Picture supply: Getty Pictures

Over time, the London inventory market’s proved a cheerful looking floor for buyers in search of dividend progress shares.

With a mean dividend yield of round 3.5%, the FTSE 100 and FTSE 250 indexes present bigger dividends than most abroad bourses. That is thanks partly to the UK market’s long-established tradition of paying money rewards.

It’s additionally as a result of many British firms are well-established in mature markets. They obtain steady money flows in industries like power, banking, shopper items and utilities. These can then be distributed within the type of dividends.

What’s extra, with fewer progress alternatives to faucet, UK shares in these sectors are inclined to return a bigger portion of their income to shareholders.

Taking care

Dividends are by no means assured, after all. As we noticed through the Covid-19 pandemic, even essentially the most reliable dividend progress inventory can abruptly scale back or axe payouts completely.

Purchase shopping for shares with robust steadiness sheets, stable positions in defensive markets, and a confirmed dedication to paying dividends can drastically improve an investor’s likelihood of receiving a wholesome passive earnings.

Right here’s one I’d purchase if I had spare money to speculate. If analyst forecasts are appropriate, it may present a £1k second earnings this yr.

Energy play

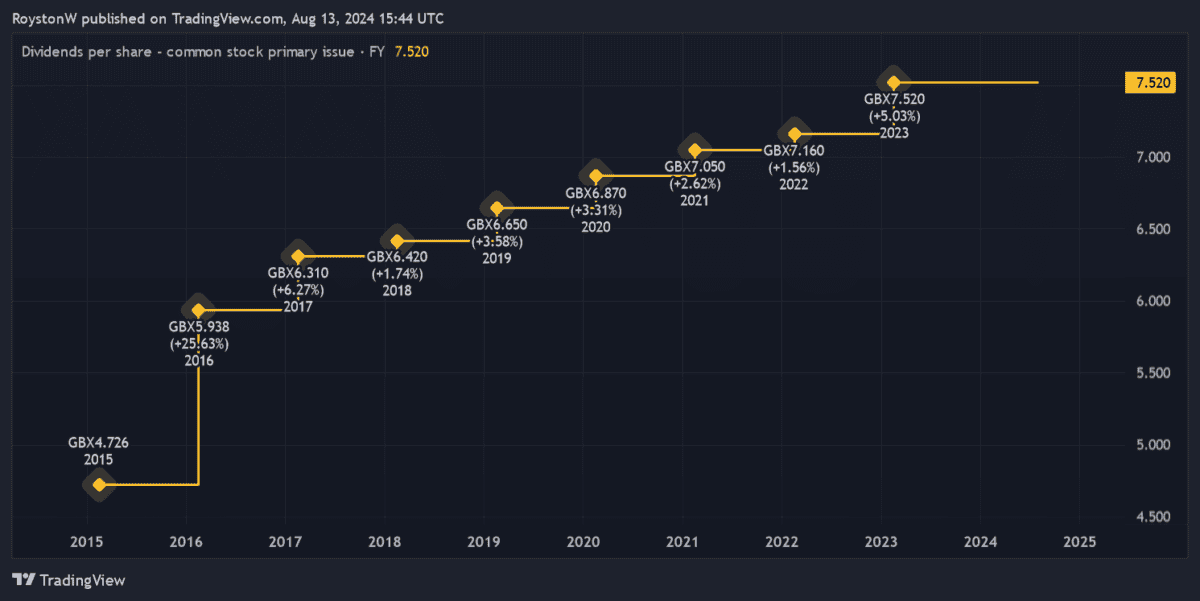

Because the chart exhibits, NextEnergy Photo voltaic Fund (LSE:NESF) has an extended historical past of elevating the annual dividend. In truth, following its resolution to boost fiscal 2024’s complete payout to eight.35p per share, it’s elevated money rewards yearly since its IPO again in 2014.

Being a renewable power inventory, the corporate advantages from steady money flows in any respect factors of the financial cycle. Electrical energy’s one in every of life’s important commodities, so NextEnergy has the monetary capability in addition to the arrogance to pay a rising dividend.

What’s extra, with a big proportion of its regulated revenues linked to the Retail Worth Index (RPI), its capability to extend dividends stays robust, even throughout inflationary intervals.

There are dangers to purchasing NextEnergy Photo voltaic Fund. Vitality era dropped nearly 7% final yr, to 852GWh, which the agency attributed to “elevated rainfall and humidity (which might have an effect on the efficiency of sure elements)”.

However weather-related points to this extent are unusual. Certainly, photo voltaic panels are well-known for offering a constant move of electrical energy, because of common yearly irradiation and restricted transferring elements. This makes NextEnergy a way more dependable income generator than many different renewable power shares.

10.1% dividend yield!

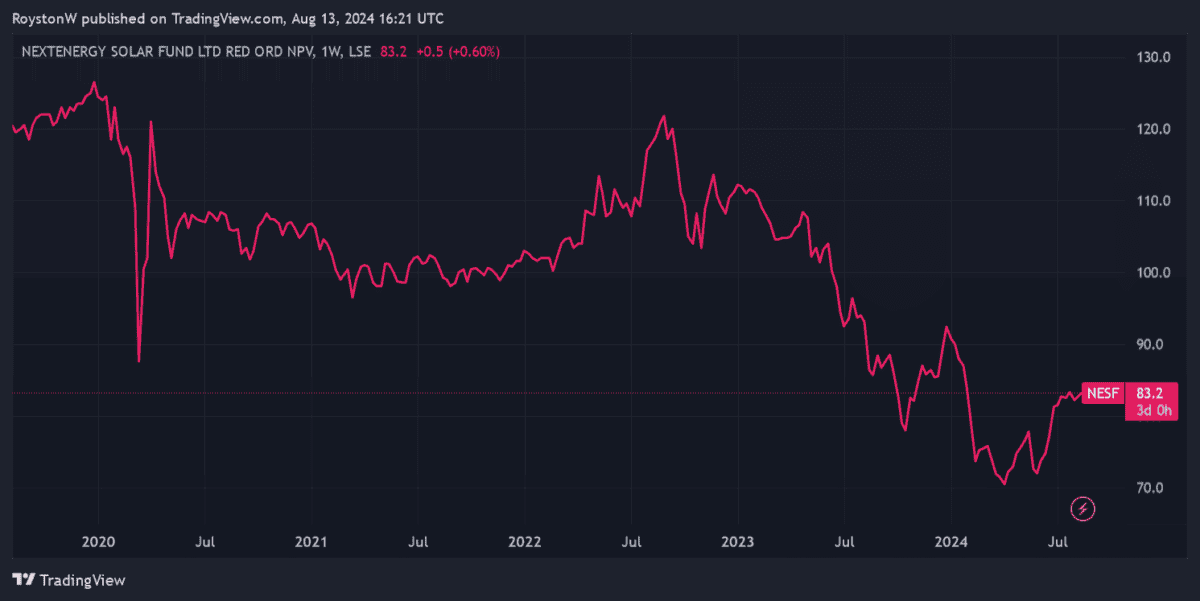

Because the chart exhibits, the corporate’s share value has struggled extra just lately. Increased rates of interest have squeezed its internet asset values (NAVs) and pulled down earnings. This might stay an issue too, if inflationary pressures persist and central banks preserve charges round present ranges.

But the spectacular cheapness of NextEnergy’s share value nonetheless makes it price severe consideration, for my part. The agency trades at a 22% low cost to its estimated NAV per share of 105.7p.

With its ahead dividend yield additionally sitting at 10.1%, I imagine it may very well be among the finest worth earnings shares on the market and price contemplating.

If I invested simply over £9,900 in NextEnergy shares, this may give me a juicy £1,000 in passive earnings this yr alone. That’s assuming that dealer forecasts are correct.