Picture supply: Getty Pictures

I haven’t been intently following the latest developments of FTSE 250 media firm Future (LSE: FUTR). It’s one thing of an under-the-radar inventory that often pops up on dealer forecasts however seldom makes massive information.

Nonetheless, it turned more durable to disregard after closing up 10% final week following a optimistic set of full-year 2024 outcomes. Print media’s been a dying trade for a while and internet marketing income appears to be dominated by Google.

But Future appears to be discovering new methods to capitalise in the marketplace and should emerge as a pressure to be reckoned with. Don’t simply take my phrase for it. Brokers are taking word too. On 6 December, Barclays went Chubby and Berenberg put in a Purchase ranking on the inventory.

I’m digging deep to see if the fuss is justified and if the inventory’s value contemplating.

Indicators of restoration

Future’s the mum or dad firm of over 200 media manufacturers, together with magazines, web sites and occasions. Its largest manufacturers embrace TechRadar, GoCompare, Marie Claire and The Week.

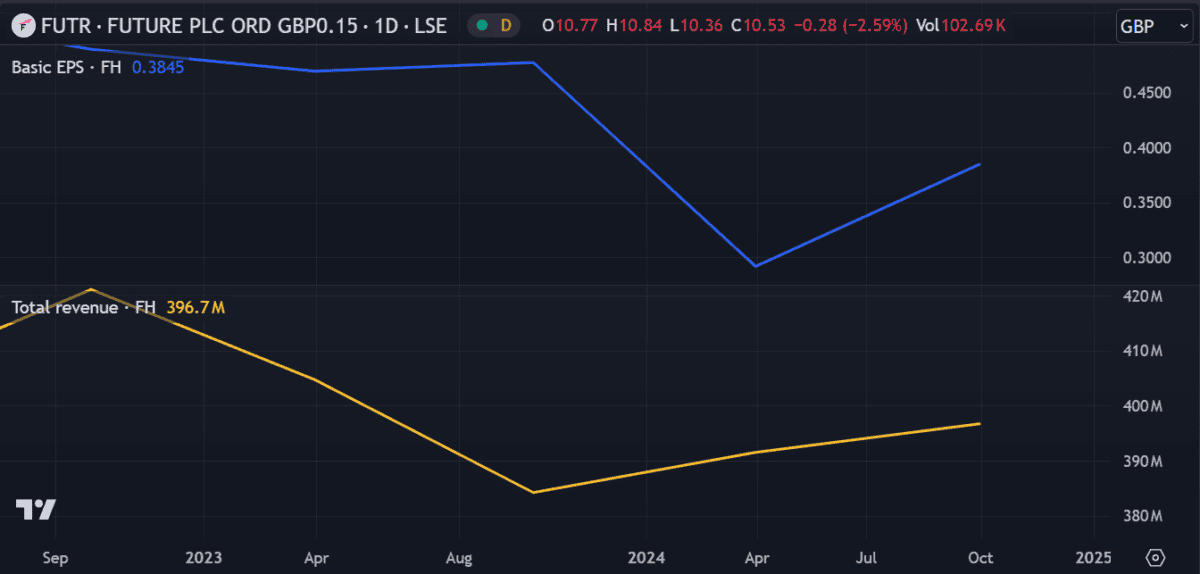

The important thing information from its newest outcomes was a return to income progress within the second half of the 12 months. This was pushed largely by a 40% increase in voucher income and a 28% improve from GoCompare.

Curiously, off-platform customers rose to 250m whereas on-line month-to-month customers decreased 6%. Adjusted working revenue fell 13% with the margin narrowing from 32% to twenty-eight%.

Earnings per share declined 29% to 66.8p in comparison with 94p in 2023. Money additionally decreased by 5%.

On the face of issues, it doesn’t instantly seem like a really optimistic outcome. Nonetheless, it displays early indicators of success within the firm’s Progress Acceleration Technique (GAS).

After a bumpy interval of viewers declines and technical challenges, the initiative appears to be gaining some momentum.

Enterprise developments

In October, the worth dipped 11% following the resignation of CEO John Steinberg. After solely two years within the position, he has determined to return house to the US to be along with his household. Naturally, the departure has involved buyers who might query the true motivation behind the transfer. If unresolved points exist inside administration, it might result in additional issues down the road.

Though a brand new CEO has but to be named, chair Richard Huntingford stays optimistic, praising the brand new GAS initiative for yielding “good strategic and monetary progress”.

A latest partnership with OpenAI suggests the corporate plans to begin utilizing synthetic intelligence (AI). Nonetheless, particular particulars haven’t been introduced and it’s unclear but if it will increase profitability.

Valuation

Valuation-wise, the inventory nonetheless appears low cost, buying and selling round 14 occasions ahead earnings. It’s barely above the trade common however nonetheless enticing for an organization producing money and innovating by partnerships.

Utilizing a reduced money movement mannequin, the shares are estimated to be buying and selling at 61.2% beneath truthful worth. The typical 12-month worth goal’s £14.30, a 32% improve from as we speak’s worth.

However with revenue margins all the way down to 9.7% from 14.4% final 12 months, it might be too early to name a restoration but. As such, I’ll keep watch over the inventory however I don’t plan to purchase the shares as we speak.