Picture supply: Getty Photographs

Rolls-Royce (LSE: RR) shares didn’t simply crush the broader FTSE 100 final 12 months. The 221% surge meant additionally they outperformed all of Europe’s blue-chips too.

Nevertheless, we haven’t seen the identical sustained momentum this 12 months. After reaching 322p earlier this month, the share value has pulled again and now sits at 303p.

Is there a shopping for alternative at this value? Or has Rolls inventory discovered its cruising altitude round £3?

Right here’s what the charts say.

Valuation

First, if we take into account the price-to-sales (P/S) ratio as a valuation gauge, the shares look fairly expensive on a historic foundation.

With a P/S a number of of 1.6, the inventory is at the moment buying and selling on the high finish of the place it’s been during the last 20 years or so.

Even adjusting for 2024’s projected gross sales figures, the inventory would nonetheless be in direction of the highest finish.

After all, we are able to additionally asses the inventory on a price-to-earnings (P/E) foundation now that Rolls-Royce has swung again into profitability. Beneath are the earnings per share (EPS) forecasts by means of to 2025 with the corresponding P/E multiples.

| 2023 | 2024 | 2025 | |

| EPS | 9.5p | 12.6p | 15.1p |

| P/E | 32 | 24 | 20 |

this, the inventory doesn’t look significantly low cost, assuming these EPS figures show correct.

Now, none of this want fear traders if Rolls-Royce really is ready to turn into a extra resilient and worthwhile firm in future (as administration is making an attempt to do).

It simply means the market is keen to worth it extra extremely than prior to now. But it surely additionally means there’s little margin for error.

Steadiness sheet

Rolls-Royce needed to tackle monumental ranges of debt to outlive when the pandemic successfully shut the worldwide civil aviation sector. This was the principle purpose the share value dipped as little as 38p in late 2020.

Trying again, that value proved to be a once-in-a-generation likelihood to take a position. After all, solely with the advantage of hindsight can we now know this. Most traders I do know weren’t touching the inventory with a bargepole again then (myself included).

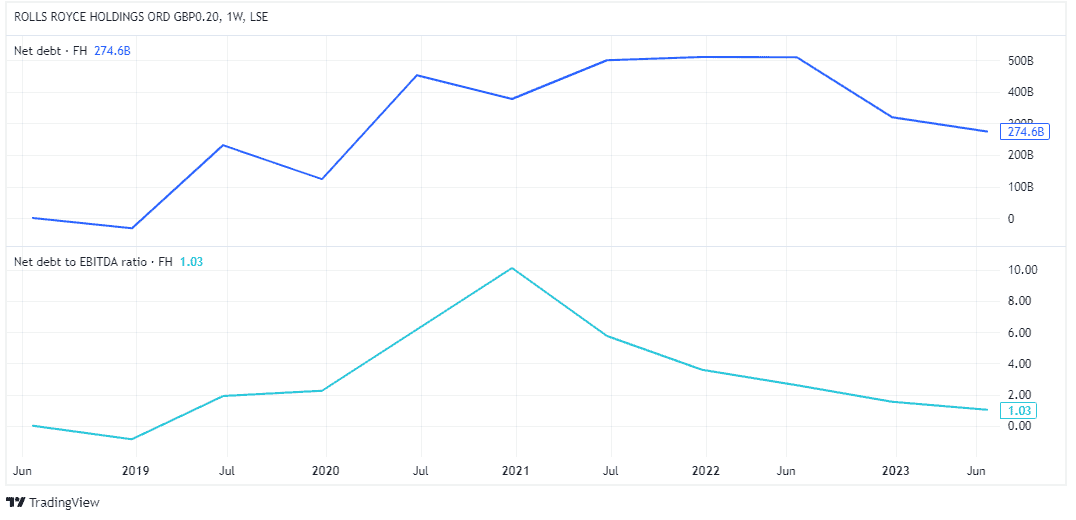

Nevertheless, this web debt scenario has been bettering just lately, as we are able to see within the chart under.

Web debt was right down to £2.8bn as of June. Consequently, the online debt-to-EBITDA ratio can also be decrease. That is clearly good because it means the corporate has much less debt in comparison with its earnings, which offers extra flexibility to spend money on development alternatives.

Worth targets

A ultimate factor we are able to take into account is what analysts suppose. In spite of everything, it’s their targets/opinions that may transfer the near-term share value. At the moment, the consensus value goal is 354p (about 16% larger).

My verdict

Placing all this collectively, I believe the inventory appears to be like priced for perfection as issues stand. In different phrases, the market might be already factoring in all potential optimistic outcomes, leaving little room for disappointment.

Any failure to fulfill these expectations might see the share value pull again sharply. It is a threat right here. Due to this fact, I’m not including to my holding right now. But, neither am I promoting, as I believe the turnaround appears to be like set to proceed.

On 22 February, the corporate is because of report full-year earnings for 2023. I’ll wait until then to see what administration says earlier than making my subsequent transfer.