Picture supply: Getty Photographs

Demand for FTSE 100 shares continues to warmth up this summer time. The UK’s premier share index hit new all-time peaks above 8,300 factors this week, taking complete good points in 2024 to eight%.

However investor urge for food hasn’t been unfold equally throughout the Footsie. Certainly, there are many blue-chip shares that stay extremely low cost following years of underperformance.

Listed here are two of my favourites proper now. As I’ll clarify, Metropolis analysts anticipate their share costs to rocket within the subsequent 12 months.

Aviva

At 496p per share, Aviva (LSE:AV.) gives sensible worth when it comes to predicted earnings and anticipated dividends.

Okay, its ahead price-to-earnings (P/E) a number of sits near the FTSE 100 common, at 10.7 occasions. Nevertheless, its price-to-earnings development (PEG) ratio stands at a rock-bottom 0.5. A reminder that any studying under 1 signifies {that a} share’s undervalued relative to predicted income.

On high of this, the ahead yield on Aviva shares is 7.1%. That is greater than double the Footsie common of three.5%.

So what are the drawbacks of investing immediately? One is the likelihood that rates of interest will stay round present highs, thus denting shopper spending. So is the menace posed by excessive competitors throughout its markets.

But Aviva additionally has a chance to develop earnings considerably. It has one of many strongest manufacturers within the monetary companies trade. It could use this — together with its cash-rich stability sheet — to capitalise on speedy development within the pensions and retirement merchandise segments.

Within the meantime, 15 Metropolis brokers have slapped a 12-month goal of 528.4p on Aviva shares. This represents potential worth upside of seven%.

Vodafone Group

Investing in any telecoms inventory may be dangerous as a result of enormous quantities they spend in infrastructure. Vodafone Group‘s (LSE:VOD) even needed to lower the dividend for this yr because it ramps up 5G-related spending.

However over the long run, firms like this even have vital long-term potential for buyers. Demand for his or her companies might develop considerably as our lives turn into more and more digitalised.

It may be argued that Vodafone has notably nice development alternatives too. That is because of its massive publicity to Africa, the place surging wealth ranges and inhabitants sizes are driving product gross sales by way of the roof.

Vodafone — which has 157m clients throughout six African international locations — reported natural service income development of 9.2% final yr.

At a present worth of 73.5p, I believe the potential rewards of proudly owning Vodafone shares outweigh the dangers. Its ahead P/E ratio — like Aviva’s — is in keeping with that of the broader FTSE. Final yr’s losses imply it doesn’t have a sound PEG ratio both.

However its dividend yield stands at an index-smashing 6.9%, even making an allowance for that upcoming dividend lower.

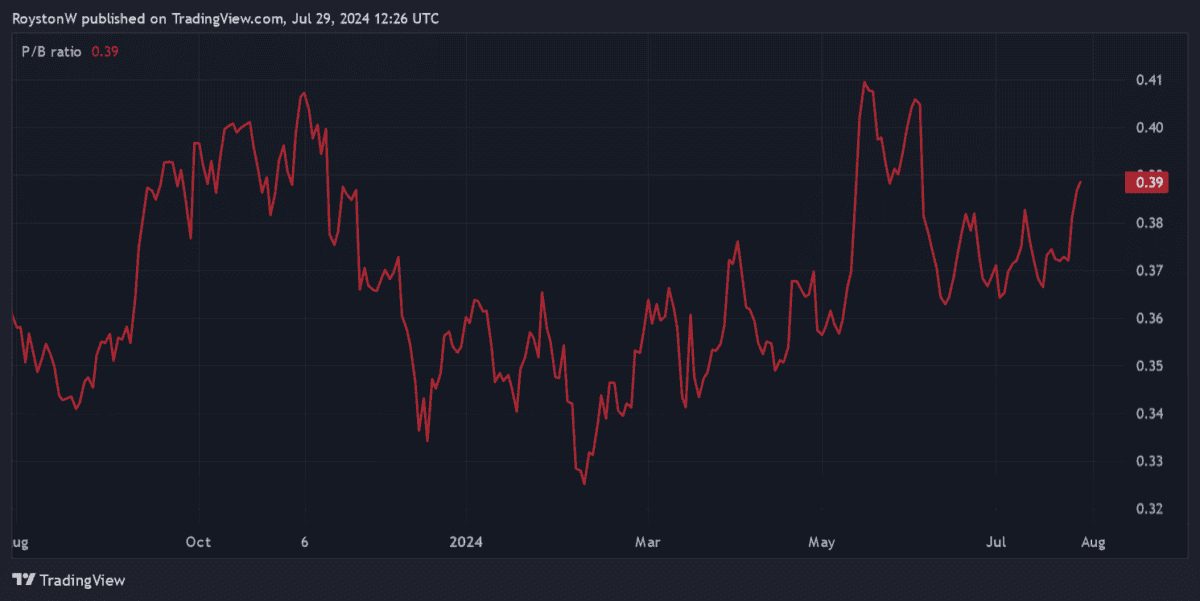

What’s extra, its price-to-book (P/B) ratio sits under 0.4, as proven above. A studying under 1 means that an organization trades at a reduction to the worth of its property.

Fourteen analysts presently have scores on Vodafone shares, making a consensus goal worth of 96.2p. This means the telecoms large might rise 31% in worth over the following 12 months.

Like Aviva, I believe it could possibly be one of many Footsie’s greatest discount shares to contemplate immediately.