Picture supply: Getty Photographs

Situations stay robust for FTSE 100 housebuilder Barratt Redrow (LSE:BTRW) because the UK economic system splutters. Within the first half, it reported an underwhelming 16,565 completions, lacking its goal vary of 16,800-17,200 by a notable distance.

So as to add additional woe, it additionally stays impacted by expensive legacy constructing defects. It booked £248m value of extra legacy property liabilities in January-June, largely as a result of fireplace security and structural points at earlier developments.

At 373p per share, the FTSE firm’s now buying and selling at a 32.8% low cost to what’s was 12 months in the past. Regardless of the builder’s issues, I believe this may occasionally signify a gorgeous dip shopping for alternative.

Certainly, Metropolis analysts imagine Barratt’s share worth might rocket nearly 40% in the course of the subsequent yr.

Restoration continues

Whereas the agency’s restoration is slower than hoped, it’s nonetheless nonetheless transferring forwards. Its web non-public reservation fee rose 16.4% between January and June, to 0.64 per outlet per week. Its additionally reported that its ahead order e-book had “continued to enhance“: this was up 10.5% and 4.3% on a worth and quantity foundation respectively within the first half.

Doubt stays as as to whether Barratt can proceed its restoration, however I’m optimistic it will possibly. Rates of interest are prone to proceed falling as inflation recedes, supporting purchaser affordability.

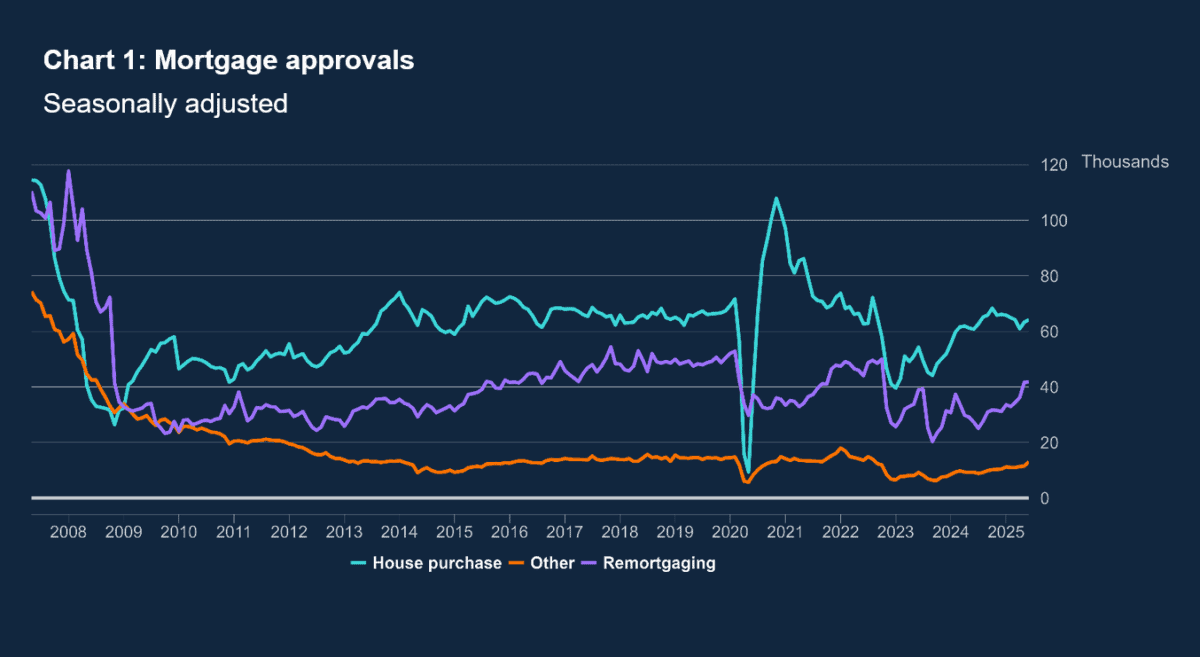

Underlining this assist, newest Financial institution of England knowledge confirmed web mortgage approvals for home purchases up 1.4% month on month in June.

Future fee cuts could possibly be fuelled, too, by enduring financial stagnation, which can offset issues like rising unemployment on Barratt’s gross sales.

Worth share

Metropolis forecasters are in settlement, and count on the builder’s income to rise sharply over the following two years

A 49% year-on-year rise in annual earnings is tipped for this monetary yr (to June 2026). Predicted development stays elevated at 31% for monetary 2027, too.

These forecasts imply Barratt’s shares supply up sturdy worth in my opinion. Its price-to-earnings (P/E) ratio of 12.6 occasions for this yr drops to 9.6 occasions for subsequent yr.

In the meantime, its P/E-to-growth (PEG) a number of is a secure 0.3 by means of the interval. Any sub-1 studying signifies {that a} share is undervalued.

Lastly, dealer consensus additionally suggests sturdy dividend development by means of the interval. So the corporate’s ahead dividend yields are a wholesome (and quickly rising) 4.5% and 5.4% for monetary 2026 and 2027, respectively.

Close to-40% worth positive aspects

As with many UK shares, sharp financial circumstances stay an issue for the corporate. However on steadiness, I’m assured Barratt’s backside line can nonetheless steadily enhance, pulling its share greater from in the present day’s ranges.

The 17 Metropolis analysts who fee the FTSE share all imagine the builder will rebound. The consensus worth goal sits at 516.6p for the following 12 months. This implies worth upside of 38.5%.

Given the strong long-term outlook for houses demand, Barratt is a share I plan to carry for years. Its merger with Redrow final yr offers it terrific scale to use this chance — the UK authorities is focusing on 300,000 new houses annually between now and 2029.