Picture supply: Getty Photographs

Rumours have swirled for months that the Treasury is about to make seismic modifications to the Money ISA. It’s a part of a plan to encourage larger participation in fairness investing utilizing merchandise just like the Shares and Shares ISA

Modifications might be introduced as quickly as Chancellor of the Exchequer Rachel Reeves’ Mansion Home speech on 15 July, in response to the Monetary Instances.

By contemplating altering the ISA regime, Reeves desires to get the UK investing in riskier property akin to shares. In doing so, she hopes that:

- Britons will obtain higher long-term returns than financial savings accounts sometimes supply.

- The UK economic system will obtain a lift from greater funding flows.

- The London Inventory Trade will get pleasure from a revival in buying and selling volumes and new listings.

Reeves mentioned earlier this yr that she desires to foment “a tradition within the UK of retail investing like what you’ve got within the US”. Within the States, greater than 60% of individuals personal shares. That compares with round 20% in Britain.

Please be aware that tax therapy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

What are the choices?

Given the superior returns on supply from share investing, I imagine Britons ought to give the inventory market larger consideration when planning for retirement. Nevertheless, that’s to not say I feel the federal government is correct to encourage this by slicing Money ISA allowances!

It’s essential to notice that even when allowances are modified, Britons will nonetheless be capable of hold saving money as ordinary.

People will nonetheless be capable of make common contributions to considered one of these tax-efficient merchandise, although the annual financial savings is more likely to be decrease. Folks will even nonetheless be capable of use commonplace financial savings accounts to maintain money, however tax might be due on curiosity that exceeds private allowances.

Nevertheless, now might be an excellent time for Britons to contemplate the opposite choices out there to them. With the Shares and Shares ISA, people can select from a variety of shares, trusts and funds that cater to a variety of danger profiles.

Low-risk investing

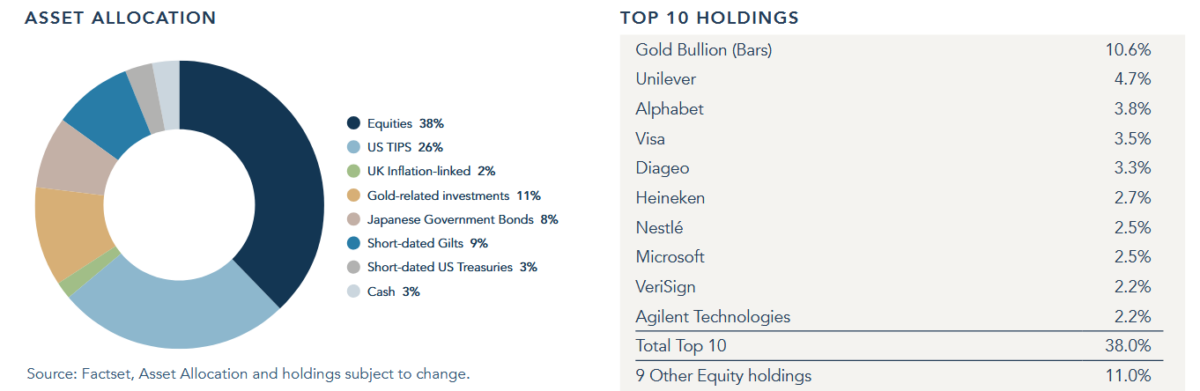

Take the Private Belongings Belief (LSE:PNL), as an illustration. Like many UK funding trusts it owns a collection of UK and world shares. However its portfolio consists of 18 separate firms unfold throughout completely different sectors and areas, a technique that drastically reduces danger.

What’s extra, lower than 40% of the fund is tied up within the inventory market. As an alternative, the vast majority of its capital is invested in basic safe-haven property like authorities bonds, money and valuable metals — gold bullion is in reality its largest single holding:

Naturally, a belief with inventory market publicity carries greater danger than a Money ISA, and particularly throughout financial downturns. However over the long run, trusts like this will nonetheless ship robust returns.

The common annual return from Private Belongings Belief is 5.4% since 2015, beating the Money ISA common of round 1.2%. This makes it value severe consideration, by illustrating how common savers can put their cash to work successfully with out having to tackle a number of added danger.