SLNH has an over 1 GW pipeline, on par with BITF, however a market cap only a fraction of the scale. With an as much as $100M credit score facility for information middle buildout, might Soluna be a child IREN within the making?

The next visitor put up comes from BitcoinMiningStock.io, a public markets intelligence platform delivering information on corporations uncovered to Bitcoin mining and crypto treasury methods. Initially revealed on Sept. 24, 2025, by Cindy Feng.

Whereas I’ve coated just a few main HPC/AI pivots and offers from public Bitcoin miners, fairly just a few followers have more and more pointed me towards a lesser-known title: Soluna Holdings (NASDAQ: SLNH). The argument? It’s a microcap participant with what seems to be a large vitality pipeline (> 1GW), constructing HPC information facilities and, most lately, a $100 million credit score facility to fund Mission Kati – its next-generation renewable-powered website meant to serve each Bitcoin mining and AI clients.

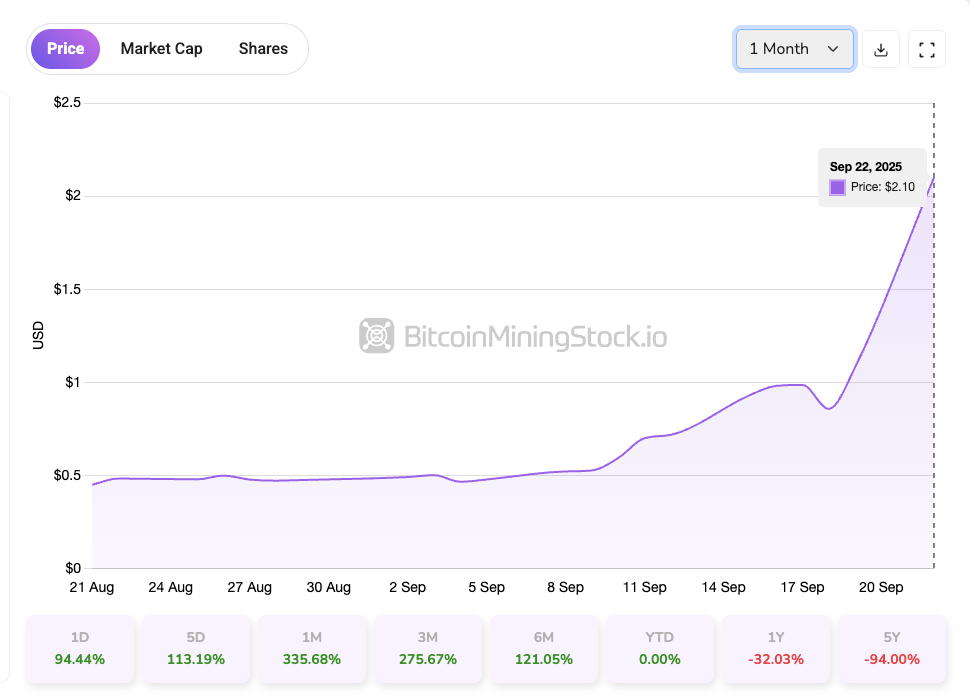

$SLNH surged 94.44% on September 22, 2025, following a pointy transfer that started late final week.

Some consider Soluna might comply with the same path to IREN or CIFR: shares largely underpriced till the market realizes its enormous HPC/AI potential. However let’s transfer past hypothesis. The query is does the hype maintain up when piecing collectively scattered info?

Let’s dive in!

Soluna’s Infrastructure Footprint: Over 1 GW in Play

Soluna Holdings is a U.S.-based developer of modular inexperienced information facilities, particularly designed for intensive computing functions like Bitcoin mining and AI workloads. The corporate positions itself as a bridge between underutilized renewable vitality property and compute demand.

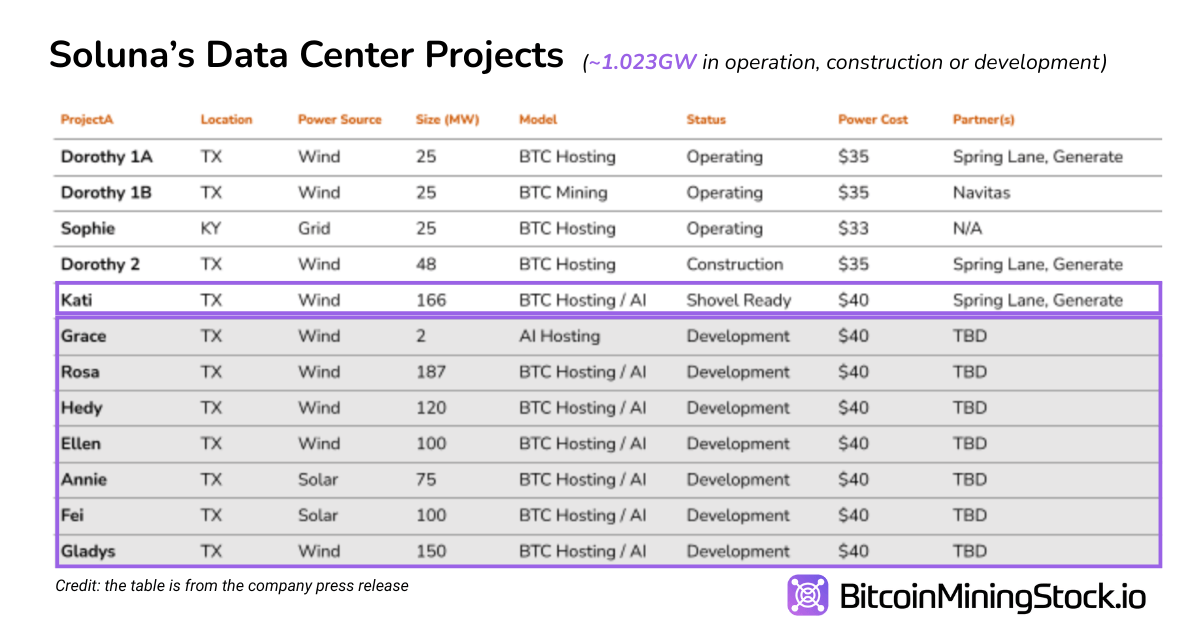

Screenshot from Soluna’s Investor presentation

It at present operates or is constructing quite a lot of modular websites throughout Texas and the U.S., most of them co-located with renewable technology. As of Q2 2025, Soluna claimed a complete clear vitality pipeline of two.8 GW, with a 1.023 GW subset targeted on near-to-mid-term improvement. That places them in the identical capability league as Bitfarms (1.2 GW)* – however with a market cap that, till lately, was almost 1.5/a hundredth of the latter.

*Regardless of reporting the same vary of vitality capability, Soluna had 3.345 EH/s of put in hash fee as of August 2025 (with 0.526 EH/s devoted to self-mining), in comparison with Bitfarms’ 19.5 EH/s.

Right here’s a breakdown of Soluna’s challenge portfolio primarily based on public disclosures:

Mission Kati is Soluna’s largest website so far and marks a transparent transfer past Bitcoin mining into AI and high-performance computing (HPC) infrastructure. The location is structured as a two-phase, 166 MW buildout.

Building of Kati 1 (83 MW) started in September 2025 and is anticipated to be operational in early 2026. Of this, 48 MW has already been leased to Galaxy Digital underneath a internet hosting settlement, whereas the remaining 35 MW is reserved for Soluna’s personal Bitcoin internet hosting purchasers.

Mission Kati broke floor (media supply)

The second part, Kati 2, will add one other 83 MW and is purpose-built to assist AI and high-performance computing (HPC) workloads. This enlargement, together with different information middle buildout plans, positions Soluna as an rising infrastructure supplier for the AI financial system.

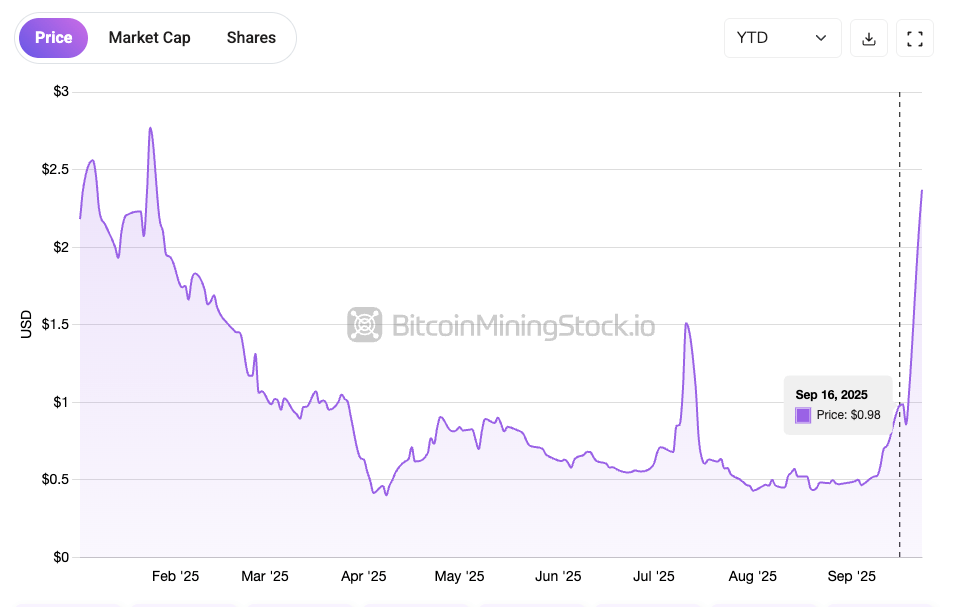

The market seems to begin pricing in Soluna’s HPC/AI pivot, particularly following the announcement of Soluna’s $100 million credit score facility.

$SLHN has been going up since because the announcement of its $100M credit score facility on September 16, 2025

The $100 Million Credit score Facility: Capital Comes at a Price

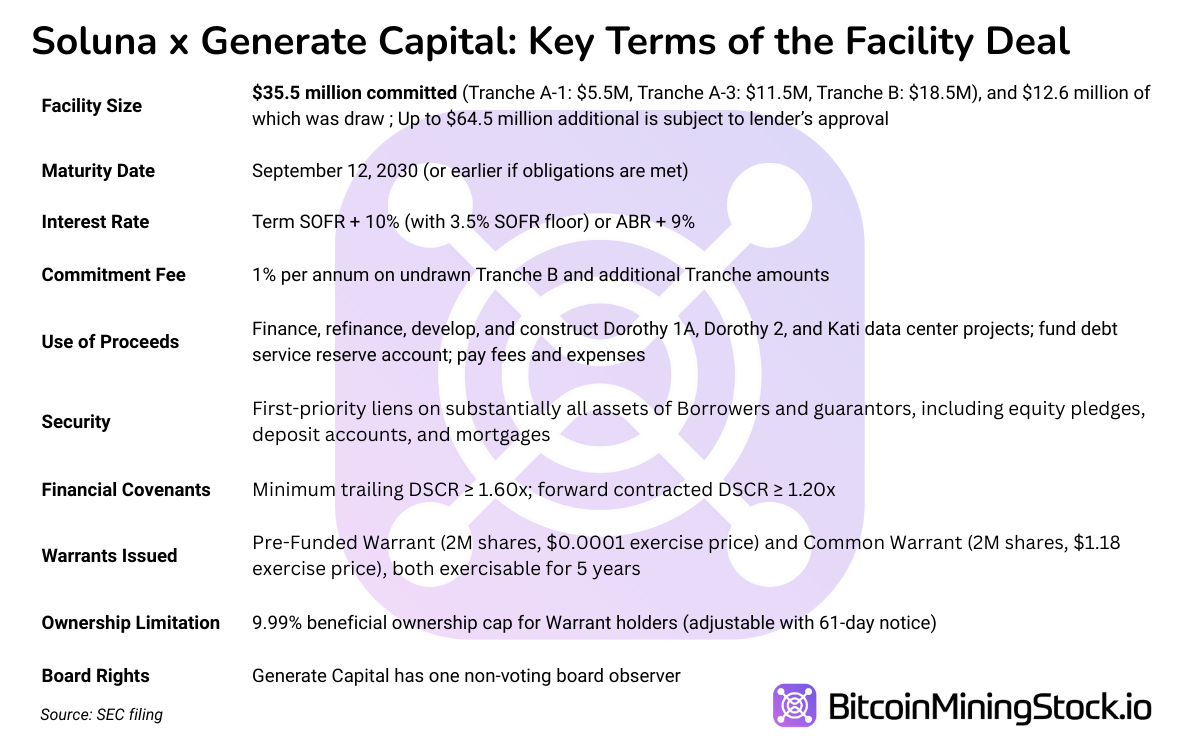

In September 2025, Soluna introduced a credit score facility of as much as $100 million from Generate Capital, a lender recognized for backing sustainable infrastructure. For a corporation with $6.15 million in quarterly income and $9.85 million in unrestricted money, the deal marks a big step ahead in securing long-term challenge funding. However whereas the headline determine is substantial, the construction of the settlement is layered with milestones and situations that form how and when the capital turns into accessible.

Of the full facility, $35.5 million is at present dedicated. This contains an preliminary $12.6 million draw used to refinance Dorothy 1A and Dorothy 2, in addition to an additional $22.9 million to assist continued improvement of Dorothy 2 and the primary part of Mission Kati. The remaining $64.5 million is uncommitted, which can be made accessible at Generate’s discretion, relying on future milestones and efficiency. In brief, the headline determine is a ceiling, not a assure.

Unlocking the capital isn’t low cost. The mortgage carries an rate of interest of SOFR + 10%, with a minimal SOFR flooring of three.50%, leading to a beginning rate of interest of at the least 13.5%. Alternatively, Soluna might select to borrow at an ABR + 9% fee. That fee alone could be thought of aggressive. On high of that, Soluna pays a 1% annual payment on unused funds in sure tranches, which implies the clock begins ticking whether or not the cash is deployed or not. Even when Soluna by no means touches the remaining facility, maintaining it accessible comes at a value.

Then there are the restrictions. The funds are ring-fenced and should solely be used for 3 particular property: Dorothy 1A, Dorothy 2, and Mission Kati. Likewise, the collateral is project-level. Generate Capital has first declare over the borrowing entities’ fairness, property, money accounts, and actual property; however notably excludes any assure from Soluna’s mother or father entity. This setup limits the corporate’s legal responsibility past the tasks whereas giving Generate clear enforcement paths tied to challenge efficiency.

The deal additionally contains monetary covenants designed to watch ongoing viability. Soluna should keep a trailing debt service protection ratio (DSCR) of at the least 1.60x and a ahead contracted DSCR of at the least 1.20x. These protection checks are normal for challenge finance and goal to make sure that project-level money flows stay ample to cowl scheduled debt obligations.

Alongside the mortgage, Generate additionally acquired equity-linked incentives within the type of two tranches of warrants: a pre-funded warrant for as much as 2 million shares at a near-zero strike value and a standard warrant for an additional 2 million shares at $1.18. Each are instantly exercisable over a five-year time period, with a 9.99% cap on possession to keep away from triggering disclosure thresholds. Such a construction offers Generate a long-term stake in Soluna’s future but additionally introduces dilution threat.

All informed, this can be a traditional case of equity-linked infrastructure financing designed for high-risk, high-upside eventualities. The construction offers Soluna a crucial runway to refinance present property and fund development of its flagship buildouts. In the meantime, it introduces new layers of value, oversight, and milestone-based situations. For a corporation with restricted conventional financing choices, the deal could possibly be a high-leverage progress enabler. But it surely additionally places Soluna on a good leash. Execution is now non-negotiable. If Soluna stumbles, the lender holds each the capital and the management levers.

Ultimate Ideas

The bull thesis on Soluna is easy: if administration delivers on Kati 1 and efficiently transitions into high-margin AI internet hosting with Kati 2, the corporate might unlock predictable recurring income at a scale not beforehand seen in its historical past.

Assuming $1.5M annualized income per MW for AI/HPC workloads, a tough benchmark primarily based on peer disclosures point out Kati 2 might finally generate $124M at full capability (83 MW × $1.5M). That’s almost 20x Soluna’s present quarterly run fee. For a corporation with a sub-$100M market cap, the upside is clearly transformative.

However the draw back threat is equally important. Generate Capital’s mortgage phrases depart little or no room for error. Any slip up, whether or not it’s a missed DSCR covenant, development delay, or underperformance, might set off penalties, asset loss, or dilution by warrant workouts or emergency fundraising.

In impact, Soluna has positioned a high-conviction wager on its means to execute.

Greatest case: it follows the trail of IREN or CORZ, scaling right into a reputable HPC infrastructure participant with diversified income and strategic relevance.

Worst case: tight covenants and excessive debt prices choke the corporate earlier than its tasks mature.

Hypothesis round potential JVs or M&A might preserve investor curiosity elevated. A latest tweet from the CEO hinted at inbound curiosity from hyperscale miners, energy plant homeowners, and infrastructure funds:

At @SolunaHoldings We’re ripe for the selecting…

Like a ripe apple 🍎 throughout harvest time.

We’re picked by the highest Hyperscale miners.

We’re picked by the highest Energy Plant homeowners.

We’re picked by the highest Infrastructure Funds.

With over 1GW clear computing tasks in… pic.twitter.com/ARn4GYybPj

— John Belizaire (@jbelizaireCEO) September 22, 2025

There’s no public affirmation of offers from “high hyperscale miners”, however with Galaxy Digital as an anchor tenant and Generate Capital on board as a lender, the muse is being laid for future partnerships.

Both method, Soluna has entered a high-stakes part. The credit score facility buys it time, not certainty.

For now, the 94% spike displays investor enthusiasm. What comes subsequent will depend upon execution.