Picture supply: Getty Photos

Will the State Pension nonetheless exist once I retire — and in that case, how a lot will it pay, and at what age will I be capable of declare it?

These are questions that I steadily ask myself. I’m not sure it’ll assist me once I’m able to retire two-to-three a long time from now, given the UK’s rising debt burden and exploding aged inhabitants.

However I’m not panicking, and I don’t suppose you must both. With a variety of funding trusts to select from, even Brits with little-to-no investing expertise have an important likelihood of reaching a snug retirement, no matter future State Pension adjustments.

Three prime trusts

Take the Allianz Expertise Belief (LSE:ATT), F&C Funding Belief, and Constancy Particular Values belief. Mixed, they’ve delivered a mean annual return of 13.7% during the last 5 years.

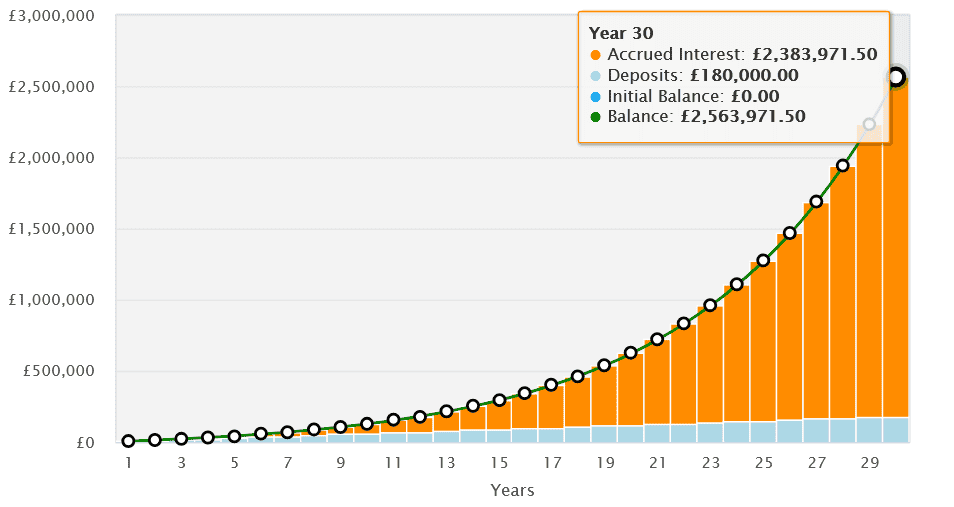

Previous efficiency isn’t at all times a dependable information to future returns. But when these funding trusts hold delivering at latest charges, they’d flip a £500 month-to-month funding unfold out equally right into a £2.6m retirement fund after 30 years.

Right here’s why I anticipate them to maintain outperforming.

Tech belief

Since late 2020, the Allianz Expertise Belief’s offered a shocking 14.7% common annual return. This displays the gorgeous efficiency of high-growth shares together with Nvidia, Apple, and Microsoft inventory.

Extra just lately, its gorgeous returns have been pushed by pleasure over the bogus intelligence (AI) revolution. Over the long run, its efficiency has benefitted from a plethora of sizzling tech tendencies, from the expansion of social media and e-commerce, to cloud computing and cybersecurity.

In whole, the Allianz Expertise Belief offers publicity to 50 totally different know-how offers. Spreading itself like this reduces focus threat, a key technique in a sector the place at this time’s stars can shortly turn into outdated.

Be aware, although, that the belief’s deal with cyclical shares can hurt its efficiency throughout financial downturns.

Energy by diversification

F&C Funding Belief’s proved a wonderful belief for each capital features and passive revenue. Helped by 54 straight years of dividend progress, it’s delivered a mean annual return of 11.5% since late 2020.

A big weighting of US tech shares has underpinned that gorgeous efficiency. At the moment, know-how shares account for roughly 30% of the belief’s entire portfolio.

That stated, the 359 shares F&C holds are unfold throughout a number of sectors, together with defensive ones like healthcare and utilities. This fashion the belief presents a wonderful stability of progress and safety for traders.

Bear in mind, although, {that a} deal with shares can nonetheless go away it susceptible to broader market downturns.

Worth star

At 15%, the Constancy Particular Values belief’s delivered a number of the finest sector returns since late 2020. This displays its deal with UK shares “which the Funding Supervisor believes to be undervalued or the place the potential has not been recognised by the market“.

As demand for cheaper shares in Britain and Mainland Europe heats up, I’m assured it might probably proceed outperforming.

Although a deal with UK shares creates extra regional threat, the belief’s 150 holdings are rather well unfold out by sector. Round 46% of the portfolio is devoted to cyclical shares, with equities in economically delicate and defensive sectors making up 29% and 25% respectively.

I’m assured a portfolio containing these three trusts may fund a snug retirement, even when the State Pension falls brief.