Bitcoin miner Marathon Digital loved a surge in its inventory value on February 28 after revealing an annual revenue of $151.8 million in This autumn final 12 months. Its MARA shares within the Nasdaq briefly surged previous $31 as its CEO outlined the corporate’s plans after the Bitcoin halving.

The value of MARA topped at $31, following a rise of 154% within the final three months.

Marathon Digital Excited About New Chapter

Marathon Digital revealed a This autumn 2023 internet revenue of $151.8 million per share in its earnings name. This revenue adopted a internet lack of $391.6 million a 12 months earlier. The corporate’s income elevated roughly 452% from $28.4 million to $156.8 million in the identical interval.

Marathon’s CEO, Fred Thiel, stated the agency’s momentum and evolving expertise stack positioned it for a number of the most enjoyable occasions in its historical past. Thiel revealed plans to broaden Marathon’s Bitcoin mining hash charge to 50 exahashes per second by the tip of the 12 months.

“Given our momentum, our sturdy steadiness sheet, and the differentiators we’re constructing with our expertise stack, we’re optimistic that essentially the most thrilling occasions for our group are nonetheless to return,” Thiel stated.

Learn extra: The 7 Greatest Cryptocurrency Mining {Hardware} for 2023

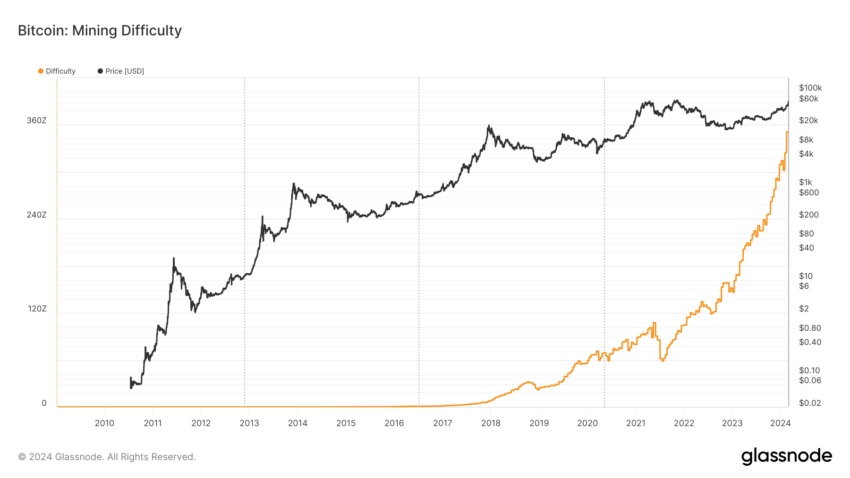

Bitcoin Mining Issue. Supply: Glassnode

The upcoming Bitcoin halving scheduled for April 19, 2024, will scale back the variety of BTC awarded per mined transaction block. After this, miners will obtain a 3.125 BTC block reward as a substitute of the present reward of 6.25 BTC. This occasion has seen miners replenish on mining computer systems to extend the prospect of fixing a Bitcoin block appropriately.

How Bitcoin Miners Put together for the Halving

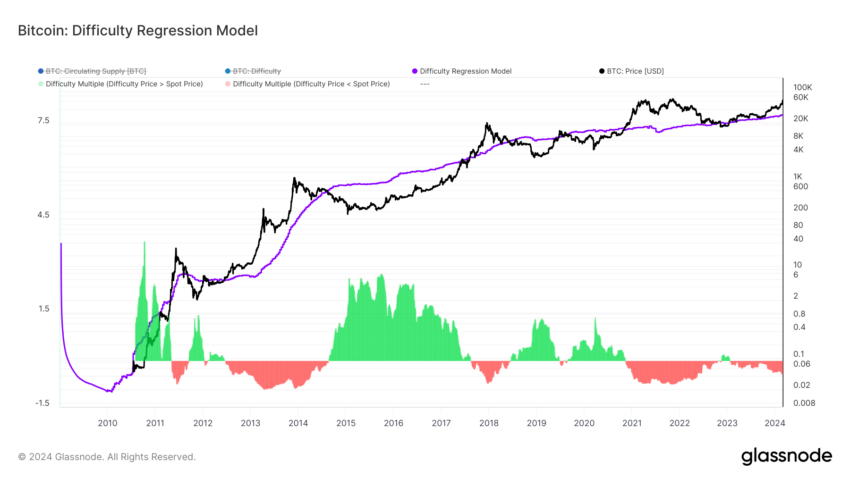

Earlier than the Bitcoin halving, miners have to be ready for dips in profitability. They do that through the use of present gear to mine BTC, which they will promote if Bitcoin’s value drops.

Marathon Digital seems effectively positioned after reporting that it mined 1,853 BTC in December 2023. This mined Bitcoin is value roughly $115 million at at this time’s costs. However being well-capitalized is just one piece of the puzzle.

Whereas Marathon seems to mine extra BTC each day than its rival, Riot Platforms, it does so at a better value. Marathon pays $22,000 to mine one BTC, whereas Riot Platforms pays virtually 90% much less at $2,000 per coin.

Learn extra: Is Crypto Mining Worthwhile in 2023?

Bitcoin Miners Revenue Squeezes. Supply: Glassnode

Riot’s location in Texas means it may well promote energy to the grid if electrical energy calls for or Bitcoin costs change. BeInCrypto reached out to Marathon and Riot for touch upon their fiscal outlook however had not heard again at publication.

Disclaimer

All the data contained on our web site is printed in good religion and for normal info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own threat.