Picture supply: Olaf Kraak by way of Shell plc

Oil shares have been one of many greatest casualties of the tariff-induced sell-off over the previous couple of weeks. However with a current pivot away from renewables, the Shell (LSE: SHEL) share value might be set to push larger within the years forward.

Oil value stoop

This month’s collapse within the value of Brent Crude to four-year lows has clobbered Shell. It additionally starkly highlights how the corporate’s fortunes are tied to the worth of an asset over which it has no management. This can be so, however is that this actually a legitimate purpose in opposition to investing?

If I took this argument to its logical conclusion I’d find yourself investing in nothing. The purpose is that no firm or business is in full management of varied macro exterior forces. A financial institution can no extra stop a recession than an insurance coverage firm can stop devastating floods or wildfires.

What I’m a lot keener to grasp is what the long-term demand trajectory for oil and gasoline trying like. Right here I’m on rather more strong floor.

Situation planning

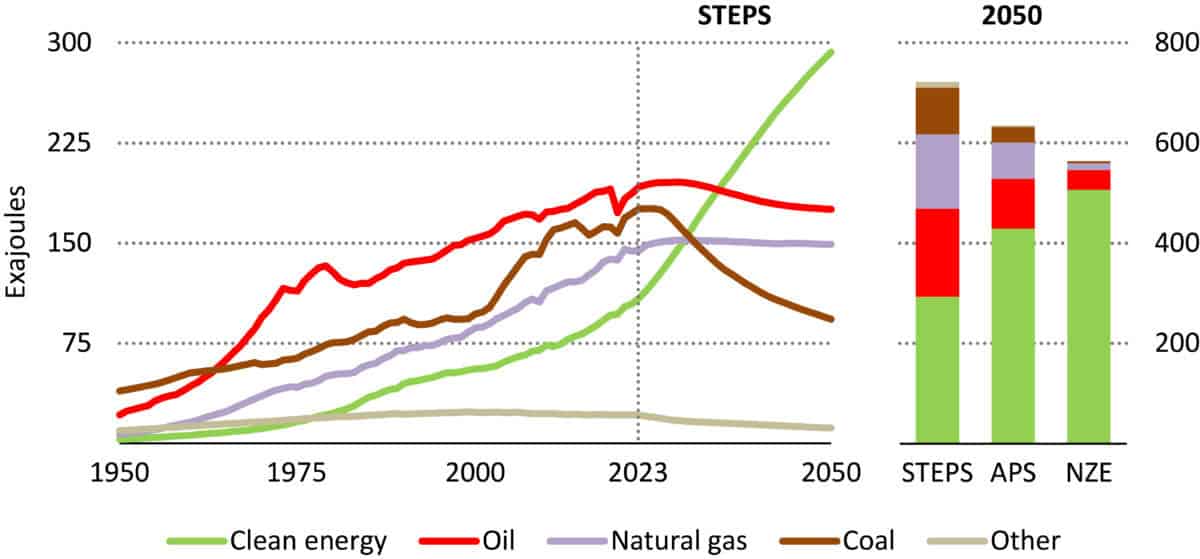

In its World Vitality Outlook 2024, the Worldwide Vitality Company, up to date its vitality combine projections out to 2050. For its default Acknowledged Insurance policies (STEPS) situation, each oil and gasoline demand peaks in 2030. However in contrast to oil, which thereafter slowly declines, pure gasoline demand stays flat.

Supply: Worldwide Vitality Company

Its Internet Zero (NZE) situation sees large declines in fossil gas demand. Nonetheless, its vitality trajectory assumptions appear fully unrealistic to me, significantly primarily based on the current state of know-how and adoption charges.

At its Capital Markets Day in March, Shell launched its personal up to date situations. Some argue that situations are simply guesses, however that essentially misses their utility. They’re not used as expressions of a technique or a marketing strategy. However they do assist stretch minds, broaden horizons and discover assumptions.

Demand for vitality

I consider we will be taught so much about future vitality demand from cues occurring now. Not because the finish of the Chilly Struggle have we seen political and societal tensions of this dimension. Plus nations are grappling with a brand new period of financial progress from AI, vitality safety and local weather change.

The sluggish unwinding of globalisation and unfolding commerce wars has the potential to re-draw the world’s manufacturing base away from China. Developments in China will probably speed up higher-income existence there, thereby boosting vitality demand. On the similar time, because the US builds extra manufacturing functionality, that may solely be a lift for demand too.

In the end, I see hydrocarbons remaining an necessary a part of the vitality combine for many years to return. However the tempo of adoption to web zero is the large unknown and stays Shell’s biggest danger.

We’re already seeing growing regulatory strain within the UK, which is stopping any additional exploration licences. Ought to traders flip in opposition to the business en masse the implications for it might be disastrous.

Like its peer BP, Shell not too long ago slashed its spend on low-carbon applied sciences. I stay satisfied that is the precise method to take. Because it prioritises shareholder returns within the coming years, I believe its share value at clearance sale ranges means traders ought to think about including it to their portfolios.