Picture supply: Getty Photographs

Palantir Applied sciences (NASDAQ: PLTR) inventory has a behavior of exploding larger after an earnings stories. This has seen it rise by a mind-boggling 780% in two years!

The AI software program agency stories Q2 earnings on 4 August. Ought to I snap up some shares earlier than this occasion?

Booming AI enterprise

Palantir develops software program that allows organisations to analyse and act on giant volumes of knowledge. Its huge buyer base consists of the likes of the US Military, CIA, NHS England, Airbus, and Ferrari.

Lately, it has been the corporate’s Synthetic Intelligence Platform (AIP) that has supercharged the enterprise and share value. AIP integrates giant language fashions (LLMs) and different AI instruments instantly with an organisation’s non-public knowledge and workflows.

The surge in contracts signed for AIP has been most pronounced throughout the pond. In Q1, US income jumped 55% 12 months on 12 months to $628m, with US business income rocketing 71%. Total income elevated 39% to $884m.

Impressively, Palantir closed 139 offers of at the very least $1m, 51 of at the very least $5m, and 31 offers of $10m or extra through the quarter. Adjusted free money circulate got here in at $370m, good for a really wholesome a 42% margin.

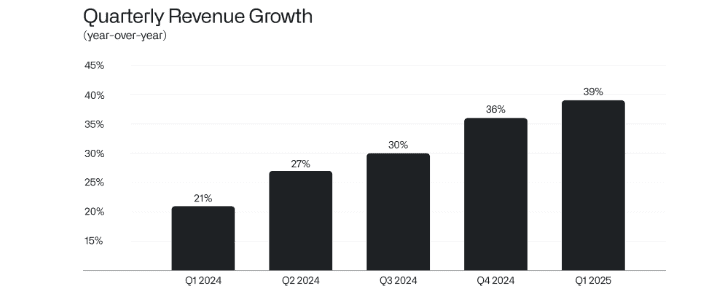

The principle motive for the inventory’s unbelievable ascent skywards is that the quarterly charges of income development have been accelerating. At any time when this occurs, buyers understandably get very excited (particularly when it’s been pushed by AI).

Co-founder and CEO Alex Karp commented: “This can be a degree of surging and ferocious development that may be spectacular for a corporation a tenth of our measurement. At this scale, nonetheless, our ascent is, we consider, unparalleled.”

Have I missed the boat?

Clearly that is all very spectacular stuff. However every time I take a look at Palantir, I can’t assist feeling pangs of remorse. That’s as a result of I used to be kicking the tyres on this inventory a few years in the past when it was at $9. However I by no means invested.

Now, I can’t assist feeling like I’ve missed the boat, as Palantir has a large $373bn market cap. This makes it the Twenty first-largest firm within the US, forward of Coca-Cola, McDonald’s, and Financial institution of America.

Furthermore, it’s buying and selling at 126 occasions gross sales, which simply appears ridiculous to me. Why so? As a result of Wall Road at present has round 30%-35% development pencilled in for the following three years. Whereas that’s undoubtedly spectacular, it doesn’t justify 126 occasions gross sales, in my view.

At this valuation, I see quite a lot of threat. If AI spending immediately slows, or earnings are available barely mild, the inventory might dump closely.

Additionally, quite a lot of the expansion Palantir is seeing proper now pertains to the US, and the CEO has been extremely vital of Europe not embracing AI. He reportedly stated that it’s “like individuals have given up“, when talking about Europe’s AI ambitions.

Due to this fact, a lot of Palantir’s development rests on the US (and pockets elsewhere, like Saudi Arabia). A US recession sparked by tariffs is subsequently a near-term threat to development.

My transfer

My view right here is that Palantir is a world-class software program firm with an infinite long-term alternative in AI. Nonetheless, the inventory is buying and selling far too expensively for me to really feel comfy investing as we speak.

If there was a significant pullback within the share value, nonetheless, that may be a special matter.