Picture supply: Getty Photos

The S&P 500 stays extremely unstable as rigidity over a widescale commerce conflict intensifies. On this local weather, it may be a good suggestion for buyers to contemplate shopping for some traditional defensive shares.

Some like Newmont Company (NYSE:NEM) even have the potential to soar in worth over the brief time period (and even past). Right here’s why I feel the gold miner’s value severe consideration proper now.

Dividend enhance

Investing in gold mining shares stays a pretty proposition to contemplate. The yellow steel’s worth surge continues and it struck new highs of above $3,230 an oz. simply now. Circumstances appear to be excellent for additional substantial good points.

Because the world’s largest gold firm — steel reserves are a whopping 135.9m ounces — I consider Newmont Company could possibly be the most effective shares to purchase to capitalise on this.

Proudly owning gold shares and price-tracking funds are the preferred ways in which folks achieve steel publicity these days. However proudly owning the businesses that truly produce the valuable steel has a number of benefits.

Gold itself doesn’t truly present an revenue, not like many mining shares that pay a dividend. Newmont’s one in every of these that gives money rewards to shareholders. For 2025, its dividend yield is a stable 2%.

Robust efficiency

Gold shares may outperform gold if operational efficiency is robust. On this entrance, proudly owning Newmont shares might have substantial benefits, given latest manufacturing information.

Gold manufacturing rose 9% within the fourth quarter, newest knowledge confirmed, that means complete manufacturing of 5.9m ounces for the total 12 months beat forecasts. All-in sustaining prices (AISCs) additionally dropped 1.5% within the quarter to $1,463 per ounce, effectively beneath the present worth of gold.

All that mentioned, even the best-run miners can sink in worth because of elements exterior of their management. Main base and treasured metal-producing areas are sometimes situated in politically unstable locations, creating substantial dangers via attainable potential unrest, regulatory adjustments or battle.

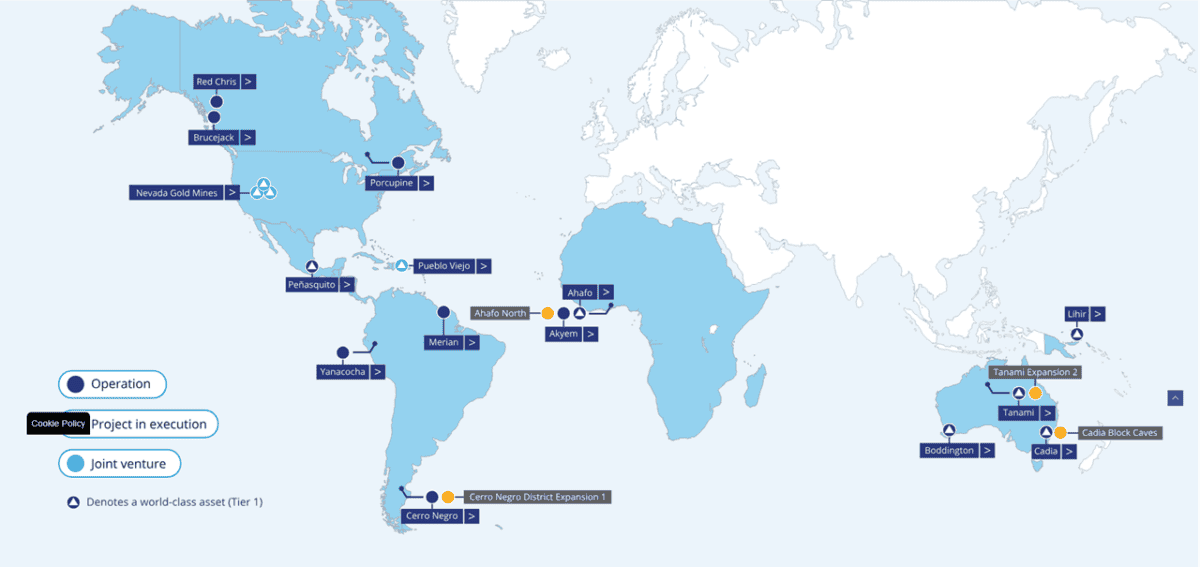

That is one cause why Newmont’s one in every of my most popular sector picks. Whereas it’s additionally weak to such occasions, with property spanning The Americas, Africa and Australasia, such issues will be higher absorbed at group degree.

An S&P 500 discount?

The most important danger nevertheless, for any commodities-producing enterprise is a pointy fall within the worth of their product. Within the case of gold, a sudden pick-up in danger urge for food might see a large scale dumping of the safe-haven steel.

However as I discussed earlier, I feel the panorama is ripe for gold (up 37% over the previous 12 months) to maintain on hovering.

The commerce spat between the US and China continues to accentuate, posing a considerable menace to the worldwide economic system. Uncertainty over future buying and selling relationship between the US and its different main buying and selling nations additionally rumbles on through the 90-day tariff pause.

A dismal outlook for the US greenback additionally bodes effectively for greenback-denominated property like gold. The US greenback index fell beneath the important degree of 100 earlier at present for the primary time in years.

Metropolis analysts anticipate Newmont’s earnings to rise 18% in 2025. This leaves it buying and selling on a price-to-earnings progress (PEG) ratio of 0.9, suggesting it’s underpriced relative to predicted income.

All issues thought-about, I feel buyers ought to give the mining large a detailed look.