Most everybody is aware of the famed motto of the information enterprise that “concern sells”. Effectively that can also be true within the funding media the place a scary headline about inventory declines goes to get extra eyeballs than one which talks about features. So, its good to ponder if buyers really ought to be fearful in regards to the latest unload in shares with the S&P 500 (SPY) pulling again from latest highs. Thus, an excellent time to tune into 44 12 months funding professional Steve Reitmeister’s view in the marketplace outlook alongside along with his buying and selling plan to outperform. Get the complete story beneath.

It’s straightforward to get sucked into the surplus noise from the funding media with concern mongering headlines like:

Dow Falls Greater than 500 Factors

And to that I say…So the heck what!!!

The index is up over 6,000 factors from the October 2023 lows. So, it’s not an enormous deal if we give again 500 factors. Even giving again 2,000 factors is type of a sleep from these lofty ranges.

What issues now could be studying the financial and inflationary tea leaves to find out when the Fed will lastly begin reducing charges. That dialogue will likely be on the heart of at this time’s Reitmeister Whole Return commentary.

Market Commentary

On the financial entrance we’ve got a combined bag of latest developments beginning with the decrease than anticipated Core PCE Worth Index on Thursday. That is the Fed’s favored measure of inflation that continues to ebb decrease with at 2.8% 12 months over 12 months. That is the 12th consecutive studying decrease than the earlier month which says the pattern is our good friend.

Subsequent on Friday got here a not so wholesome 47.8 studying for ISM Manufacturing. That’s underneath the all necessary 50 mark which denotes contraction. Not serving to issues was the New Orders element falling month over month from 52.5 to 49.2. Which means that the outlook has dimmed.

Then on Tuesday we discovered that ISM Companies appears to be clipping alongside at a well-recognized tempo. Although a notch softer than anticipated at 52.6, it’s the development within the ahead wanting New Orders element at 56.1 that factors to higher readings forward.

The most effective a part of that report was the reducing of the Employment element from barely expansionary 50.5 into contraction territory at 48.0. Sure, I perceive that doesn’t sound good on the floor, because it factors to potential weak spot within the jobs market. However actually, it has been the power of employment resulting in sticky wage inflation that has stored inflation too excessive and the Fed not keen to decrease charges.

Maybe this weak ISM Companies Employment studying is lastly an indication of softening in employment that eases inflationary pressures there. That may most likely be the final piece of the jigsaw puzzle to fall into place permitting the Fed to start out reducing charges.

We’ll know extra about employment on Wednesday from the ADP Employment Change report adopted by the JOLTs Job Openings outcome. Most necessary would be the Authorities Employment Scenario announcement on Friday morning the place 195,000 jobs added is the expectation.

With that Friday jobs report will come an replace on wage inflation which was a tad too “sizzling and sticky” final month. Hopefully we see extra indicators of easing this time round.

All in all, the financial system is on good footing as will be seen by the +2.1% GDPNow estimate for Q1. Be aware that is down from +3.2% on Friday after the weaker than anticipated readings for ISM Manufacturing and Building Spending.

This too appears like a unfavourable on the floor. However not likely. That’s as a result of the next progress price creates extra inflationary pressures…and the longer it should take for the Fed to start out reducing charges.

The Goldilocks GDP outcomes all of us need is extra within the vary of +1 to 2%. That’s as a result of this can be a degree that speaks to modest progress and staves off recession whereas on the identical time eases inflationary pressures.

Nobody is anticipating this to result in a price reduce on the subsequent Fed assembly on March 20th. Powell put a really clear nail in that coffin on the earlier press convention.

As we glance out to the Might 1st Fed assembly odds are on the rise once more with 70% likelihood of a reduce. Sorry to be a party-pooper, however that isn’t going to occur as a result of the Fed is a gradual and deliberate group. There may be nonetheless an excessive amount of sticky inflation in locations like housing and employment to actually take into account reducing as early as Might 1st.

Thus, my cash at the moment rides on the June 12th assembly as doubtlessly being the timing of the primary price reduce. I’m completely happy to get on board the Might 1st bandwagon however might want to see way more spectacular inflation readings nearer to the Fed’s 2% goal within the subsequent a number of weeks.

Buying and selling Plan

Although I imagine we’re firmly implanted in a brand new long run bull market…the straightforward cash has been from the bear market lows of late 2022. And a variety of these features had been predicated on the Fed ALREADY reducing charges which ought to bolster the financial system and earnings progress.

With that being on maintain…so too ought to additional S&P 500 (SPY) features be on maintain. Thus, not a shock to me that shares offered off mightily on Tuesday. Particularly the over ripe tech shares which as a gaggle fell -2.5% on the session.

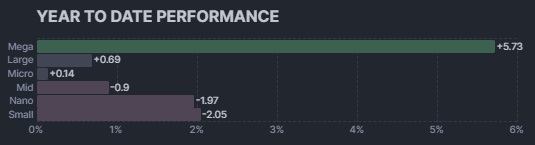

No…that doesn’t imply it’s time to run for canopy. Only a wholesome time for buyers to rotate out of the overplayed 2023 winners and provides others an opportunity to shine. Like small and mid caps which have spent a bit extra time within the solar this previous month:

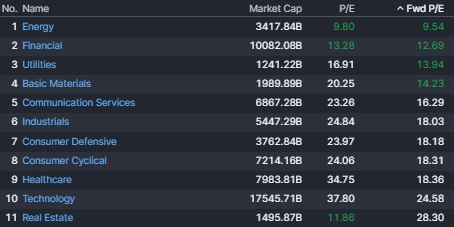

Worth additionally ought to be in greater consideration with a number of the sectors close to the highest of this Ahead PE listing getting extra love.

Or just, I imagine that purchasing wholesome rising firms at discounted costs is the most effective path ahead.

Sure, I’m a damaged file on that entrance since I at all times assume that makes probably the most sense. Gladly historical past is on my facet on the subject of that method.

Nevertheless, there are occasions, like the massive bull run we noticed from November by finish of February the place the “in vogue” progress shares take heart stage. Now it’s time for them to return stage and let others have an opportunity within the limelight.

That are my favourite progress shares at an inexpensive value now?

Learn on beneath for the reply.

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Almost 4X higher than the S&P 500 going again to 1999)

This consists of 5 underneath the radar small caps not too long ago added with great upside potential.

Plus I’ve 1 particular ETF that’s extremely properly positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 44 years of investing expertise seeing bull markets…bear markets…and all the things between.

If you’re curious to be taught extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares rose $0.52 (+0.10%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has gained 6.71%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

Extra…

The publish Ought to Inventory Buyers Be Scared by Latest Promote Off? appeared first on StockNews.com