Nothing’s assured, however buyers wanting to buy shares this Halloween is likely to be in for a fright. Happily, as with the witches and the ghosts, there’s most likely nothing to be terrified of.

Don’t run away

Inventory market crashes could be scary. However the rewards for buyers who keep away from operating away when issues get horrifying could be terrific.

For instance, Warren Buffett completed shopping for shares in Coca-Cola (NYSE:KO) in 1994. Since then, the inventory market’s crashed 3 times – in 2001, 2008 and 2020.

Regardless of this, the funding that Berkshire Hathaway paid $1.3bn for has a market worth of virtually $27bn at present. And that isn’t together with the dividends, which have elevated every year.

Buffett hasn’t wanted to foretell what the inventory market will do to generate that spectacular outcome. The one factor needed has been to seek out an excellent firm and maintain on.

Coca-Cola completely matches the invoice on this regard. At at present’s costs, I feel there are higher alternatives round, however the high quality of the underlying enterprise is plain.

Promoting the Coke funding in anticipation of a market crash at any level within the final 30 years would most likely have been a giant mistake. And I feel that’s a lesson buyers can be aware of.

Blissful Halloween

Halloween’s an ideal reminder that it may be enjoyable to really feel scared. However a inventory market crash is sort of by no means pleasant for buyers who see their shares falling.

As with Halloween although, the horrifying half doesn’t final perpetually. And being scared off by the prospect of a short-term scare may trigger buyers to overlook out on some long-term treats.