Picture supply: Getty Pictures

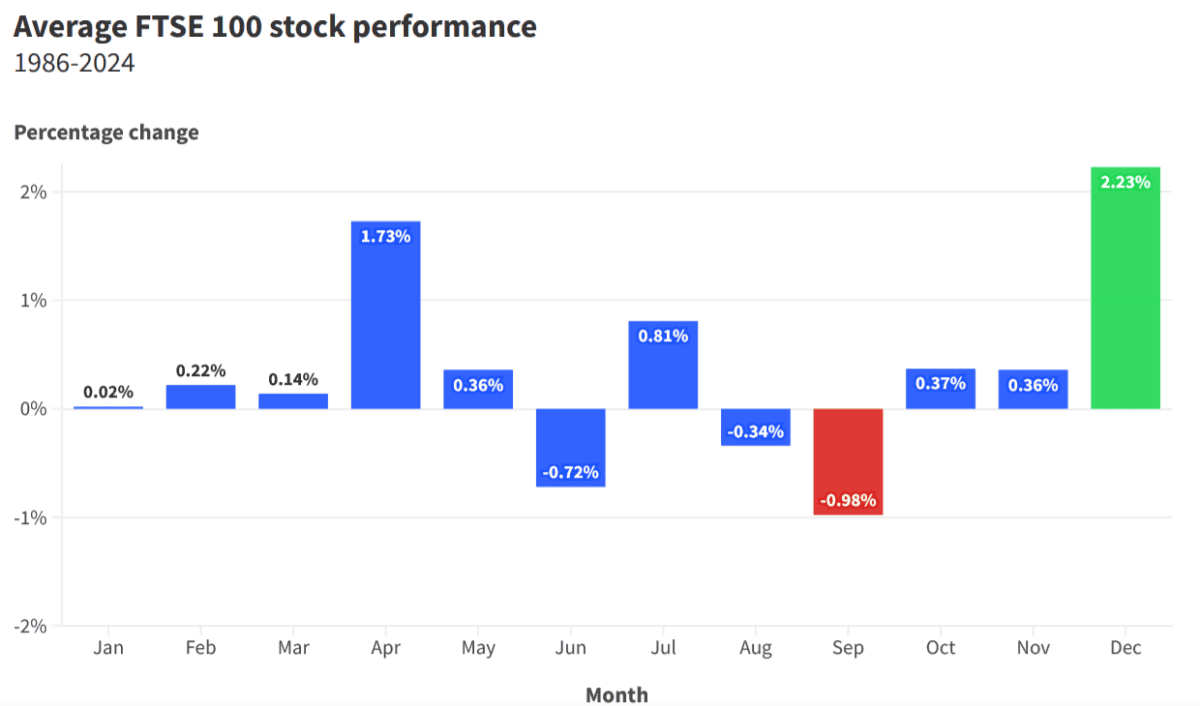

The omens aren’t good for traders who need to make massive positive factors in September. Knowledge exhibits that the ninth month of the yr is well the worst for UK share costs.

In accordance with Finder.com, the FTSE 100 has fallen, on common, 1% every September going all the best way again to the mid-Nineteen Eighties.

To be truthful, different main worldwide indexes have additionally traditionally recorded their worst performances in September. The Euro Stoxx 50 has dropped 2.13% on common, whereas the S&P 500 and Nikkei 225 have reversed 0.88% and 0.83%, respectively.

So what ought to I do now?

What’s taking place?

Firstly, it’s value contemplating why indexes just like the Footsie fall in the course of the first month of autumn.

Worth comparability knowledgeable Finder has a number of theories. These embody:

- Institutional elements, like traders promoting near the top of the third quarter

- Funds exiting much less profitable investments earlier than the quarter finishes

- Traders who’re coming back from summer season holidays taking income and offsetting positive factors with losses earlier than the top of the yr

- Damaging market expectations for September prompting promoting as a part of a ‘self-fulfilling prophecy’

What subsequent?

So the ‘September impact’ is probably going a market irregularity, then, quite than a sound cause to promote up and head for hills.

As somebody who invests for the lengthy haul — I intention to carry the shares I purchase for at least 5 years — I’m not nervous on the prospect of one other poor September. I’m assured that the shares I purchase will steadily acquire in worth over a chronic interval.

In reality, I’ll be doing the alternative of many traders this month. I’ll be in search of oversold bargains so as to add to my portfolio. This manner, I’ve an opportunity of constructing larger capital positive factors by shopping for in even decrease than I’d anticipate to in any other case due to September’s market anomaly.

A high dip purchase

One share I’m already taking a look at at present is Hochschild Mining (LSE:HOC).

The valuable metals miner has endured a poor begin to September, and now seems prefer it might be too low-cost to overlook. It trades on a ahead price-to-earnings (P/E) ratio of 8.2 instances.

Hochschild’s fall isn’t mainly all the way down to this month’s historic quiet down, nevertheless. It extra doubtless displays a fall in gold and silver costs because the US greenback has risen. An appreciating buck makes it much less cost-effective to purchase and maintain dollar-denominated property.

Mining corporations are naturally susceptible to volatility on commodity markets. The excellent news for gold producers, nevertheless, is that the yellow steel might get well strongly within the weeks and months forward.

Costs touched new document peaks above $2,500 per ounce final month, pushed by worries over financial progress, battle in Europe and the Center East, and expectations of upper inflation as central banks reduce charges.

So I’d anticipate Hochschild shares to additionally rebound as steel costs enhance. But I wouldn’t simply purchase the miner to capitalise on this. I feel it might be an amazing share to personal for the lengthy haul to handle threat in my portfolio.

And at present costs, it might be a really cost-effective manner for me to take action.