The 2024 bitcoin mining business reached historic milestones whereas grappling with vital obstacles, in accordance to an intensive report sponsored by Nicehash and authored by Digital Mining Options and Bitcoinminingstock.io. The excellent research sheds mild on unprecedented community growth, developments in {hardware} effectivity, and main financial transitions.

Nicehash and Digital Mining Options Showcase the Bitcoin Mining Business’s Unprecedented Progress in 2024

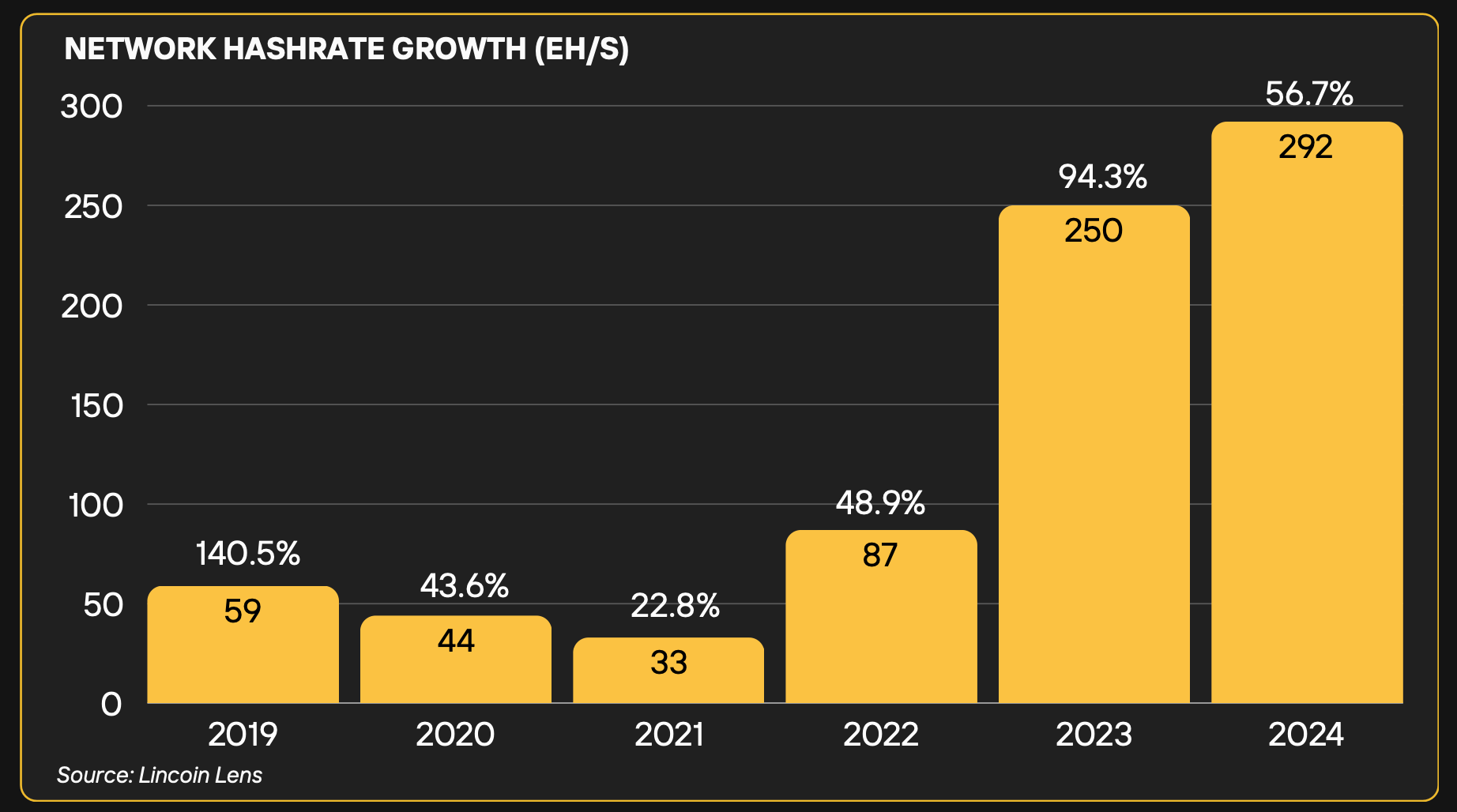

Bitcoin mining operations in 2024 skilled phenomenal progress, with community hashrate peaking at 808 exahash per second (EH/s) by year-end, in keeping with Digital Mining Options‘ and Bitcoinminingstock.io‘s report authored by Cindy Feng and Nico Smid. Miners contributed almost 300 EH/s to the community, surpassing all earlier data. Nonetheless, this speedy growth got here with challenges. April’s fourth bitcoin halving occasion diminished the block subsidy from 6.25 BTC to three.125 BTC, exerting appreciable stress on miners’ profitability.

Bitcoin’s value crossed the $100,000 threshold in 2024, closing the yr at $93,400—a rise of 121.3% from January. This surge elevated its market capitalization to $2 trillion, outpacing silver and positioning bitcoin because the seventh-largest international asset. Regardless of this rally, mining economics had been strained post-halving. The hashprice—a metric reflecting miners’ income—dropped to a document low of $38 per petahash per day (PH/day) earlier than rebounding to $55 PH/day by December.

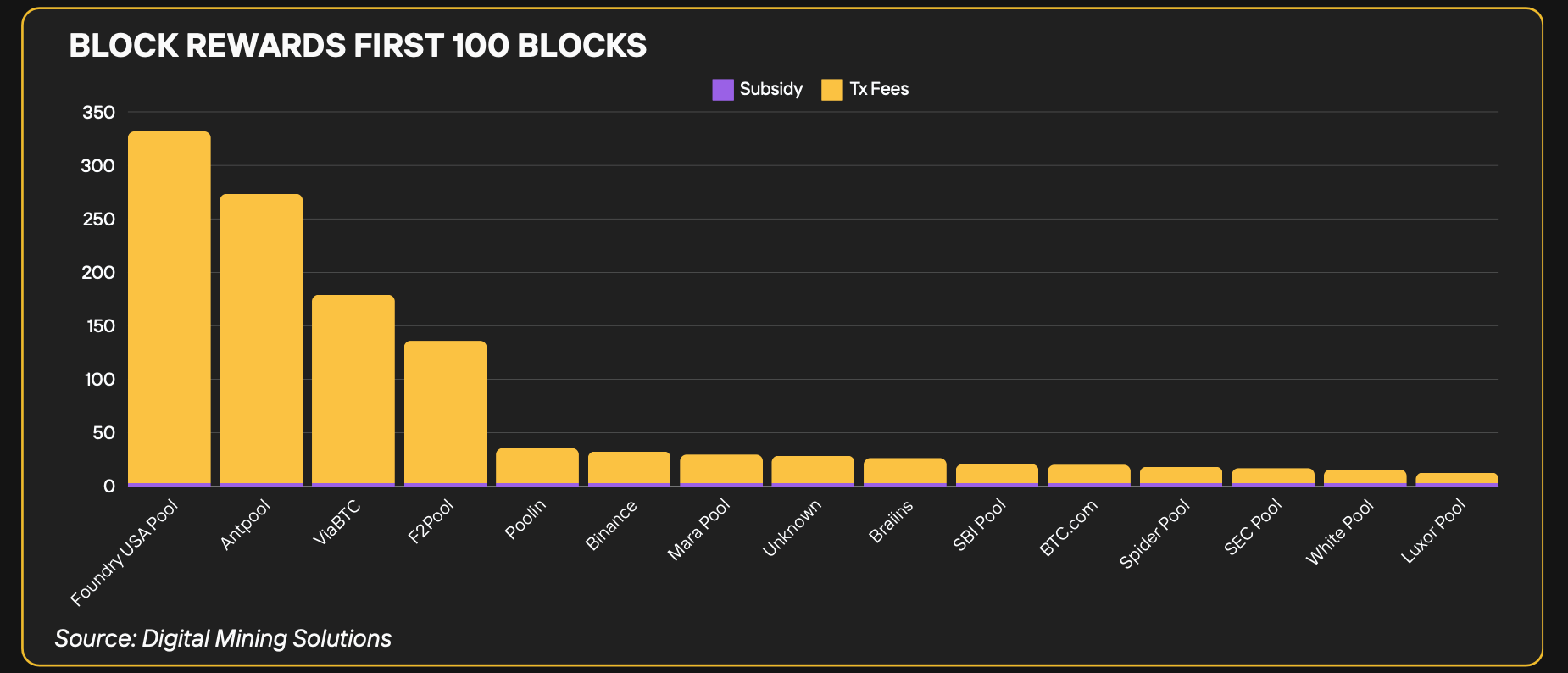

Feng and Smid’s findings present transaction charges spiked throughout the halving, accounting for 139.8% of block rewards on April 19. Whereas this quickly offset miners’ income declines, the drop in hashprice highlighted the sector’s vulnerabilities.

The research exhibits the ASIC (application-specific built-in circuit) {hardware} market noticed the discharge of 30 new fashions in 2024, specializing in hydro-cooling and standardized designs. Regardless of these improvements, community effectivity plateaued attributable to deployment delays. The Bitmain Antminer S21 collection, as an example, represented simply 4.1% of the community by year-end, with tangible effectivity enhancements anticipated in 2025.

Falling ASIC costs mirrored broader market challenges. Mid-generation machines with effectivity ranges between 25 and 38 joules per terahash (J/T) misplaced as much as 97.5% of their worth, underscoring the difficulties confronted by hosting-based miners.

The mining report highlights how america retained its place because the main bitcoin mining hub, commanding 38% of worldwide hashrate. In the meantime, rising areas like Ethiopia and South America gained momentum by harnessing renewable vitality. Ethiopia, pushed by hydropower, contributed 2.5% to international hashrate—a improvement highlighted within the report.

Miners additionally explored new frontiers, diversifying into high-performance computing (HPC) and synthetic intelligence (AI). U.S.-based operations repurposed mining amenities for AI workloads to mitigate inconsistent mining returns.

The Digital Mining Options and Bitcoinminingstock.io report anticipates additional progress propelled by technological innovation and strategic diversification. As bitcoin mining evolves, operators should prioritize adaptability and resilience to deal with financial challenges and regulatory complexities.