Picture supply: Getty Photographs

Excessive-yield shares can provide juicy passive revenue streams. However typically a excessive yield signifies an above-average degree of perceived threat on the a part of traders.

For example, contemplate a inventory that jumped as a lot as 14% in morning buying and selling in the present day (31 July) after releasing its outcomes for the primary half of this yr: Ferrexpo (LSE: FXPO). Its dividend historical past has been a rollercoaster, to say the least.

That’s already apparent trying on the historical past of its dividend per share.

Created utilizing TradingView

However dividend yield is a operate of dividend per share and share worth. Ferrexpo shares have misplaced three quarters of their worth over the previous 5 years.

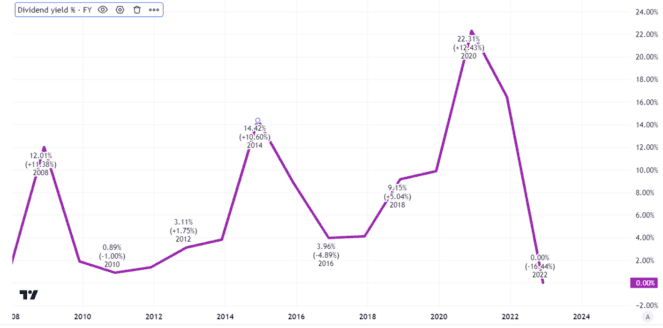

The dividend yield chart is due to this fact much more dramatic than the one displaying dividends per share.

Created utilizing TradingView

That’s proper. The inventory – now with a dividend yield of zero – had a excessive yield of over 20% in 2020.

What’s going on – and will the yield ever get near the place it was?

Excessive-risk inventory

The clue to all that is the character of Ferrexpo’s enterprise. The miner makes its cash from mining in Ukraine.

Even earlier than the battle in that nation, this geographic focus was a threat to income in my opinion. Earlier than Russia invaded Ukraine in February 2022, when the share had a excessive yield of 12%, I wrote, “I see an enormous threat with Ferrexpo’s enterprise mannequin. Not solely it’s it targeting iron alone… it is usually focussed on manufacturing from a single complicated of mines.”

That is still a key threat in my opinion. On prime of that, one other threat that has materialised since I penned these phrases is the battle. On prime of even that, there’s a long-running authorized dispute regarding a subsidiary’s contested possession of key property.

All shares have dangers — however clearly Ferrexpo has tons.

Enterprise proving resilient

Regardless of that, the corporate has truly carried out pretty effectively given the dire circumstances beneath which it’s working.

Immediately’s interim outcomes confirmed whole industrial manufacturing up 75% on the identical interval final yr and whole gross sales up 85% to nearly 4m tonnes. Revenues grew 64% to over half a billion {dollars} and revenue after tax greater than doubled to $55m. Ferrexpo has $112m in web money.

Regardless of this resilience, the market capitalisation of the enterprise is presently £370m. That displays ongoing dangers, not least the possession dispute.

Far too dangerous for me

The dividend stays suspended because of the authorized dispute. If that’s resolved favourably, the corporate might conceivably resume dividends even throughout wartime given the confirmed resilience of its enterprise.

However the dangers listed below are big in my opinion.

Certainly, Ferrexpo recognises that its “ongoing authorized disputes in Ukraine” might in the end have an effect on its potential to proceed as a going concern. If that eventuality got here to move, the share worth might fall even from right here.

Ferrexpo is an effective illustration of why a high-yield inventory can find yourself being a expensive funding, because the dividend will get axed and share worth falls too.

I’m glad I didn’t purchase in when it was yielding over 20% — and haven’t any plans to take action now.