Picture supply: Getty Pictures

Having a second retirement earnings along with a pension is the dream of many. However slightly than ready to win the lottery, I consider a strategic UK share portfolio might be one option to obtain this. And in contrast to shopping for property, inventory investing doesn’t require quite a lot of money to get began.

Plus, historical past reveals proof of equities’ spectacular long-term returns, typically exceeding different choices.

Think about turning a mere £5,000 funding right into a self-sustaining earnings stream of over £1,000 each month. Sounds fantastical, proper? Effectively, buckle up, as a result of I’m about to unveil my plan to try to make this dream a actuality!

Choose an funding account

I believe the most suitable choice for UK residents is to open a Shares and Shares ISA. With this product, customers can put money into a variety of property as much as £20,000 a yr with no tax obligations on the capital features. It’s most likely the most effective methods to get probably the most out of a portfolio of shares.

Different buyers solely centered on retirement might desire a Self-Invested Private Pension (SIPP), permitting as much as £60,000 a yr. However bear in mind, this cash is locked up till retirement.

Each choices are a good way to speculate tax-free in shares and shares to construct a second earnings.

Please notice that tax remedy relies on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Selecting the best-performing shares

I don’t know anyone with a crystal ball that may predict the perfect shares to purchase. No one really is aware of for positive precisely which shares will outperform others. However there are methods to make better-informed decisions.

There’s a typical disclaimer utilized in finance: “Previous efficiency is not any indication of future outcomes.” That could be true. However I nonetheless discover that established firms with a superb historical past have a greater probability of performing properly.

That’s why I have a look at an organization’s fee historical past when contemplating shares for dividends. Take the UK-based non-public fairness funding agency Intermediate Capital Group (LSE: ICG) for instance.

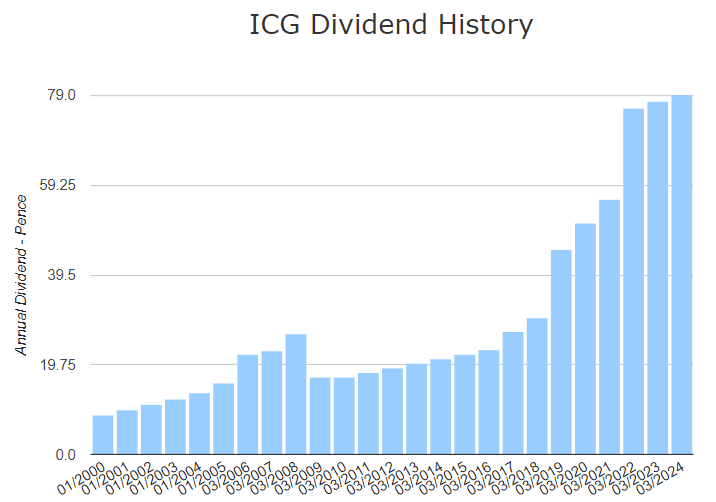

Aside from a short discount in 2009, this FTSE 100 constituent has been paying a persistently rising dividend for twenty-four years. From 8.65p per share in 2000, the dividend has elevated to 79p per share this yr. In simply the previous 10 years, it’s grown at a compound annual development charge (CAGR) of 14.17%.

And it’s not simply dividends. In the identical interval, the share value has elevated by 787.4%, representing an annualised return of 9.52% per yr.

So £5,000 invested right into a inventory with these returns might develop to £145,635 in 22 years. Assuming the dividends proceed to develop as they’ve been, that quantity would pay out £12,898 in annual dividends — over £1,000 a month.

However non-public fairness may be dangerous.

It’s closely reliant on world markets performing properly. A monetary crash or recession might damage the share value and dividend funds, which occurred in 2008 and 2020. If rates of interest stay excessive it might drive up borrowing prices and dampen market sentiment.

The share value has additionally shot up lately, suggesting it could be overvalued and will expertise a reversal quickly. The corporate is valued at £6.4bn however doesn’t have quite a lot of money to cowl its £1.49bn debt.

Nonetheless, I believe it’s a superb instance of a long-term, dependable dividend payer. As such, I believe it’s value contemplating as a part of a portfolio of earnings shares geared toward constructing wealth for retirement.