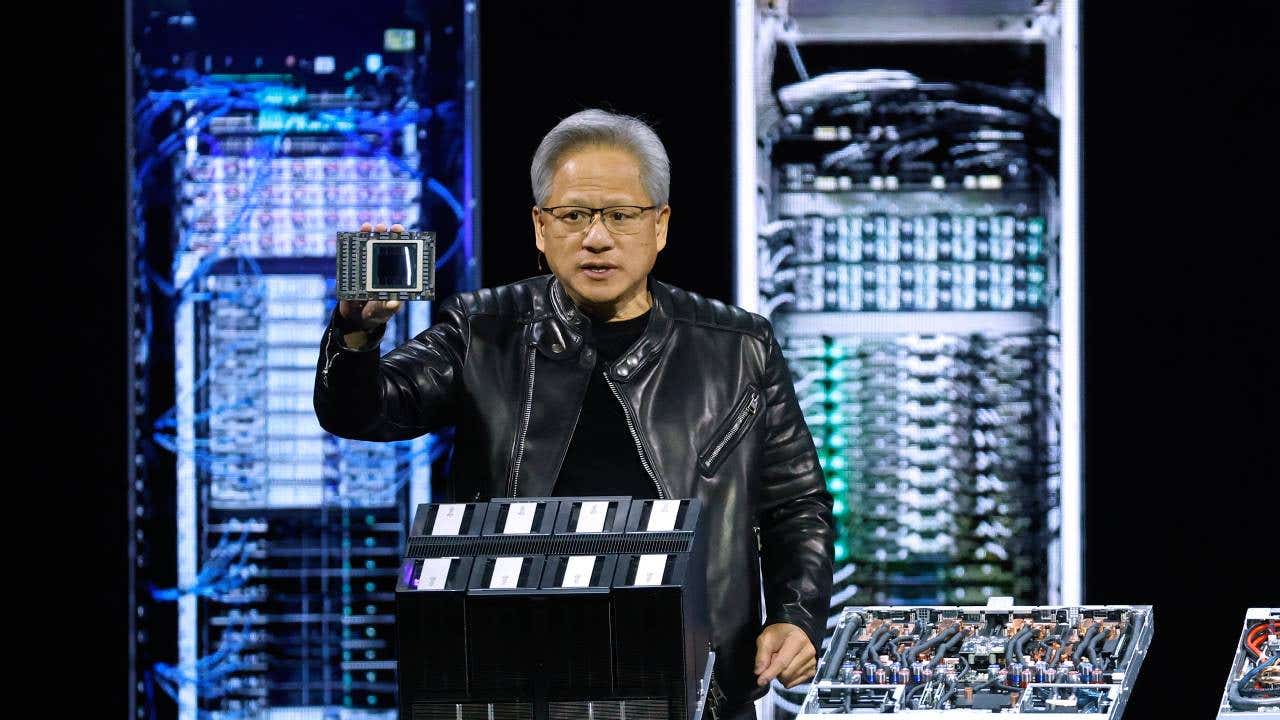

Justin Sullivan/Getty Pictures

Nvidia is internet hosting its annual GPU Expertise Convention, and kicked off the week with information of its next-generation chips, amping up analysts’ expectations of the corporate’s development path. The occasion happens amid a market setting that appears able to query the sustainability of the chipmaker’s development, as the large AI-powered tech shares have fallen laborious in current weeks.

Nvidia CEO Jensen Huang introduced the corporate’s new chips and hyped the information middle trade’s build-out. Huang laid out the map: The corporate’s subsequent AI chip out of the fab shall be Blackwell Extremely, which debuts within the second half of this 12 months. That shall be adopted up with Vera Rubin within the second half of 2026 and the Vera Rubin Extremely on account of arrive in 2027’s second half.

Past that, Huang stated he nonetheless sees sturdy development for the corporate’s chips and expects the information middle trade to develop to $1 trillion in spending. Because the AI chip chief, Nvidia would seize a good portion of that development, which is being pushed by large gamers corresponding to Microsoft, Amazon and Alphabet as they quickly spend to construct their processing functionality.

The information is hopeful in an trade whose shares have stalled to start out the 12 months, following just a few years of large development. Many analysts have been questioning whether or not tech shares have gotten forward of themselves as they await development to meet up with the investments being made.

Want an advisor?

Want skilled steerage in terms of managing your investments or planning for retirement?

Bankrate’s AdvisorMatch can join you to a CFP® skilled that can assist you obtain your monetary objectives.

Inventory market has soured on AI shares, for now

Nvidia’s occasion comes whereas AI powerhouses — the large tech shares behind the Magnificent 7 title — have been reeling to start out the 12 months. All seven of those blockbuster shares at the moment are down for the 12 months, resulting in a decline within the Nasdaq. In truth, the tech-heavy Nasdaq has fallen by greater than 10 p.c from its current excessive, coming into what market watchers name a “correction.”

Decline from 52-week excessive

| Apple (AAPL) | -16.1% |

| Microsoft (MSFT) | -17.3% |

| Alphabet (GOOGL) | -23.1% |

| Amazon (AMZN) | -21.8% |

| Meta Platforms (META) | -20.0% |

| Nvidia (NVDA) | -20.9% |

| Tesla (TSLA) | -52.4% |

Knowledge as of March 19, 2025

These firms are principally large consumers of Nvidia’s chips, they usually’ve been planning an enormous spending binge as they roll out AI-enabled providers and options. For instance, Microsoft has deliberate capital spending of about $80 billion this fiscal 12 months, which ends in June. This beautiful quantity helps construct out the corporate’s knowledge facilities, which energy AI apps, amongst different issues.

However just lately analysts have been questioning whether or not the AI trade is rising quick sufficient to warrant the premium placed on the shares of Magazine 7 shares. Maybe that’s not so shocking, given the huge runs in these tech shares over the previous two years, with Nvidia posting the best beneficial properties of that lot as its AI chips have been snapped by chip-hungry companies.

However the emergence of rival AI fashions corresponding to DeepSeek has referred to as into query how a lot sustained demand will exist for Nvidia’s chips. DeepSeek and different AI fashions have required a lot much less computing energy than standard fashions corresponding to ChatGPT, main many to take a position that the continued want for Nvidia’s chips received’t be as sturdy as traders at the moment count on.

With Nvidia’s decline from its 52-week excessive, the inventory trades round 26 occasions analysts’ expectations for earnings within the present 12 months. These estimates suggest earnings development of round 51 p.c. Sure, bushes don’t develop to the sky, however this P/E a number of shouldn’t be precisely excessive if Nvidia can ship this 12 months’s estimates and maintain even average development within the years forward.

Editorial Disclaimer: All traders are suggested to conduct their very own unbiased analysis into funding methods earlier than investing resolution. As well as, traders are suggested that previous funding product efficiency isn’t any assure of future value appreciation.