Picture supply: Getty Photographs

A Shares and Shares ISA is likely one of the greatest instruments obtainable to UK buyers. And whereas the info from HMRC comes with a little bit of a lag, the variety of ISA millionaires appears to maintain going up.

There’s a £20,000 contribution restrict per 12 months. However even for somebody ranging from scratch at 30, I feel it’s greater than attainable to construct a portfolio value £1m by retirement.

Please notice that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Returns

Investing £20,000 per 12 months entails placing apart £1,666 every month from a wage. That received’t be lifelike for everybody, however the probability to earn tax-free returns is one value taking severely.

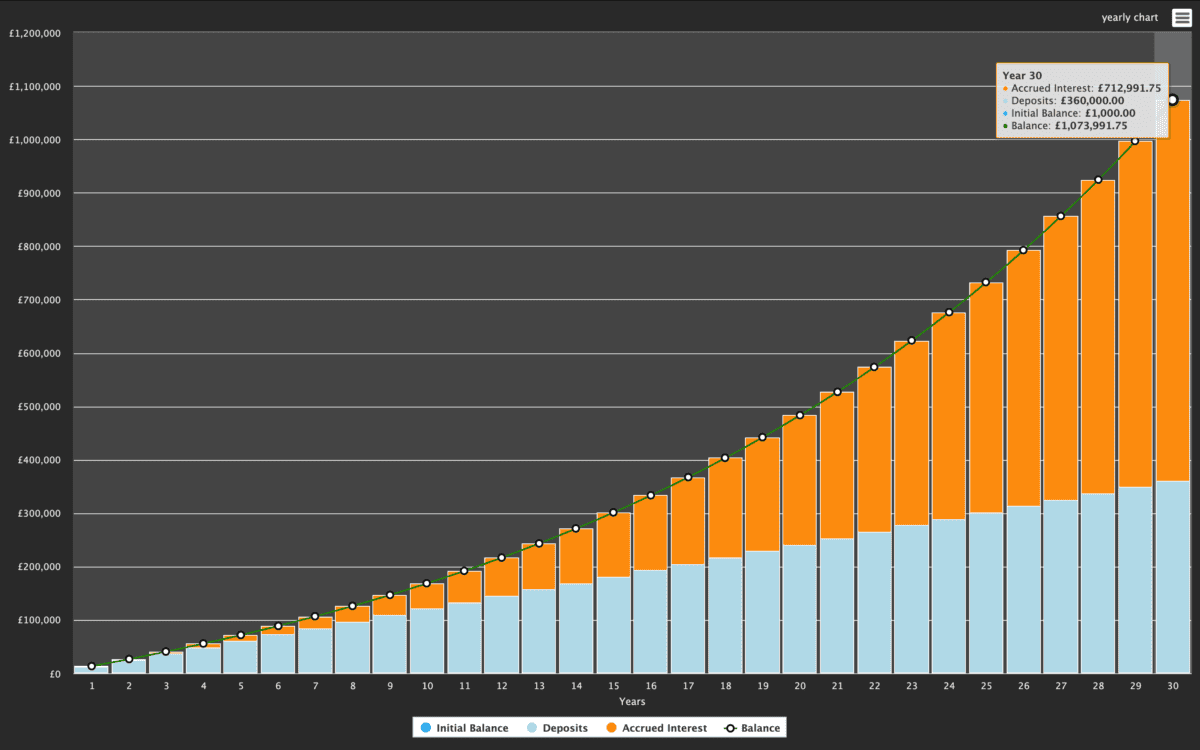

Even with £1,000 per thirty days, reaching 1,000,000 inside 30 years entails incomes a mean annual charge of 6.5% (with any dividends reinvested). And I feel that may very well be extremely achievable.

Supply: The Calculator Web site

The typical return from the FTSE 100 during the last 20 years is 6.8% per 12 months – above the required charge. And for the primary decade, buyers beginning at 30 have one other massive benefit.

Till the age of 39, a Lifetime ISA provides buyers a 25% increase on as much as £4,000 of deposits. Which means a possible £1,000 per 12 months, which is already an 8% return on a £12,000 annual funding.

Even with this, incomes greater than 6.5% per 12 months isn’t assured – investments can go down in addition to up. Nevertheless it’s a giant a part of why I feel that return could be very lifelike over the long run.

After 10 years of incomes 8% per 12 months, the required charge for the remaining 20 years falls to only 6%. And the long-term file of the inventory market makes me optimistic on this entrance.

The place to take a position?

The chance of shedding cash within the inventory market could be very actual. However top-of-the-line methods for buyers to attempt to minimise this chance is by specializing in high-quality corporations.

I feel FTSE 100 firm Informa (LSE:INF) is an effective instance. The inventory is down because the begin of the 12 months and one motive is a possible problem to the agency’s educational publishing arm.

The US is threatening to chop federal funding to academia by 44% from 2026. There’s a danger that might scale back demand for publishing providers and it’s an vital one to contemplate.

Publishing, nevertheless, isn’t Informa’s greatest division. Many of the agency’s gross sales come from its B2B Reside Occasions division – and this a part of the enterprise is definitely rising strongly.

The newest buying and selling replace reported year-over-year gross sales progress of 8.3%. And these are vastly worthwhile occasions for the corporate with comparatively low working capital necessities.

Traders won’t be accustomed to Informa. However robust progress, enticing economics, and a strong aggressive place imply I feel it’s value contemplating for the long run.

Sounds straightforward…

There’s no straightforward technique to flip £1,000 per thirty days into £1m. However by following some comparatively easy guidelines, buyers can provide themselves the perfect probability over the long run.

One among these is maximising returns through the use of a Shares and Shares ISA (and a Lifetime ISA). These won’t look like massive issues, however the outcomes can add up over time.