Picture supply: Getty Pictures

Based in 1996, Polar Capital Expertise Belief‘s (LSE:PCT) a inventory that gained’t enchantment to these looking out for passive revenue alternatives. That’s as a result of it doesn’t pay a dividend. The truth is, it by no means has. And it’s the one present member of the FTSE 100 that adopts this strategy to shareholder distributions.

As an alternative, it focuses on capital progress.

Current efficiency

Throughout the 5 years to 31 Could, the belief’s share worth has elevated 71% and its web asset worth’s risen 119%.

This compares favourably to a different FTSE 100 technology-focused belief – Scottish Mortgage Funding Belief – that’s seen its share worth rise by 38% throughout this era. Nonetheless, this fund invests closely in unquoted corporations, which might be tough to worth.

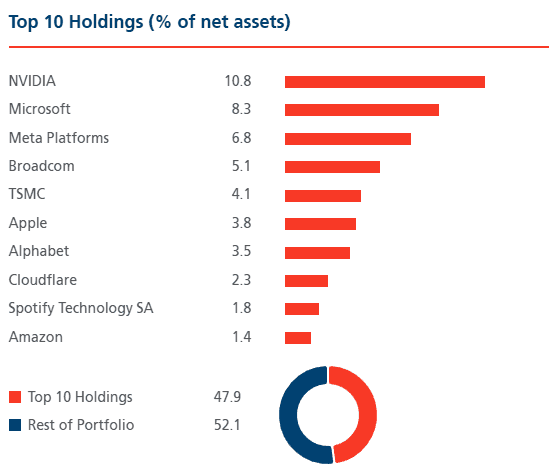

Against this, a lot of Polar Capital’s progress might be attributed to having positions in every of the ‘Magnificent 7’. On the finish of Could, six of those shares had been within the belief’s high 10 holdings. Nonetheless, it must be identified that an equal funding in all seven would have generated a return of over 300% since June 2020.

Diversification’s key

But it surely’s sensible to have a diversified portfolio. By spreading threat throughout a number of positions, it’s potential to mitigate among the volatility that arises from investing within the inventory market.

And that’s one of many benefits of an funding belief. By proudly owning one inventory, an investor may have publicity to a number of corporations typically in several jurisdictions.

Nonetheless, though Polar Capital has positions in 98 shares, they’re all in the identical sector. Its supervisor is especially eager on synthetic intelligence (AI). Certainly, it describes itself as an “AI maximalist”.

Additionally, over 30% of its publicity is to the semiconductor business. This could possibly be a priority as a result of historical past tells us that these kind of shares might be unstable. The tech-heavy Nasdaq dropped 75% between March 2000 and October 2002.

My view

However the belief’s at present (27 June) buying and selling at a near-10% low cost to its web asset worth. In concept, this implies it’s potential to achieve publicity to the world’s largest tech shares for lower than their market worth.

Nonetheless, over 70% of its worth comes from North American shares. Right here, there’s nonetheless a big diploma of uncertainty as to how President Trump’s strategy to tariffs will have an effect on the financial system. In keeping with JP Morgan, there’s a 40% probability of a recession this yr. And resulting from their lofty valuations, a downturn’s more likely to have an effect on the tech sector — and the Magnificent 7 particularly — greater than most.

For many who consider know-how shares will proceed to ship over the long run, I believe Polar Capital Expertise Belief’s a share to contemplate. However solely as a part of a well-diversified portfolio. And anybody taking a place shouldn’t anticipate to obtain a dividend any time quickly.