Picture supply: Getty Photos

One progress inventory caught out like a sore thumb once I opened my Shares and Shares ISA watchlist yesterday (23 June). That was Hims & Hers Well being (NYSE: HIMS), which was down nearly 35%, registering it’s worst-ever day.

This can be a share I’ve been anticipating some time, however haven’t purchased but. Even after yesterday’s crash, it’s nonetheless up 86% over 12 months.

May this crash be an opportune time for me to nip in and open a place?

Personalised medication platform

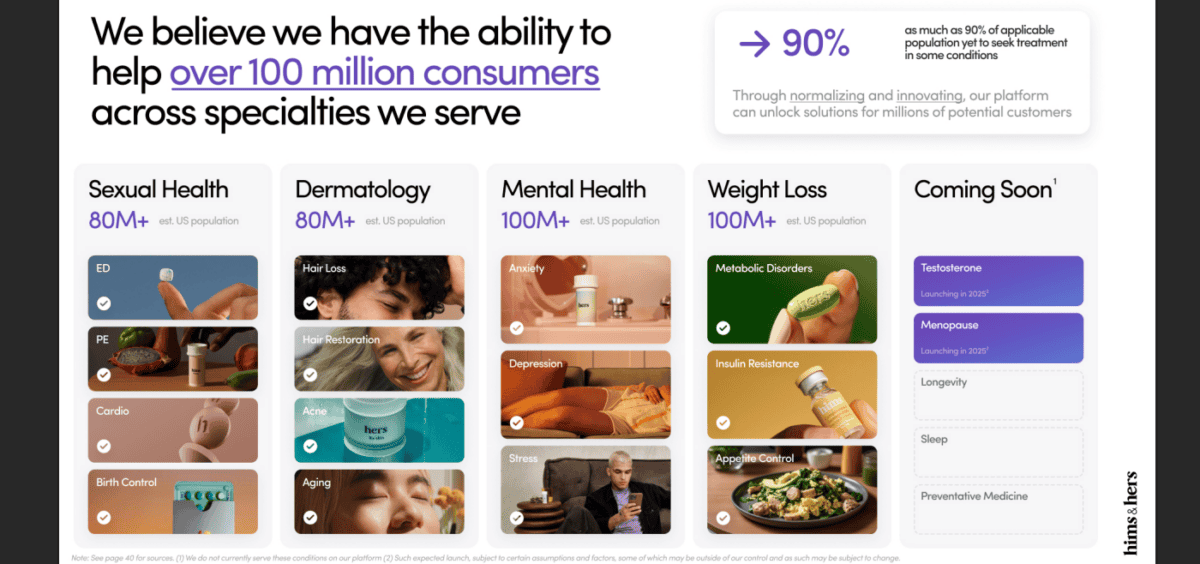

Hims & Hers is a vertically built-in pharmacy and telehealth platform targeted on personalised wellness. It gives prescription and over-the-counter therapies for hair loss, psychological well being, skincare, sexual well being, and extra.

In 2024, the agency’s income soared 69% yr on yr to $1.5bn. Nevertheless, this isn’t a jam-tomorrow progress story, as a result of each internet revenue and free money circulation greater than quadrupled in Q1 of this yr. Subscribers grew 38% to 2.4m.

Driving a few of this eye-catching progress has been compounded GLP-1 weight-loss medication, which the agency started promoting on its platform in 2024. In Might, it introduced a partnership with pharmaceutical large Novo Nordisk to promote its blockbuster Wegovy therapy.

Disagreement

Since that announcement, Hims & Hers inventory has been rocketing. Till yesterday that’s, when Novo terminated the collaboration.

In a press release, the agency pulled no punches, accusing Hims of “unlawful mass compounding and misleading advertising and marketing“. It used the phrases “knock-off medication” a lot of instances in relation to “personalised” doses of semaglutide that Hims continues to promote. Semaglutide is the lively ingredient in Wegovy.

Extra critically, Novo alleges that doubtlessly unsafe lively substances are being sourced from international suppliers in China, thereby placing sufferers in danger.

Primarily then, there are three allegations right here:

- The continued promoting of copycat variations of Wegovy, which Novo says violates rules.

- Misleading advertising and marketing of those as ‘personalised’ therapies.

- Semaglutide sourced from unapproved Chinese language suppliers.

In response, Hims’ CEO Andrew Dudum wrote on X: “We refuse to be strong-armed by any pharmaceutical firm’s anticompetitive calls for that infringe on the unbiased determination making of suppliers and restrict affected person alternative.”

Dudum stated Novo’s administration is “deceptive the general public“, and that the platform will proceed providing entry to totally different weight-loss therapies, together with semaglutide.

My transfer

What to make of all this? Effectively, there might clearly be regulatory compliance danger right here. Lawsuits seem inevitable, and there’s seemingly not less than some model injury.

In the meantime, Novo will maintain promoting Wegovy with two of Hims’ rivals, specifically Ro and LifeMD. So the agency might lose share within the booming weight-loss area, which isn’t supreme.

Nevertheless, there’s extra to the platform than simply Wegovy. It was already rising strongly earlier than GLP-1s, and its alternative to combination demand in some very giant well being classes seems undimmed to me. It’s additionally increasing into Europe by way of a current acquisition.

Hims’ disruptive direct-to-consumer platform goals to be cheaper and extra personalised than the normal healthcare mannequin. Subsequently, I feel shareholders ought to count on additional business resistance, like Uber bought from taxi corporations.

I’d like administration to reassure traders in regards to the provide chain accusations. Ideally, it will occur when the agency reviews Q2 earnings in August, if not earlier than.

But when the inventory retains falling within the coming days, I’ll open a starter place.