Picture supply: Getty Photographs

Previous returns should not at all times a dependable information to the long run. But when the historic efficiency of FTSE 250 shares does proceed, an investor might construct a big shares portfolio with only a few kilos put aside every day.

Even those that attain center age with £0 in financial savings might have a terrific probability of retiring in consolation. With a balanced portfolio of development and dividend shares, traders have an opportunity to construct a giant retirement pot in below 30 years.

Right here’s how.

Ranging from zero

It’s a cliche, however it’s by no means too late to start saving or investing for retirement. Even a small quantity put aside every day could make a giant distinction to our post-work existence. And as inflationary pressures recede, this could turn into potential for tens of millions of individuals.

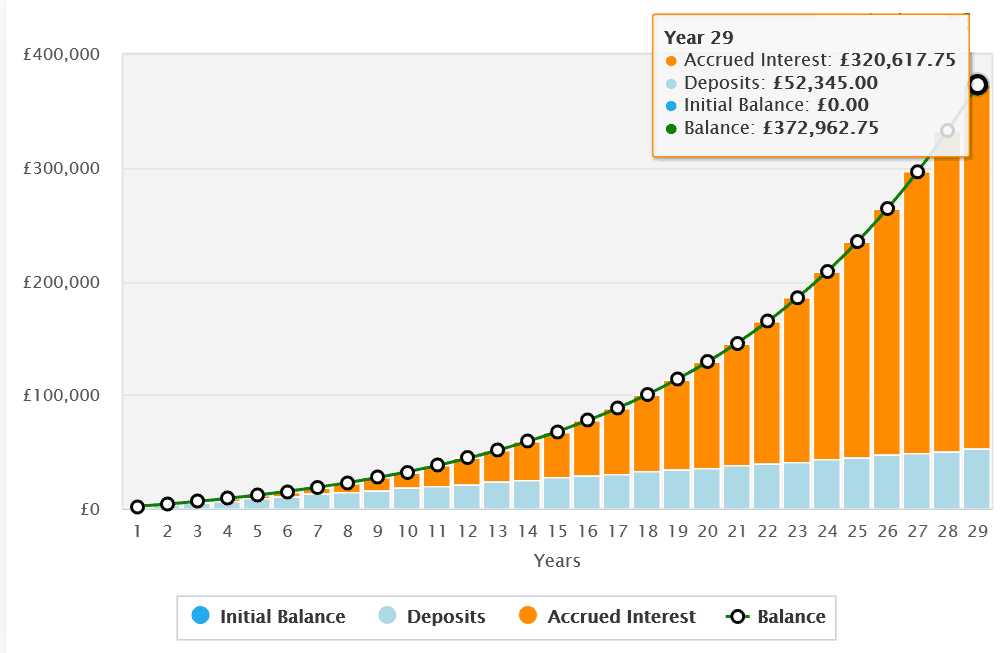

Let’s say somebody has £5 of their pocket to take a position a day. This might, if invested in a FTSE 250 index fund, create a portfolio price greater than £370k after simply 29 years.

This looks as if a unprecedented sum of cash for such a small each day saving. So let me break this down to point out you the way it might work.

Constructing wealth

Investing that saved money every single day, week, and even month, may very well be a foul thought. It’s because a big proportion of that cash can be eaten up in buying and selling charges.

Investing quarterly could also be a greater approach to stability value and reward. An investor who selected this path would have £451.25 each three months to place in that FTSE 250 fund in the event that they used a dealer who charged a fiver per commerce (£456.25 – £5).

After 29 years, the mathematical miracle of compounding might flip that £5 saved every day right into a portfolio price £372,963.

That’s assuming that the FTSE 250 continues delivering its long-term common annual return of 11%.

It additionally supposing the investor makes use of a Shares and Shares ISA to guard them from capital positive factors tax and dividend tax.

Please observe that tax remedy relies on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

A high FTSE 250 share

Mixed with the State Pension, this £370k+ ISA might present somebody with an honest lifestyle in retirement.

Nevertheless, they may probably have a good bigger nest egg in the event that they invested in particular person shares fairly than a FTSE 250 tracker fund. Software program developer Kainos Group (LSE:KNOS) is one such inventory on my watchlist.

Investing in particular person shares carries extra threat than shopping for a fund that maintain lots of of various corporations or extra. On this case, returns from Kainos might disappoint throughout financial downturns when corporations reduce spending.

However the future is brilliant for Kainos, in my view, as non-public and public sector entities proceed digitalising their operations. Since its IPO in 2015, the tech star has delivered a median annual return of 19.5%.

I’m particularly excited by its rising place in synthetic intelligence (AI). The agency’s executed greater than 140 AI & Information initiatives thus far, and racked up one other 40 contracts right here within the six months to September.

Sturdy money technology provides Kainos the means to maintain investing closely on this development space, too.